As global markets navigate a landscape marked by cooling labor markets and fluctuating economic indicators, small-cap stocks have shown resilience, with the Russell 2000 Index gaining ground amid upbeat sentiment in the tech sector. In this context, high growth tech stocks are capturing attention due to their potential for innovation and adaptability, especially in areas like artificial intelligence where recent developments have sparked investor interest.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.80% | 45.66% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Rakovina Therapeutics | 40.75% | 16.49% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

NEXON Games (KOSDAQ:A225570)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NEXON Games Co., Ltd. is a South Korean game developer with international operations, and it has a market capitalization of approximately ₩972.85 billion.

Operations: The company generates revenue primarily through game sales, amounting to ₩249.34 million, and rental income sales of ₩5.16 million.

NEXON Games, amid a challenging tech landscape, has demonstrated robust financial agility with its recent earnings growth of 42.4% annually, outpacing the broader KR market's 20.9%. This growth is supported by strategic investments in R&D which aligns with their innovative drive in gaming technology. Despite a slight downturn in quarterly sales to KRW 51.31 billion from KRW 52.63 billion year-over-year and an increase in net losses, the company's commitment to enhancing shareholder value is evident through a substantial share repurchase program valued at KRW 15 billion valid until September 2025. These maneuvers underscore NEXON's proactive stance in navigating market dynamics while fostering long-term growth prospects.

- Unlock comprehensive insights into our analysis of NEXON Games stock in this health report.

Gain insights into NEXON Games' historical performance by reviewing our past performance report.

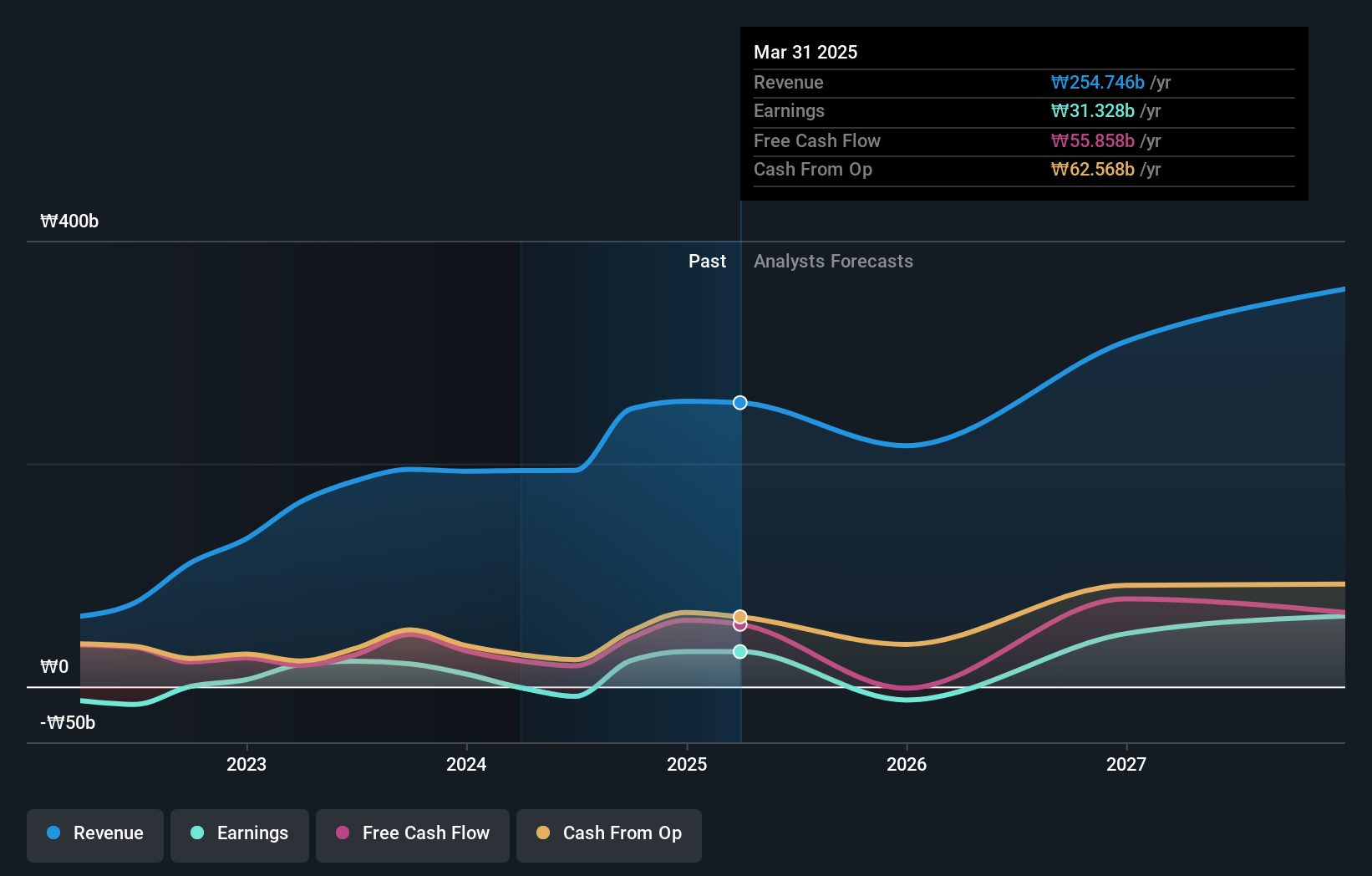

NHN (KOSE:A181710)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NHN Corporation is an IT company that offers gaming, payment, entertainment, IT, and advertisement solutions both in South Korea and internationally with a market cap of ₩793.61 billion.

Operations: NHN generates revenue primarily through its payment and advertising segment, which contributes ₩1.19 trillion, followed by its gaming segment at ₩462.92 billion. The company operates across various sectors, providing a diverse range of IT solutions internationally.

NHN's strategic focus on innovation is evident from its R&D commitment, with expenses consistently aligning with industry demands to foster growth and competitiveness. Despite a challenging fiscal environment marked by a net loss of KRW 3,751.5 million in Q1 2025, the company has actively repurchased shares worth KRW 11,311.56 million, underscoring its confidence in future recovery and value creation. The launch of 'DarkEST DAYS' highlights NHN's adaptive strategy in gaming, enhancing global reach through multilingual support and cross-platform integration between PC and mobile devices, aiming to boost user engagement across diverse markets.

- Get an in-depth perspective on NHN's performance by reading our health report here.

Assess NHN's past performance with our detailed historical performance reports.

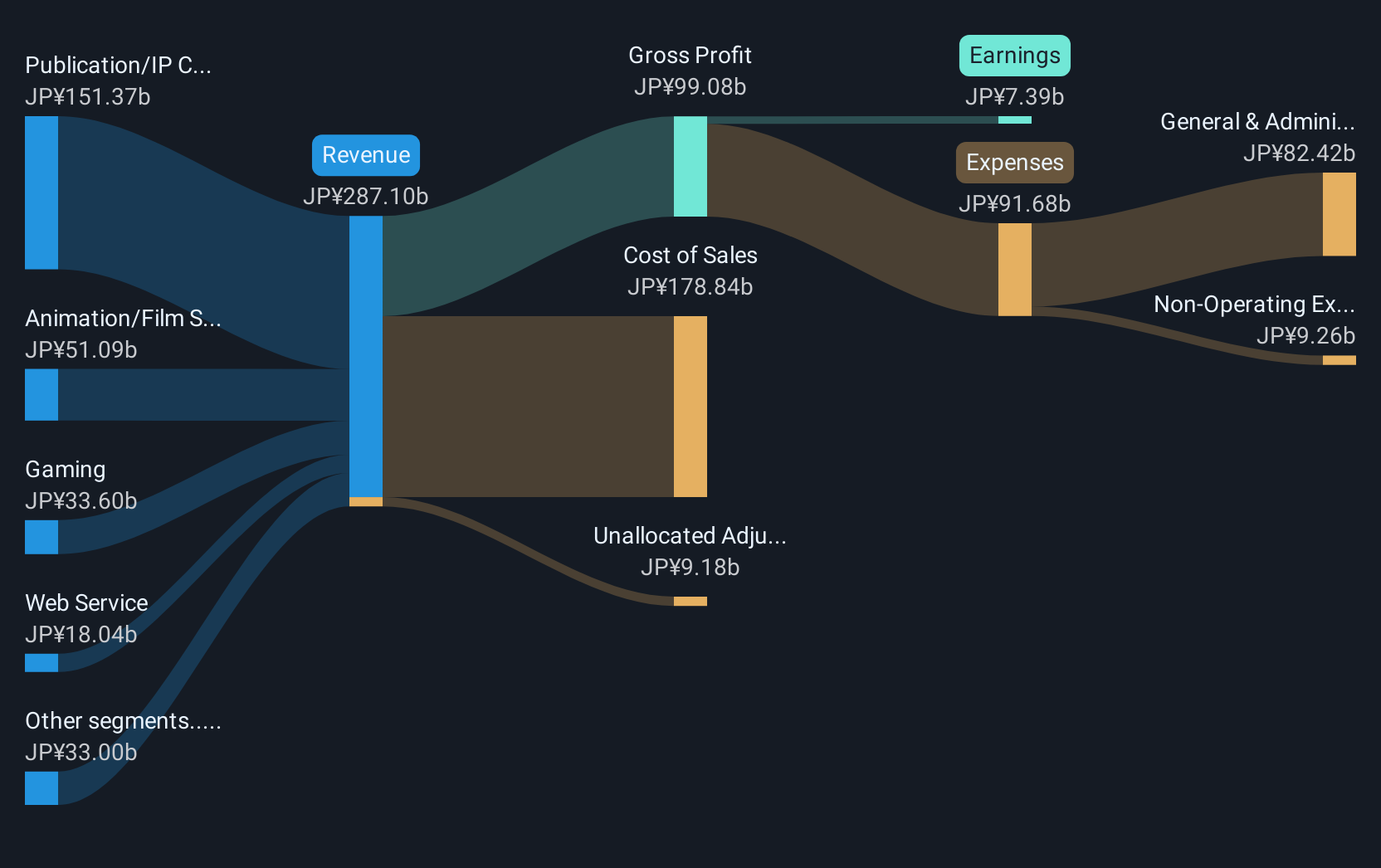

Kadokawa (TSE:9468)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kadokawa Corporation is an entertainment company in Japan with a market capitalization of approximately ¥542.23 billion.

Operations: Kadokawa Corporation generates revenue primarily from its Publication/IP Creation segment, which accounts for ¥151.37 billion, and its Animation/Film Segment, contributing ¥51.09 billion. The Gaming segment also adds to the revenue at ¥33.60 billion, while the Web Service and Education/Edtech segments contribute smaller portions of ¥18.04 billion and ¥15.12 billion respectively.

Kadokawa's trajectory in the high-growth tech landscape is underscored by its strategic R&D investments and recent corporate activities. With an earnings growth forecast of 21.4% annually, Kadokawa is poised to outpace the Japanese market average of 7.5%. However, its revenue growth at 5.9% yearly signals a more modest expansion compared to industry disruptors but remains above the market trend of 3.7%. The company's focused approach on dividends, as evidenced by a consistent JPY 30 per share payout, aligns with its stable financial outlook despite a challenging past performance marked by negative earnings growth last year (-35.1%). This blend of strategic R&D spending and shareholder returns positions Kadokawa uniquely within both traditional and digital media realms, leveraging partnerships like the one with NHN for game development to tap into global markets effectively.

- Take a closer look at Kadokawa's potential here in our health report.

Explore historical data to track Kadokawa's performance over time in our Past section.

Summing It All Up

- Unlock more gems! Our Global High Growth Tech and AI Stocks screener has unearthed 744 more companies for you to explore.Click here to unveil our expertly curated list of 747 Global High Growth Tech and AI Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kadokawa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9468

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives