- Japan

- /

- Entertainment

- /

- TSE:7974

Is It Time to Reassess Nintendo After a 43.7% Surge in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Nintendo is a bargain or overpriced right now? You are not alone. With the gaming giant in the spotlight, it is a great time to dig into its real value.

- Despite a rocky patch this week with shares down 6.2%, Nintendo's stock has soared 43.7% year-to-date and an impressive 60.1% over the last 12 months. This hints at both momentum and market excitement.

- Recent headlines have kept Nintendo in focus as anticipation swirls around new game releases and ongoing buzz about its next-generation console. These developments add new context to the stock's movements and have investors watching closely for the company’s next move.

- Digging into the numbers, Nintendo currently has a 1/6 valuation score, suggesting it is considered undervalued in just one area based on our usual checks. Let us look at what this really means, how typical valuation methods measure up, and why there might be an even better way to assess a stock's true worth by the end of this article.

Nintendo scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Nintendo Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future cash flows and discounting them back to today, reflecting both expected growth and risk. For Nintendo, analysts have provided detailed forecasts for free cash flow over the next five years, with longer-term numbers extrapolated by Simply Wall St.

Nintendo’s current Free Cash Flow stands at ¥138.2 Billion. Analyst projections expect this to grow steadily, and by 2030 Free Cash Flow is forecasted to reach roughly ¥721 Billion. This significant anticipated growth translates to big numbers, but the DCF model weighs these future amounts less because of the time value of money.

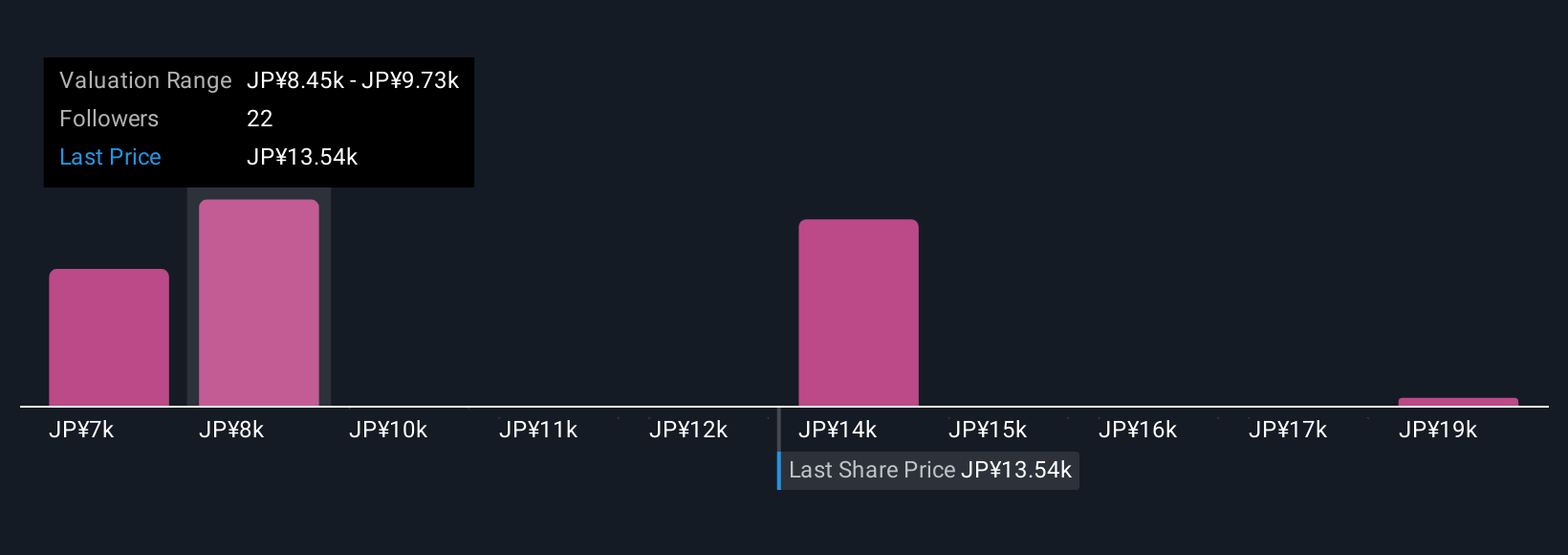

Using the 2 Stage Free Cash Flow to Equity model and all the available data, Nintendo’s estimated intrinsic value stands at ¥10,715 per share. With the current trading price about 21.6% above this mark, the analysis suggests that Nintendo stock is overvalued when judged strictly on cash flow fundamentals.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Nintendo may be overvalued by 21.6%. Discover 897 undervalued stocks or create your own screener to find better value opportunities.

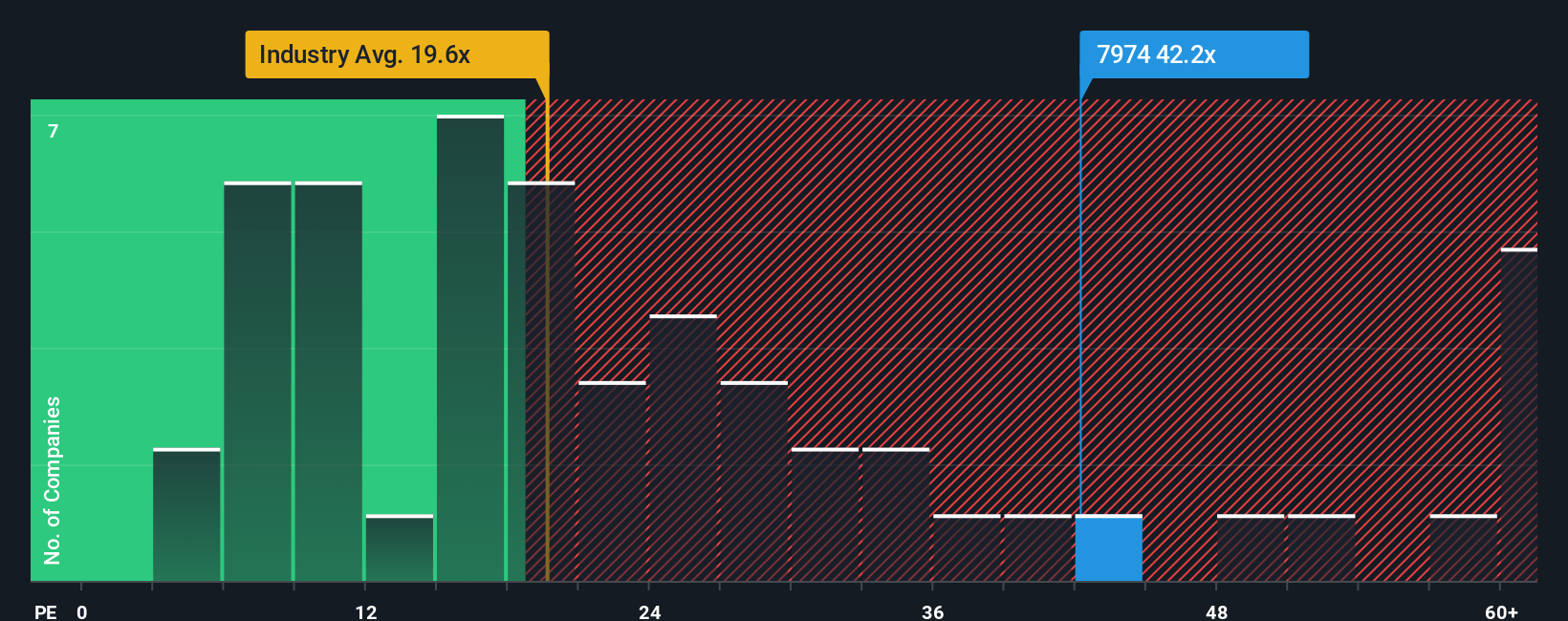

Approach 2: Nintendo Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a favored metric for valuing profitable companies like Nintendo. It measures how much investors are willing to pay for each unit of earnings, making it especially relevant for businesses with strong and stable profits.

Growth expectations and risk play a big role in setting what is considered a “normal” PE ratio. If a company is seen as having strong future prospects and lower risks, investors typically accept a higher PE. On the flip side, higher risk or limited growth warrants a lower ratio.

Nintendo’s current PE sits at 41.1x. This is well above the Entertainment industry average of 19.2x and also higher than the peer average of 34.3x. At first glance, this premium could raise eyebrows, but headline comparisons do not always tell the full story.

That is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio, which in this case is 46.3x, is calculated by factoring in not just growth rates, but also Nintendo’s profit margins, size, and industry-specific risks. This is a more thoughtful benchmark than simply comparing with industry peers, since it reflects both the context and potential of Nintendo itself.

Given that Nintendo’s PE of 41.1x is just below its Fair Ratio of 46.3x, the stock looks about in line with expectations for its profile.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1416 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Nintendo Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, story-driven approach where you combine your perspective and expectations about a company with the hard numbers, linking your view of its future to a financial forecast and ultimately a fair value.

Narratives make stock analysis more intuitive, helping you see the “story behind the numbers,” from projecting revenue growth and margins to estimating fair prices. You can then compare your Fair Value to the current market price to help guide buy or sell decisions. Available on Simply Wall St’s Community page and used by millions, Narratives let you create, browse, or adjust your own scenarios based on the latest news or company results. These estimates are updated dynamically as new information comes in.

For example, when looking at Nintendo, one investor’s Narrative forecasts a fair value as high as ¥10,715 per share based on aggressive console sales and franchise growth, while another sets it as low as ¥7,613 per share with more cautious growth and margin assumptions, allowing you to quickly see how different outlooks lead to different investment decisions.

Do you think there's more to the story for Nintendo? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nintendo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7974

Nintendo

Develops, manufactures, and sells home entertainment products in Japan, the Americas, Europe, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives