Zenrin (TSE:9474) Margin Miss Reinforces Market Caution Despite Forecast Profit Growth Outpacing Peers

Reviewed by Simply Wall St

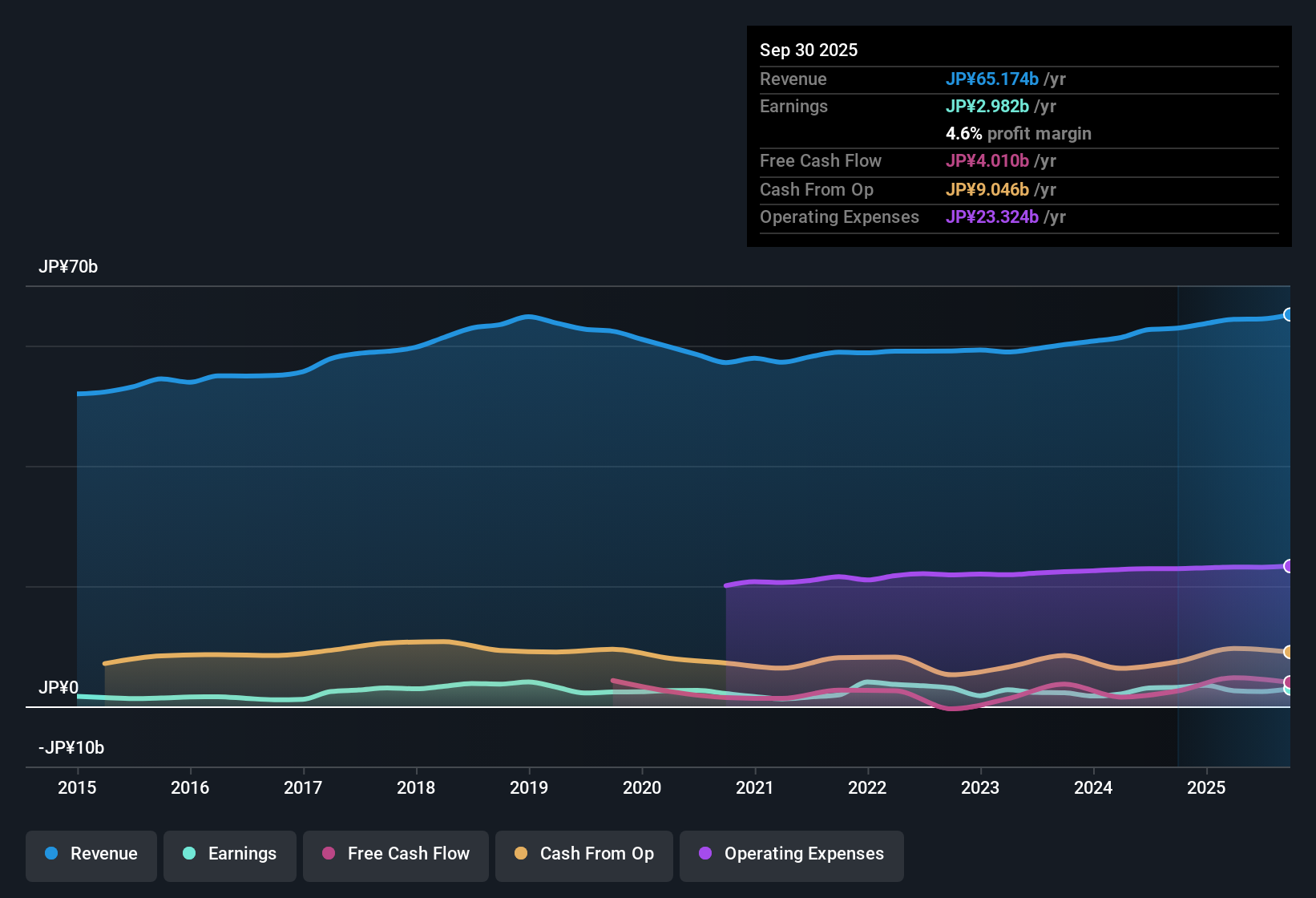

Zenrin (TSE:9474) posted annual earnings growth of 6.3% over the past five years, while its net profit margin currently sits at 4.6%, slipping from last year's 5.1%. Looking forward, earnings are forecast to accelerate 9.48% per year, outpacing the Japanese market’s 7.9% projection. However, revenue growth is expected to be a modest 2.8% per year, trailing the broader market’s 4.5%. For investors, the focus will be on how Zenrin can leverage its reward factors like forecasted profit growth and attractive dividends, especially as its margins narrow in the context of a premium-priced stock.

See our full analysis for Zenrin.Next, we will measure these headline results against the key narratives circulating in the Simply Wall St community to see which perspectives hold up and which might need to shift in light of the new data.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Compresses Despite Historical Strength

- Net profit margin stands at 4.6%, dipping from the previous year's 5.1%, highlighting near-term compression even after a five-year earnings growth streak of 6.3% annually.

- Prevailing market analysis points out that while Zenrin’s expertise in geospatial mapping provides a steady base, recent margin pressure brings fresh urgency to the need for digital innovation and new partnerships.

- The 0.5 percentage point margin decline offsets the appeal of past gains, aligning with investor caution about sector-wide pricing and cost competition.

- Rather than showing a rapid decline, the margin trend positions Zenrin as a steady, legacy player. The narrative could shift only if the company can announce and deliver major technology collaborations.

Premium Price Tag Versus DCF Valuation

- At a current share price of ¥1,017, Zenrin trades well below its DCF fair value estimate of ¥3,650.45, despite sitting at a premium Price-to-Earnings ratio of 18.2x compared to the industry’s 16.9x average.

- The analysis underscores a valuation tension: although the stock commands a sector premium on earnings multiples, its pricing leaves substantial upside to DCF-based fair value if growth resumes.

- Bulls watching for a re-rating will note the deep gap to fair value, but skeptics can point to the higher P/E as a sign the market already prices in much of the digitalization narrative.

- This disconnect means investors may wait for clearer catalysts, such as automotive tech partnerships, to justify narrowing the valuation gap.

Revenue Outlook Trails Sector Growth

- Zenrin’s revenue is forecast to grow at just 2.8% per year, well behind the Japanese market’s expectation of 4.5% annual revenue growth, casting doubt on top-line momentum.

- The data highlights a key point: while Zenrin is stable, the modest revenue trajectory frustrates hopes of a breakout, even as digital geospatial trends offer long-term promise.

- Investors looking for rapid expansion may need to temper enthusiasm, as sector headwinds and stiff competition limit immediate upside in reported sales.

- Any material shift in growth expectations likely depends on Zenrin turning emerging technology buzz into tangible new business.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Zenrin's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Zenrin’s modest revenue growth and recent profit margin compression raise questions about whether its premium price is justified for the long term.

If you want companies with much stronger upside and less valuation risk, discover these 848 undervalued stocks based on cash flows that are trading at more attractive prices relative to their fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zenrin might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9474

Zenrin

Engages in the collection and management of a range of geospatial information worldwide.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives