A Fresh Look at SKY Perfect JSAT (TSE:9412) Valuation Following SpaceX Satellite Partnership

Reviewed by Simply Wall St

SKY Perfect JSAT Holdings (TSE:9412) is moving forward with a collaborative initiative to launch three satellites in partnership with SpaceX. This step supports the company’s strategy to enhance its satellite communications capabilities and appears to be attracting fresh attention from investors.

See our latest analysis for SKY Perfect JSAT Holdings.

Investor excitement following the SpaceX collaboration is evident, with SKY Perfect JSAT Holdings posting a stunning 9% share price gain in a single day and an 18% jump over the past week. Momentum has clearly gathered steam, as its 1-year total shareholder return has reached an impressive 117.8%. The five-year figure sits at 346.8%, underscoring both short-term enthusiasm and sustained long-term growth.

If you’re interested in spotting more companies with robust growth drivers and strong investor backing, now’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

Yet given the surge in share price, investors are left to wonder if SKY Perfect JSAT is trading below its true value or if the market has already factored in all the expected growth from its latest moves.

Price-to-Earnings of 26x: Is it justified?

SKY Perfect JSAT Holdings trades at a price-to-earnings (P/E) ratio of 26x, with its share price sitting at ¥1,799. Compared to peer averages and market benchmarks, this ratio offers a mixed picture of value.

The price-to-earnings ratio is a key metric for investors, measuring how much they are paying for each unit of earnings. This is especially relevant for companies like SKY Perfect JSAT, whose profit growth potential is in focus following recent strategic moves.

At 26x, SKY Perfect JSAT is considered good value relative to its peers, which are trading on average at a much higher 40.2x. However, it is more expensive than the broader Japanese media industry average, which sits at 17.2x. When compared to what the market estimates as a "fair" price-to-earnings ratio (26.6x), there may be limited room for expansion from here but the figure suggests the current valuation is close to justified and could shift based on forward earnings trajectory.

Explore the SWS fair ratio for SKY Perfect JSAT Holdings

Result: Price-to-Earnings of 26x (ABOUT RIGHT)

However, short-term overexuberance and a share price already above analyst targets could result in volatility if growth expectations are not fully met.

Find out about the key risks to this SKY Perfect JSAT Holdings narrative.

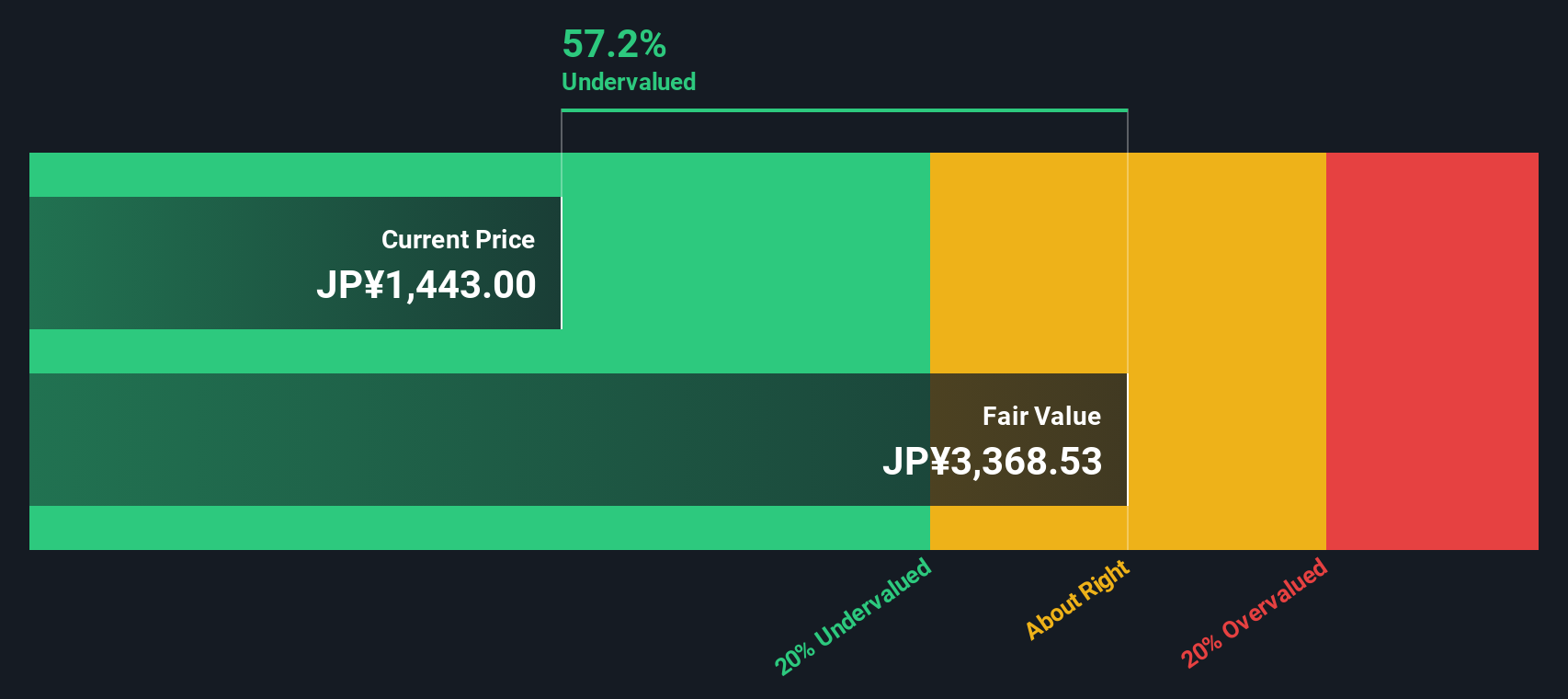

Another View: DCF Model Shows Deep Value

Looking at SKY Perfect JSAT through the lens of the SWS DCF model, the story shifts. The DCF suggests shares are trading a remarkable 47.6% below estimated fair value. This signals a major undervaluation compared to current market pricing. Is the market missing bigger upside, or are expectations too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SKY Perfect JSAT Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SKY Perfect JSAT Holdings Narrative

If you want to take a deeper dive or reach your own conclusions, you can assemble your own analysis of SKY Perfect JSAT Holdings in just a few minutes, Do it your way

A great starting point for your SKY Perfect JSAT Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop at just one opportunity. Use Simply Wall Street’s powerful screener to spot tomorrow’s winners before everyone else catches on. Don’t let these market leaders slip by unnoticed.

- Accelerate your returns with these 848 undervalued stocks based on cash flows, offering strong potential at prices below their true worth, perfect for value-focused portfolios.

- Capture massive new trends by checking out these 25 AI penny stocks and spot companies at the forefront of artificial intelligence innovation.

- Lock in passive income streams by tapping into these 18 dividend stocks with yields > 3%, where high-yield stocks are handpicked for stable, ongoing payout potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9412

SKY Perfect JSAT Holdings

Provides satellite-based multichannel pay TV and satellite communications services primarily in Asia.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives