- Japan

- /

- Specialty Stores

- /

- TSE:3660

Japanese Growth Companies With High Insider Ownership For October 2024

Reviewed by Simply Wall St

Japan's stock markets have seen significant gains recently, with the Nikkei 225 Index rising 5.6% and the broader TOPIX Index up 3.7%, driven by optimism around China's stimulus measures and dovish commentary from the Bank of Japan. This favorable backdrop provides an excellent opportunity to explore growth companies with high insider ownership, as such stocks often indicate strong confidence from those closest to the business and can be particularly appealing in a bullish market environment.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Micronics Japan (TSE:6871) | 15.3% | 31.5% |

| Hottolink (TSE:3680) | 27% | 61.5% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.7% | 43.5% |

| Medley (TSE:4480) | 34% | 30.4% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.3% |

| ExaWizards (TSE:4259) | 22% | 75.2% |

| Money Forward (TSE:3994) | 21.4% | 68.1% |

| Loadstar Capital K.K (TSE:3482) | 33.8% | 24.3% |

| AeroEdge (TSE:7409) | 10.7% | 25.3% |

| Soracom (TSE:147A) | 16.5% | 54.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

istyle (TSE:3660)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: istyle Inc. operates the beauty portal site @cosme in Japan and internationally, with a market cap of ¥42.61 billion.

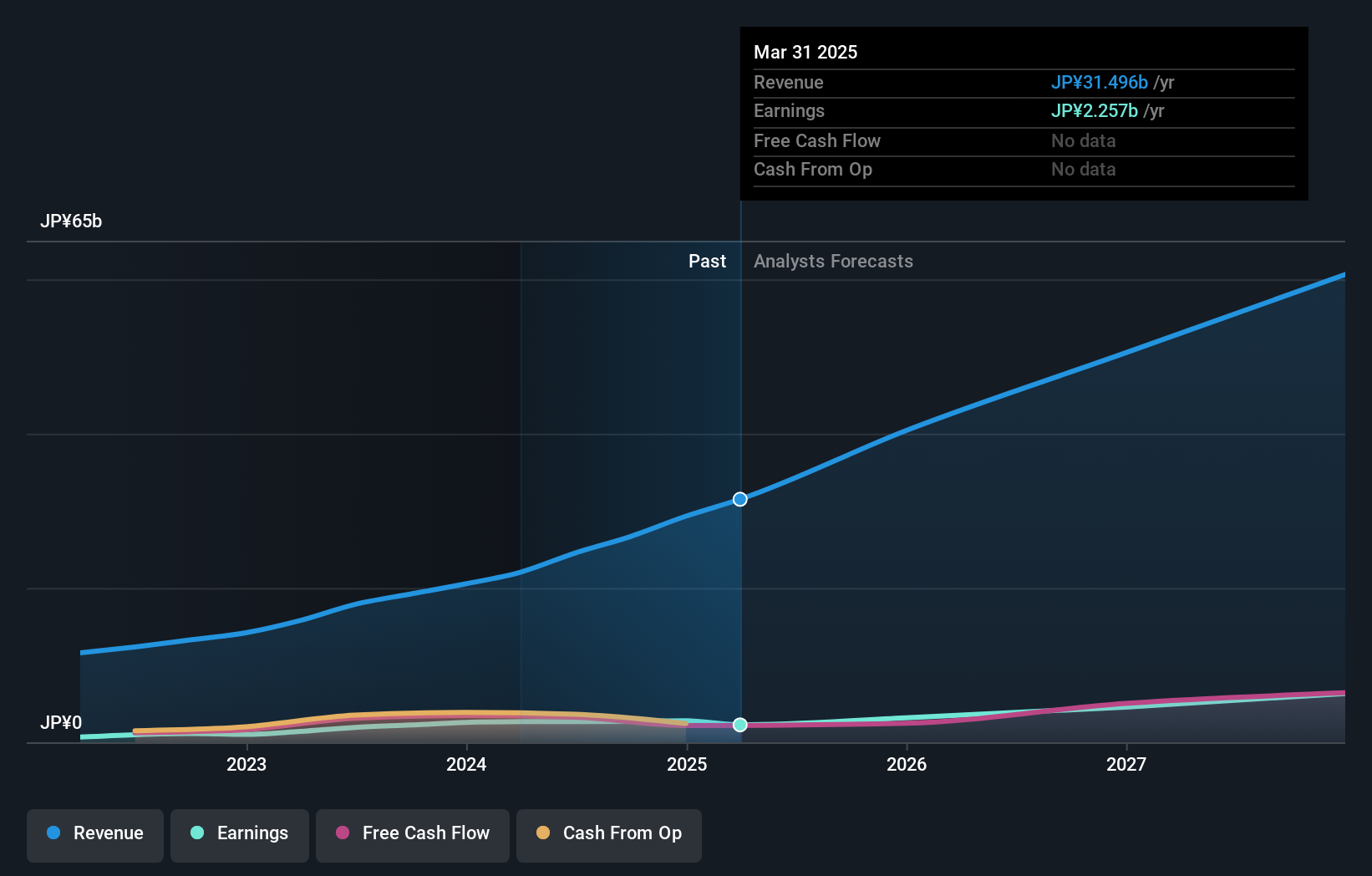

Operations: istyle Inc. generates revenue through its Retail segment (¥42.24 billion), Business segment (¥1.70 billion), Global Business segment (¥3.94 billion), and Marketing Solution segment (¥9.24 billion).

