The Bull Case For Kadokawa (TSE:9468) Could Change Following Its Global Chinese Animation Distribution Launch – Learn Why

Reviewed by Sasha Jovanovic

- Earlier this month, iQIYI announced a partnership with KADOKAWA Corporation to globally distribute its animated series "The Fated Magical Princess," marking KADOKAWA’s first simultaneous worldwide release of a premium Chinese animation produced by a Chinese streaming platform.

- This collaboration underscores KADOKAWA's entry into international Chinese animation distribution, enhancing its role in connecting diverse audiences with Chinese cultural content.

- We’ll look at how KADOKAWA’s global push into Chinese animation distribution could affect its investment narrative and international reach.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Kadokawa's Investment Narrative?

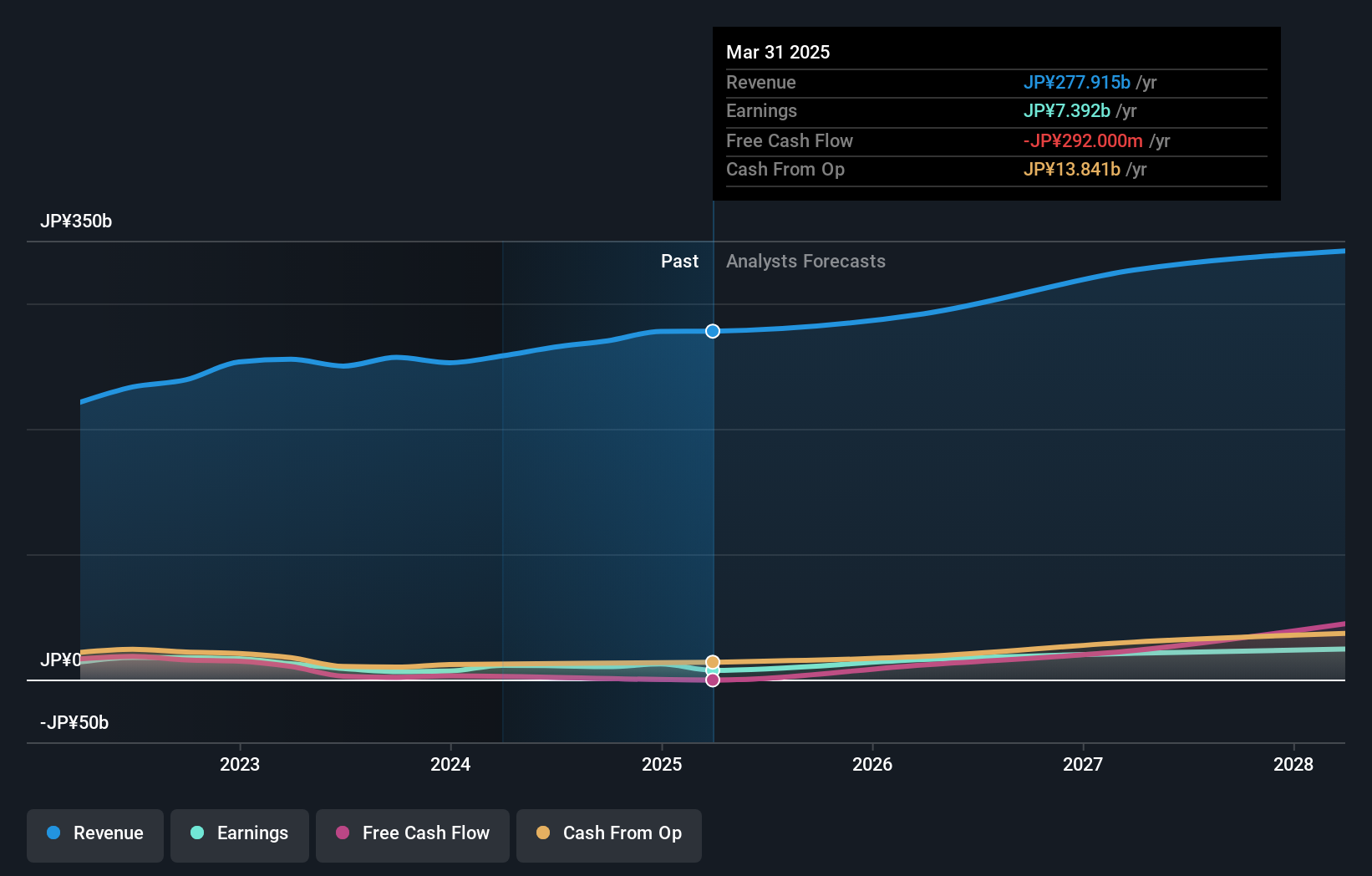

To really see the appeal in Kadokawa right now, it helps to think beyond just financials and focus on how the business is positioning itself. The new partnership with iQIYI, Kadokawa’s first major move into global distribution of Chinese animation, signals a potential shift in short-term catalysts. Previously, steady digital content growth and solid dividend guidance were in focus, but this move could inject new momentum into international revenue streams and content visibility. On the other hand, risks tied to expensive valuations, ongoing profit margin pressures, and low return on equity haven't disappeared. The iQIYI partnership may provide fresh narrative and some new audience reach, but whether it translates to material near-term financial upside remains to be seen. For now, the market seems cautious: recent price moves have been flat to slightly down, reflecting both the promise and the uncertainty tied to these strategic initiatives.

But against that optimism, keep a close eye on ongoing profitability challenges. Despite retreating, Kadokawa's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 2 other fair value estimates on Kadokawa - why the stock might be worth just ¥3947!

Build Your Own Kadokawa Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kadokawa research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Kadokawa research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kadokawa's overall financial health at a glance.

No Opportunity In Kadokawa?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kadokawa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9468

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives