- Japan

- /

- Entertainment

- /

- TSE:7844

Marvelous (TSE:7844) Profit Return Challenges Bearish Narratives on Earnings Sustainability

Reviewed by Simply Wall St

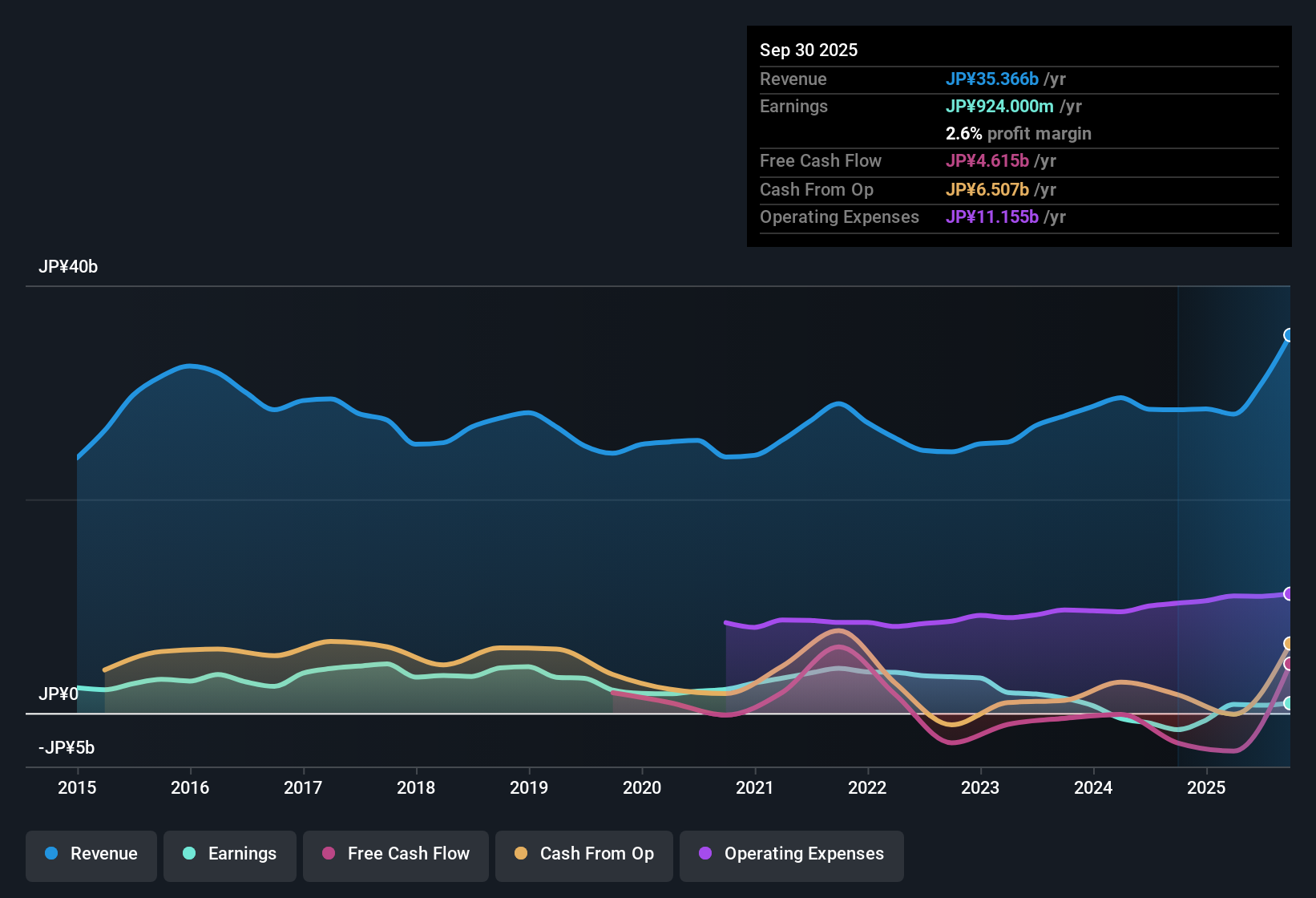

Marvelous (TSE:7844) has turned a corner, moving from five straight years of average annual earnings declines of 40.7% to finally posting a profit. The company is now forecasting a robust 37.3% per year earnings growth, outpacing the broader Japanese market’s expected 7.8%. Revenue is projected to rise at 4.2% annually, just under the market’s 4.5% pace, and margins have improved with this shift back to profitability.

See our full analysis for Marvelous.Next, we'll take a look at how these headline numbers stack up against the most talked-about narratives. We will also consider whether the recent results reinforce or challenge popular investor views.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Bounce Back With Profit Turnaround

- Marvelous has returned to profitability after five straight years of annual earnings declines averaging 40.7%, demonstrating a material shift toward more sustainable operations and improved cost control.

- With margins tracking higher, prevailing market analysis highlights how the company’s path back to profit builds on established intellectual property and innovation in gaming. This signals that execution on upcoming releases could further cement this rebound.

- Sector peers are watching closely to see if these margin gains can drive lasting momentum, especially as industry competition rises.

- Positive news and new title launches typically ignite optimism. However, continued delivery on these improved margins will be key to sustaining market enthusiasm.

Premium Price Tag Reflects High Hopes

- The ¥566 share price trades at a hefty 37.1x price-to-earnings ratio, well above the Japanese entertainment industry average of 21.6x. This signals that investors are baking substantial future growth into the stock’s current valuation.

- Analysis underscores that while optimism drives Marvelous’s premium, the risk is clear. Any stumbles on growth targets could put downward pressure on the stock if expectations do not materialize as quickly as factored into today’s valuation.

- The current price eclipses both the discounted cash flow fair value of ¥210.25 and peer average multiples, leaving little margin for error.

- This tension between elevated expectations and actual delivery will define how the market responds to Marvelous in the coming quarters.

Dividend Sustainability on Investors’ Radar

- The EDGAR summary flags a minor risk around dividend sustainability as profits recover, prompting cautious investors to question whether current payout levels can be upheld alongside ambitious growth spending.

- Prevailing market views highlight that while profitability and earnings quality have rebounded, maintaining both dividend distributions and robust investment in new titles may prove challenging if performance falters.

- As the sector remains dynamic and competition intensifies, Marvelous faces a balancing act between rewarding shareholders and funding future growth.

- This trade-off makes ongoing dividend sustainability a focal point for those evaluating long-term confidence in the company.

See our latest analysis for Marvelous.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Marvelous's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Marvelous’s premium valuation leaves little margin for error. Any slip in earnings or growth delivery could quickly erase investor optimism.

If you want greater value upside and resilience, check out these 840 undervalued stocks based on cash flows to discover companies trading below their intrinsic worth with stronger downside protection.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7844

Marvelous

Engages in the planning, development, production, marketing, and sale of game software for home-use game machines.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives