Stock Analysis

- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6645

High Growth Tech Stocks In Japan Featuring freee K.K And 2 Others

Reviewed by Simply Wall St

Japan's stock markets recently experienced volatility due to political shifts, with the Nikkei 225 and TOPIX indices both seeing declines as investors adjusted to the new prime minister's slightly hawkish monetary policy stance. Despite these fluctuations, opportunities in Japan's high-growth tech sector remain compelling, especially for companies like freee K.K., which are well-positioned to leverage technological advancements and navigate economic uncertainties effectively.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| GMO AD Partners | 69.79% | 97.87% | ★★★★★☆ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

freee K.K (TSE:4478)

Simply Wall St Growth Rating: ★★★★★☆

Overview: freee K.K. provides cloud-based accounting and HR software solutions in Japan, with a market cap of ¥162.58 billion.

Operations: The company focuses on delivering cloud-based accounting and HR software solutions within Japan. Its revenue model is primarily driven by subscription fees for its software services, catering to small and medium-sized enterprises.

Amidst a volatile market, freee K.K. stands out with its robust projected revenue growth of 18.2% annually, surpassing Japan's average of 4.2%. This growth is underpinned by significant R&D investments, which are crucial as the company transitions to profitability within the next three years—a pace well above market norms. Recent strategic shifts include appointing Yasuhiro Kimura as CPO, signaling a strengthened focus on enhancing their ERP systems to better serve small businesses—an area ripe for technological integration and innovation.

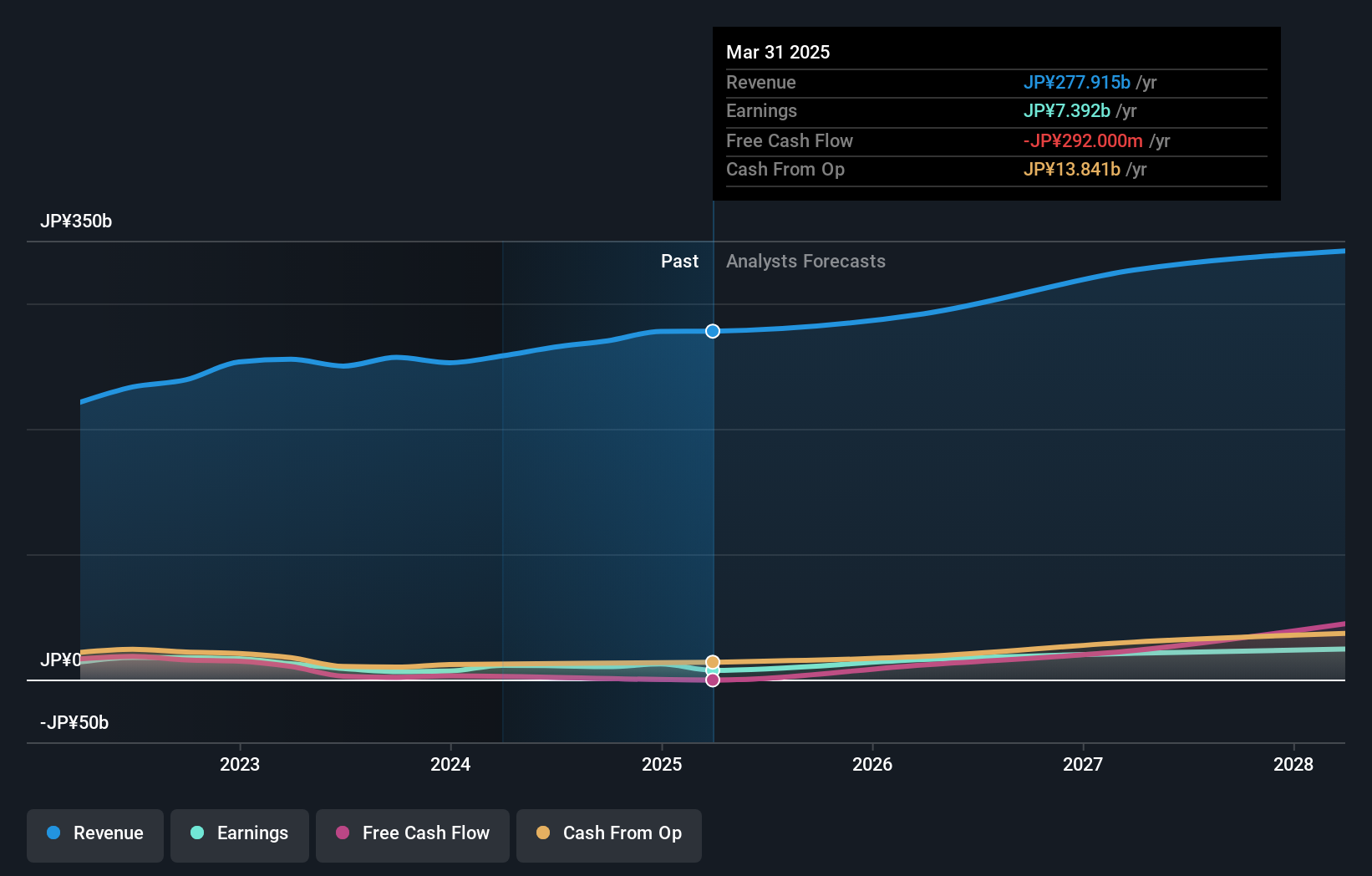

OMRON (TSE:6645)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OMRON Corporation operates globally in industrial automation, device and module solutions, social systems, and healthcare sectors with a market capitalization of ¥1.31 trillion.

Operations: OMRON Corporation generates revenue primarily from its Industrial Automation Business (IAB) and Social Systems, Solutions and Service Business (SSB), with IAB contributing ¥373.70 billion and SSB ¥156.85 billion. The Healthcare Business (HCB) adds ¥150.40 billion, while the Devices & Module Solutions Business (DMB) accounts for ¥143.69 billion in revenue.

OMRON Corporation, amidst its diverse operations, shines in its automation segment, which significantly contributes to both revenue and earnings. With a strategic focus on innovation, the company's R&D expenses have surged to 5.6% of total revenue, fostering developments that keep it competitive in fast-evolving tech landscapes. This investment supports an expected earnings growth of 46.1% annually, positioning OMRON well above many peers in Japan's tech industry. Recent events like the Q1 2025 Earnings Call highlight forward-looking initiatives and a commitment to shareholder returns with a recent ¥52 dividend announcement. These factors collectively underscore OMRON’s potential in navigating the complexities of high-tech markets while maintaining robust financial health.

- Click to explore a detailed breakdown of our findings in OMRON's health report.

Explore historical data to track OMRON's performance over time in our Past section.

Kadokawa (TSE:9468)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kadokawa Corporation is a Japanese entertainment company with a market capitalization of ¥445.75 billion, engaging in various sectors including gaming, publishing, web services, animation/film production, and education technology.

Operations: Kadokawa Corporation generates significant revenue from its publishing segment, amounting to ¥143.28 billion, followed by animation/film production at ¥46.36 billion and gaming at ¥28.63 billion. The company's diverse operations also include web services and education technology, contributing to its overall financial performance.

Kadokawa stands out in Japan's tech landscape, notably with its 21.6% expected annual earnings growth, surpassing the broader Japanese market forecast of 8.7%. This robust projection is underpinned by a significant commitment to R&D, with expenses reaching 5.6% of total revenue, fostering innovation crucial for staying ahead in competitive sectors. Moreover, Kadokawa's strategic maneuvers are evident as its revenue growth rate at 6.7% annually also beats the national average of 4.2%, positioning it well for sustained advancements in a challenging industry environment.

- Dive into the specifics of Kadokawa here with our thorough health report.

Gain insights into Kadokawa's past trends and performance with our Past report.

Seize The Opportunity

- Get an in-depth perspective on all 120 Japanese High Growth Tech and AI Stocks by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6645

OMRON

Engages in industrial automation, device and module solutions, social systems, and healthcare businesses worldwide.