Japan’s stock markets have seen significant gains recently, with the Nikkei 225 Index rising 5.6% and the broader TOPIX Index up 3.7%, buoyed by dovish commentary from the Bank of Japan and optimism surrounding China’s stimulus measures. In this favorable market environment, identifying high growth tech stocks can be particularly rewarding, as these companies often benefit from both domestic economic policies and international developments.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| Material Group | 17.82% | 28.74% | ★★★★★☆ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Medley (TSE:4480)

Simply Wall St Growth Rating: ★★★★★★

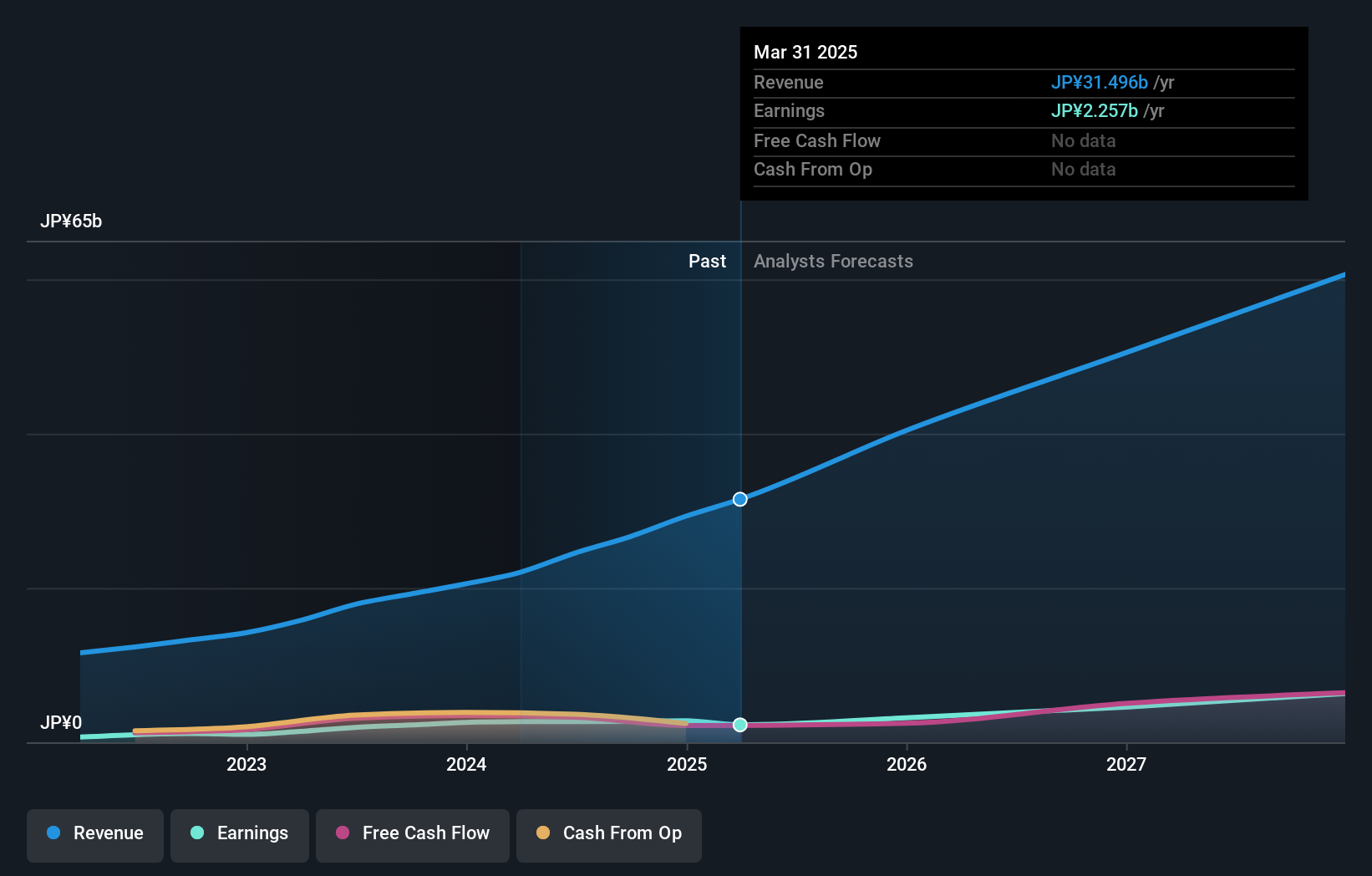

Overview: Medley, Inc. operates platforms for recruitment and medical businesses in Japan and the United States with a market cap of ¥124.25 billion.

Operations: Medley, Inc. generates revenue primarily from its Human Resource Platform Business (¥17.87 billion) and Medical Platform Business (¥6.09 billion), with additional contributions from New Services (¥573 million). The company operates in both Japan and the United States, focusing on recruitment and medical platforms.

Medley's strategic initiatives, including its recent decision to potentially acquire Offshore Inc., underscore its commitment to expanding its influence in the healthcare sector. This move, coupled with Jobley's robust expansion across the United States, highlights Medley’s proactive approach in addressing critical workforce shortages in healthcare—a sector that continues to face significant challenges. Financially, Medley is poised for substantial growth with expected annual revenue and earnings increases of 25% and 30.4%, respectively, outpacing the Japanese market averages significantly. Moreover, a forecasted Return on Equity of 24.4% suggests strong future profitability and shareholder value creation. These factors collectively paint a promising picture of Medley’s strategic direction and financial health amidst an evolving industry landscape.

- Navigate through the intricacies of Medley with our comprehensive health report here.

Explore historical data to track Medley's performance over time in our Past section.

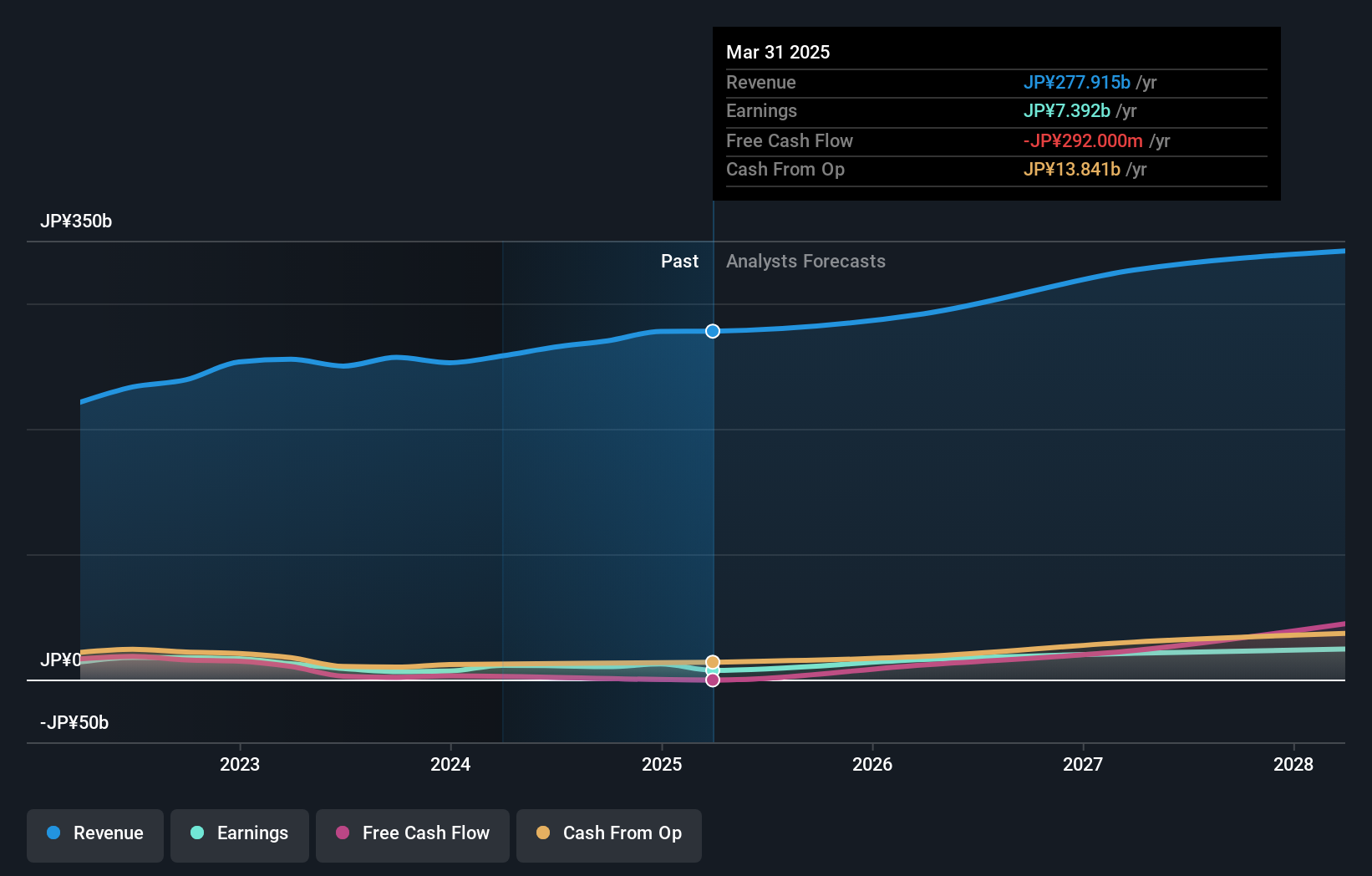

OMRON (TSE:6645)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OMRON Corporation operates globally in industrial automation, device and module solutions, social systems, and healthcare businesses, with a market cap of ¥1.29 trillion.

Operations: OMRON generates revenue primarily from its Industrial Automation Business (¥373.70 billion), Social Systems, Solutions and Service Business (¥156.85 billion), Healthcare Business (¥150.40 billion), and Devices & Module Solutions Business (¥143.69 billion). The company operates across diverse sectors, focusing on automation, healthcare solutions, and social systems globally.

OMRON's recent strategic maneuvers and financial forecasts indicate a nuanced trajectory in Japan's tech landscape. With revenue growth projected at 5.6% annually, OMRON is set to outpace the broader Japanese market average of 4.3%, despite a competitive electronic industry where it remains unprofitable currently. The company’s focus on innovation is evident from its substantial R&D expenses, which are crucial for future profitability, highlighted by an anticipated earnings surge of 46.2% per year over the next three years. This investment in technology development could position OMRON favorably against industry norms, despite current financial challenges and a modest forecasted Return on Equity of 7.6%. Moreover, the recent declaration of a ¥52 cash dividend suggests confidence in maintaining steady shareholder returns amidst these expansive growth efforts.

- Click here to discover the nuances of OMRON with our detailed analytical health report.

Understand OMRON's track record by examining our Past report.

Kadokawa (TSE:9468)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kadokawa Corporation operates as an entertainment company in Japan, with a market cap of ¥429.48 billion.

Operations: The company generates revenue primarily from its Publication segment (¥143.28 billion), followed by Animation/Film (¥46.36 billion) and Game (¥28.63 billion) segments, with additional contributions from Web Service and Education/Edtech sectors.

In the dynamic tech landscape of Japan, Kadokawa stands out with its strategic focus on R&D, investing significantly to fuel innovation and growth. With earnings expected to grow by 21.5% annually, Kadokawa is not only outpacing the Japanese market average growth of 8.7% but also shows a robust commitment to development as evidenced by its substantial R&D expenses. This investment strategy is crucial as it navigates through a competitive media industry where it has achieved an impressive earnings growth of 23.8% over the past year, surpassing industry norms significantly. Looking ahead, Kadokawa's aggressive push into digital and multimedia platforms could further enhance its market position, supported by a positive free cash flow and a forward-thinking approach that might set new benchmarks in Japan’s high-tech ecosystem.

Make It Happen

- Navigate through the entire inventory of 124 Japanese High Growth Tech and AI Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kadokawa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9468

Flawless balance sheet with solid track record.