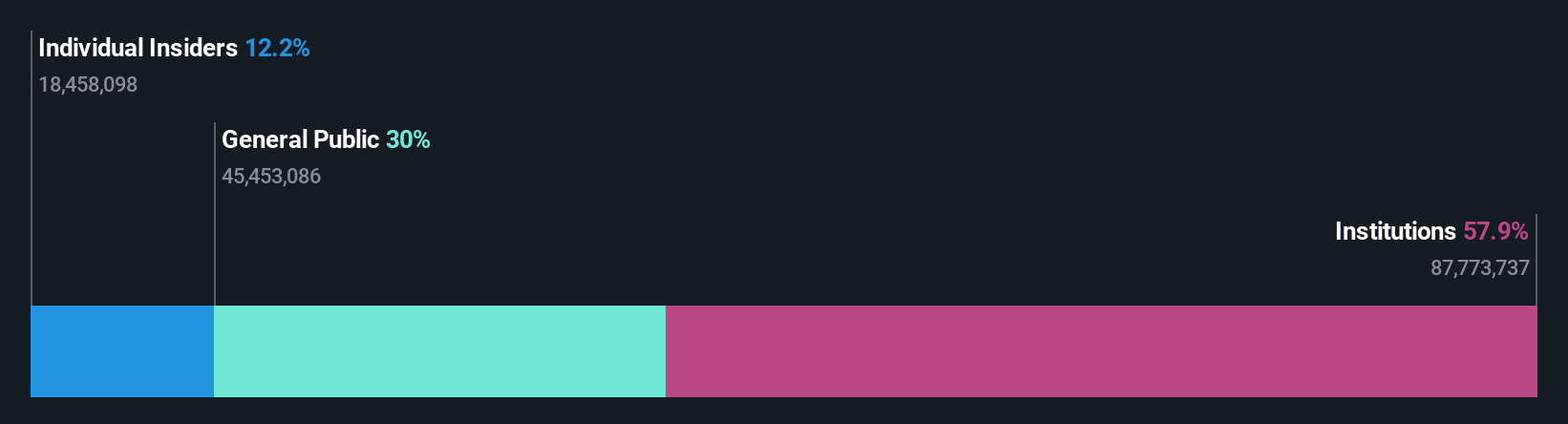

Insider Ownership: 18.3%

istyle Inc. demonstrates strong growth potential with significant insider ownership, evidenced by a 341.5% increase in earnings over the past year and forecasted annual profit growth of 20.6%, outpacing the Japanese market's 8.7%. Despite recent shareholder dilution, istyle's revenue grew to ¥56.09 billion from ¥42.89 billion last year, and net income rose to ¥1.21 billion from ¥275 million, indicating robust financial health amidst high volatility in share price movements.

- Take a closer look at istyle's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, istyle's share price might be too optimistic.

Medley (TSE:4480)

Simply Wall St Growth Rating: ★★★★★★

Overview: Medley, Inc. operates platforms for recruitment and medical businesses in Japan and the United States, with a market cap of ¥124.25 billion.

Operations: Medley's revenue segments include ¥0.57 billion from New Services, ¥6.09 billion from its Medical Platform Business, and ¥17.87 billion from its Human Resource Platform Business.

Insider Ownership: 34%

Medley, Inc. exhibits strong growth potential with high insider ownership and significant revenue and earnings growth forecasts. The company's revenue is projected to grow 25% annually, outpacing the Japanese market's 4.3%, while earnings are expected to increase by 30.4% per year over the next three years. Despite recent share price volatility, Medley's fair value is estimated to be significantly higher than its current trading price. Recent expansions in the U.S., particularly through Jobley's phased rollout in healthcare hiring services, further bolster Medley's growth outlook.

- Click to explore a detailed breakdown of our findings in Medley's earnings growth report.

- The valuation report we've compiled suggests that Medley's current price could be inflated.

BayCurrent Consulting (TSE:6532)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BayCurrent Consulting, Inc. provides consulting services in Japan and has a market cap of ¥804.73 billion.

Operations: BayCurrent Consulting, Inc. generates revenue through its consulting services in Japan, with a market cap of ¥804.73 billion.

Insider Ownership: 13.9%

BayCurrent Consulting demonstrates strong growth potential with high insider ownership. The company's earnings grew by 16.8% over the past year and are forecast to grow at 18.42% annually, outpacing the Japanese market's 8.7%. Revenue is expected to increase by 18.4% per year, faster than the market's 4.3%. Trading at a significant discount of 44.2% below its estimated fair value, BayCurrent also boasts a high forecasted return on equity of 35.5%.

- Unlock comprehensive insights into our analysis of BayCurrent Consulting stock in this growth report.

- In light of our recent valuation report, it seems possible that BayCurrent Consulting is trading beyond its estimated value.

Taking Advantage

- Take a closer look at our Fast Growing Japanese Companies With High Insider Ownership list of 102 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if istyle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3660

istyle

Operates a beauty portal site @cosme in Japan and internationally.

Solid track record with excellent balance sheet.