- Japan

- /

- Entertainment

- /

- TSE:9684

Square Enix (TSE:9684) Considers Extraordinary Loss Amid Forecast Revision Is Its Turnaround Strategy at a Crossroads?

Reviewed by Sasha Jovanovic

- Square Enix Holdings announced that its board met on November 6, 2025, to consider recording an extraordinary loss for the six-month period ended September 30, 2025, and to revise its consolidated financial forecast for the fiscal year ending March 31, 2026.

- This disclosure signals ongoing financial uncertainties for the company, even as it continues to launch high-profile titles such as the recent DRAGON QUEST I & II HD-2D Remake.

- We’ll explore how the anticipated extraordinary loss and the revised forecast are shaping Square Enix’s current investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Square Enix Holdings' Investment Narrative?

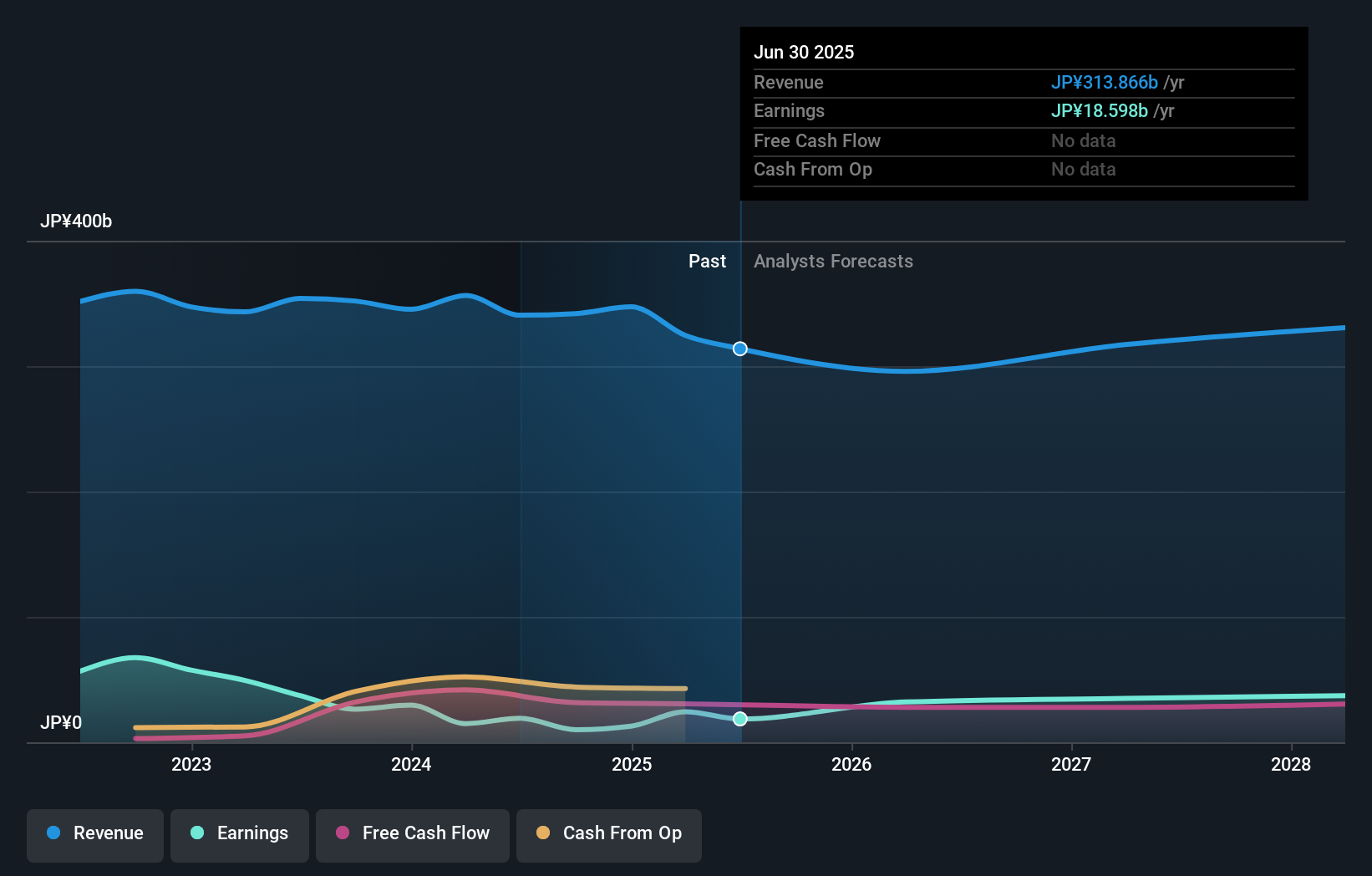

To own shares in Square Enix Holdings right now, you need to believe in the enduring appeal of its flagship game franchises and the company's ability to translate major new releases into strong financial performance, despite emerging headwinds. The recent board decision to consider booking an extraordinary loss and revise its financial forecast adds fresh uncertainty to the stock’s short-term catalysts. Previously, optimism rested on the continued momentum from launches like DRAGON QUEST I & II HD-2D Remake and an improving earnings trend compared to last year, even as growth appeared to lag both market and sector averages. Today’s news could mean a reset on both expectations for near-term profitability and confidence in the ongoing turnaround, especially as the revised guidance and loss announcement have yet to be fully absorbed by the market or reflected in earlier analyst targets. Risks around dividend cuts and elevated valuation multiples now feel more immediate. In contrast, a possible dividend decline is an important risk investors should note.

Square Enix Holdings' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Square Enix Holdings - why the stock might be worth as much as ¥2749!

Build Your Own Square Enix Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Square Enix Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Square Enix Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Square Enix Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9684

Square Enix Holdings

Operates in the content and service businesses in Japan and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives