- Japan

- /

- Entertainment

- /

- TSE:7974

Does Animal Crossing’s Switch 2 Upgrade Deepen Nintendo’s Engagement Strategy for TSE:7974?

Reviewed by Sasha Jovanovic

- Nintendo has announced that Animal Crossing: New Horizons will launch in an enhanced edition for the Nintendo Switch 2 on January 15, 2026, featuring 4K visuals, expanded multiplayer capability, mouse controls, and new interactive features, alongside a substantial free update for existing Switch users introducing new gameplay content and collaborations.

- The addition of a paid upgrade pack for current owners and pre-order availability suggests Nintendo's ongoing focus on deepening player engagement in one of its bestselling franchises with flexible monetization options.

- We'll explore how the integration of expanded online multiplayer and major content updates could strengthen Nintendo's long-term engagement strategy.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Nintendo's Investment Narrative?

For Nintendo shareholders, the core belief has always centered on the company’s ability to keep its beloved franchises relevant through hardware cycles, creative updates, and cross-generational content. The announcement of Animal Crossing: New Horizons - Nintendo Switch 2 Edition suggests a fresh short-term catalyst, a high-profile release timed with the new console, layered with paid and free updates to drive engagement. Such moves signal an effort to extend the Switch ecosystem’s momentum while encouraging both new and existing players to invest further in the franchise. While analysts previously cited risks around valuation, slower margin improvement, and competition in the maturing Switch segment, this news could shift the discussion, especially if it triggers visible demand lifts or wider adoption of paid upgrade models. The scale of the impact, however, may hinge on how much incremental sales and user engagement the new content brings, something not yet reflected in recent trading or consensus numbers. On the flip side, the premium price tag versus peers is still a risk investors should keep top of mind.

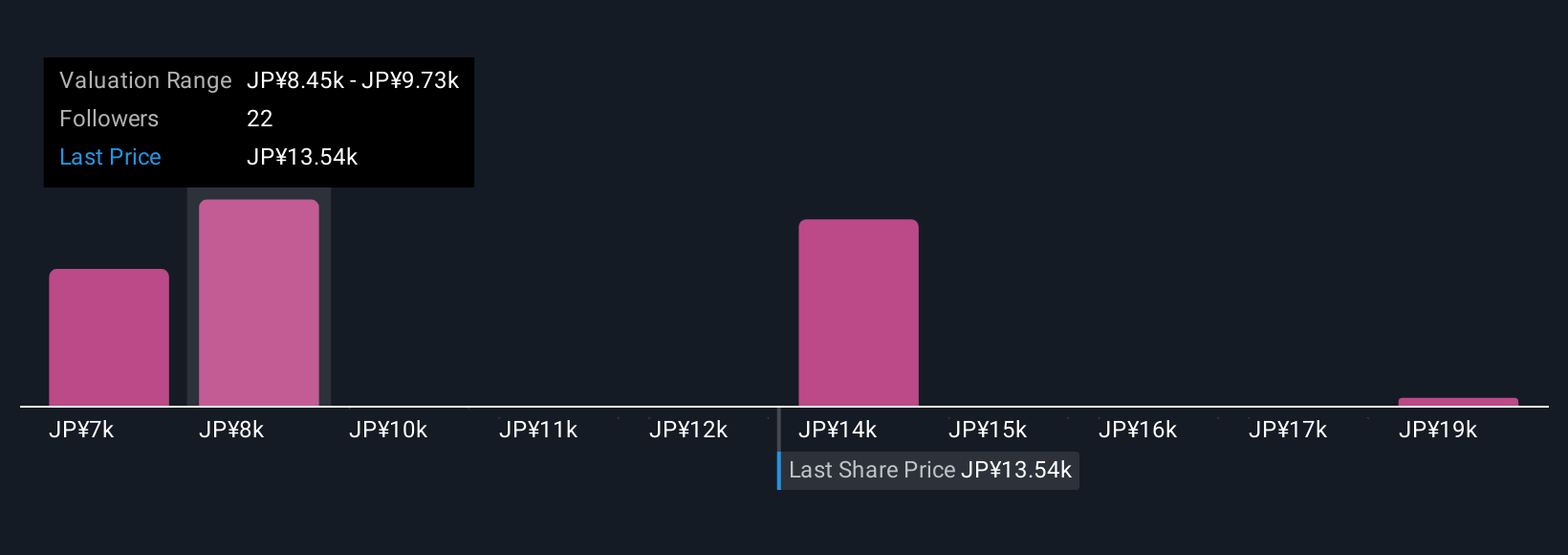

Nintendo's shares are on the way up, but they could be overextended by 18%. Uncover the fair value now.Exploring Other Perspectives

Explore 7 other fair value estimates on Nintendo - why the stock might be worth as much as 50% more than the current price!

Build Your Own Nintendo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nintendo research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Nintendo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nintendo's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nintendo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7974

Nintendo

Develops, manufactures, and sells home entertainment products in Japan, the Americas, Europe, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives