- Japan

- /

- Entertainment

- /

- TSE:7974

Nintendo (TSE:7974) Margin Dip Challenges Bullish Narratives Despite Robust Profit Growth Forecasts

Reviewed by Simply Wall St

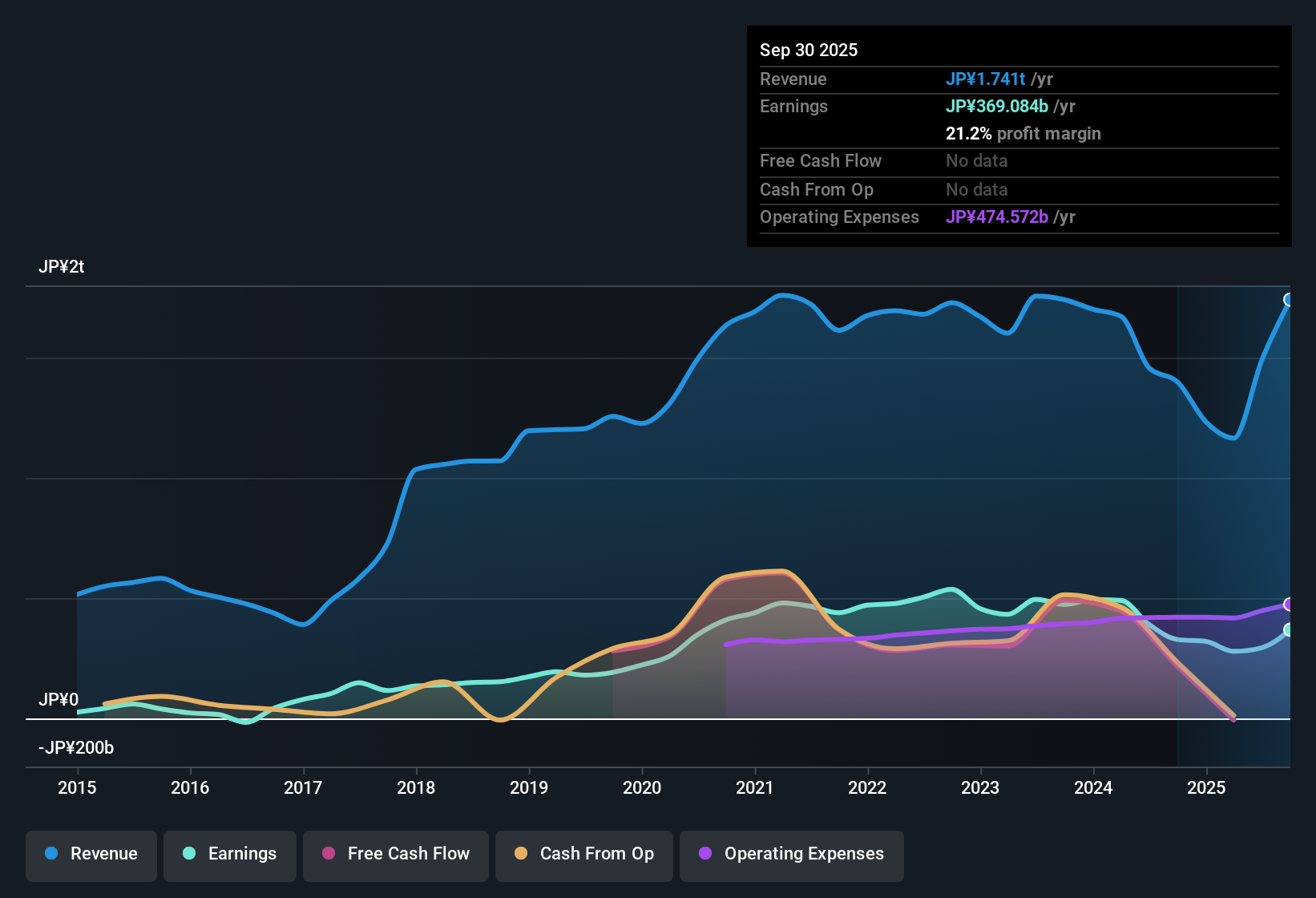

Nintendo (TSE:7974) reported revenue growth forecasts of 4.9% per year, just ahead of the Japanese market’s 4.5%. Earnings are set to climb by 14.1% per year, topping the market average of 7.8%. However, net profit margins have dipped to 19.7% compared to 26.8% last year, and historical earnings have averaged a 6.7% decline annually over the past five years. Investors will be weighing these growth expectations against a lack of flagged risks and the promise of continued operational expansion, even as Nintendo trades at a steep price-to-earnings ratio of 54.5x and a share price of ¥13,750.

See our full analysis for Nintendo.Next, we will see how these headline numbers compare with the prevailing narratives in the market and whether they are supported or challenged.

See what the community is saying about Nintendo

Margins Slip but Profit Quality Remains High

- Net profit margins have dropped to 19.7% from last year’s 26.8%, shifting Nintendo’s profitability profile notably. Even so, earnings themselves are regarded as high quality in the filing.

- What’s surprising, according to prevailing market view, is that despite this margin compression and a recent five-year average annual earnings decline of 6.7%, Nintendo’s forecasted annual profit growth of 14.1% is still projected to outpace not just its past trend but also the wider Japanese market’s 7.8%.

- This resilience in projected profit comes at a time when many peer companies are struggling to even maintain flat margins.

- Yet, the dip in margins calls attention to the gap between headline growth rates and underlying operational performance.

Premium Valuation Drives Market Caution

- Nintendo’s price-to-earnings ratio of 54.5x sharply exceeds both the peer average (38.1x) and the sector average (22.7x). Its current share price of ¥13,750 is well above its DCF fair value of ¥9,845.98.

- Prevailing market view emphasizes that this elevated valuation means investors are paying a significant premium for Nintendo’s growth profile, even though that growth is not classified as “significant” by the 20% annual threshold.

- The lack of major flagged risks in filings leaves the high multiple in focus, increasing pressure on Nintendo to deliver outsized operational and financial results.

- The valuation gap also signals that cautious investors may hesitate to enter until the price aligns more closely with fundamental measures.

To see how market consensus weighs these valuation and growth factors, dig into the full narrative for the most balanced view of Nintendo’s long-term outlook. 📊 Read the full Nintendo Consensus Narrative.

Steady Revenue Growth Supports Expansion Case

- Forecasted revenue growth of 4.9% per year slightly edges out the Japanese market’s 4.5%, highlighting Nintendo’s ability to keep pace with or even exceed its domestic competitors despite margin pressures.

- Market commentary points out that while these growth estimates aren’t dramatic, Nintendo’s stable expansion profile may still appeal to investors focused on long-term, lower-risk exposure.

- Ongoing top-line gains are a key reward for shareholders amid an otherwise rich valuation and tighter margins.

- This forward momentum allows Nintendo to remain attractive to those prioritizing consistency over volatile, high-growth plays.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Nintendo on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Not seeing the story the same way? Share your unique take and craft a custom narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Nintendo.

See What Else Is Out There

Nintendo’s lofty valuation and shrinking profit margins suggest that investors may face premium prices without the reassurance of robust underlying performance.

If you want to focus on value opportunities with stronger fundamentals, check out these 839 undervalued stocks based on cash flows that could offer you better upside at a more reasonable price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nintendo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7974

Nintendo

Develops, manufactures, and sells home entertainment products in Japan, the Americas, Europe, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives