- Japan

- /

- Food and Staples Retail

- /

- TSE:2659

Undiscovered Japanese Gems SAN-ALTD And 2 Small Caps With Solid Potential

Reviewed by Simply Wall St

In recent weeks, Japan's stock markets have faced volatility amid political changes and evolving economic policies, with the Nikkei 225 Index and the broader TOPIX Index experiencing notable declines. Despite these fluctuations, the search for promising small-cap stocks remains a focal point for investors seeking growth opportunities in a challenging market environment. Identifying potential gems often involves looking at companies with strong fundamentals that can navigate current conditions effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ryoyu Systems | NA | 1.08% | 8.08% | ★★★★★★ |

| Central Forest Group | NA | 7.05% | 14.29% | ★★★★★★ |

| Otec | 9.81% | 2.32% | -1.39% | ★★★★★★ |

| Uoriki | NA | 3.90% | 6.15% | ★★★★★★ |

| Nippon Denko | 18.00% | 4.31% | 48.41% | ★★★★★★ |

| Soliton Systems K.K | 0.58% | 5.04% | 16.76% | ★★★★★★ |

| Maezawa Kasei Industries | 0.81% | 2.01% | 18.42% | ★★★★★★ |

| Yashima Denki | 2.93% | -2.38% | 13.99% | ★★★★★★ |

| Mizuho MedyLtd | NA | 19.43% | 34.66% | ★★★★★★ |

| Yukiguni Maitake | 170.63% | -6.51% | -39.66% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

SAN-ALTD (TSE:2659)

Simply Wall St Value Rating: ★★★★★★

Overview: SAN-A CO., LTD. operates a chain of supermarkets in Okinawa and has a market capitalization of ¥176.69 billion.

Operations: SAN-A CO., LTD. generates revenue primarily from its retail segment, contributing ¥221.26 billion, and a smaller portion from convenience stores at ¥8.39 billion.

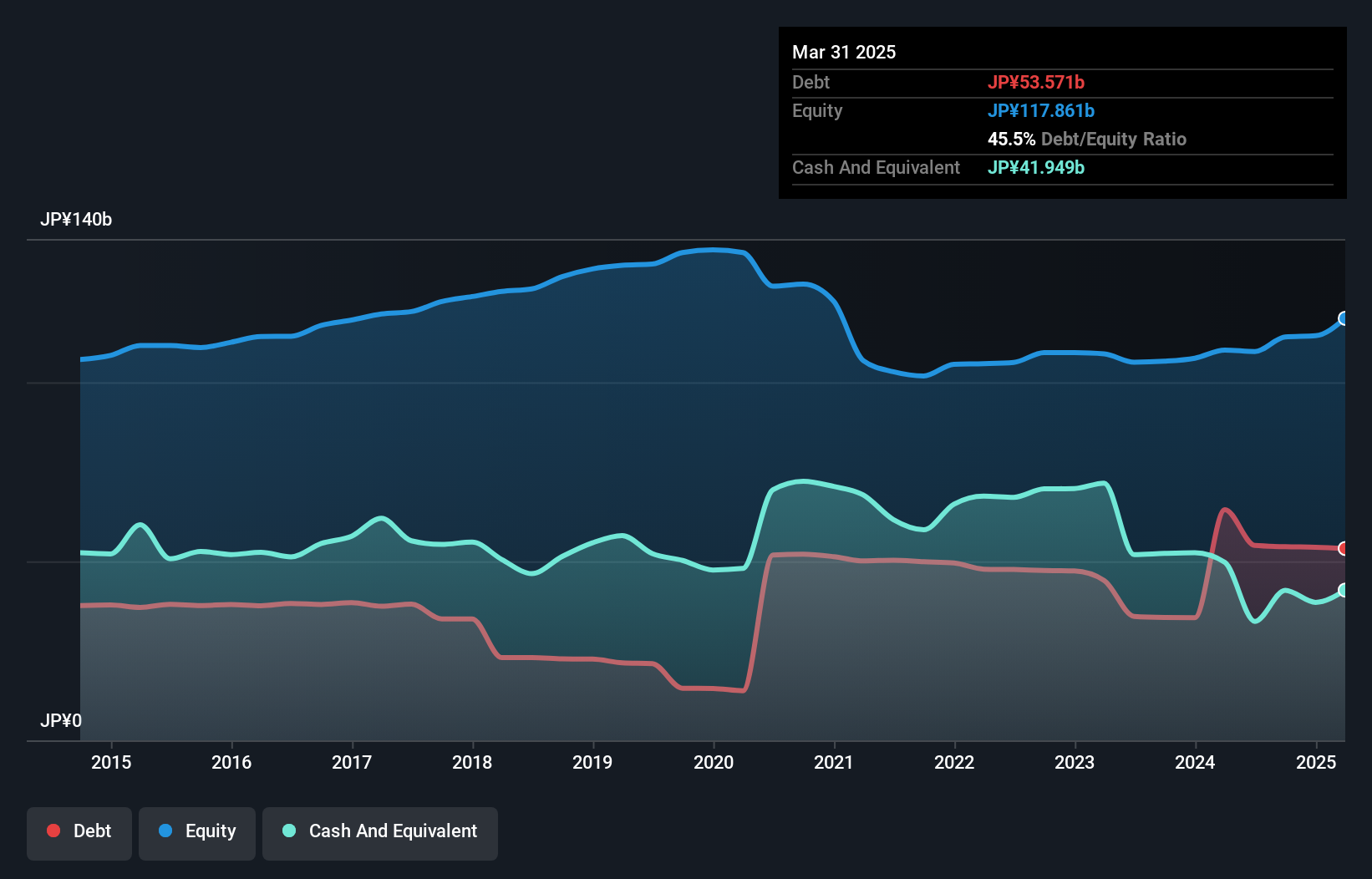

SAN-A CO., LTD., a promising player in Japan's market, has shown impressive earnings growth of 34.4% over the past year, outpacing the Consumer Retailing industry average of 22.2%. The company is trading at a significant discount, approximately 41.8% below its estimated fair value. With no debt on its books now compared to five years ago when it had a debt-to-equity ratio of 0.2%, SAN-A appears financially robust and well-positioned for future growth.

- Click here to discover the nuances of SAN-ALTD with our detailed analytical health report.

Assess SAN-ALTD's past performance with our detailed historical performance reports.

Daiichikosho (TSE:7458)

Simply Wall St Value Rating: ★★★★★☆

Overview: Daiichikosho Co., Ltd. is a Japanese company that specializes in the sale and rental of commercial karaoke systems, with a market capitalization of ¥193.60 billion.

Operations: The company's primary revenue streams include the Commercial Karaoke segment, generating ¥61.10 billion, and the Karaoke and Restaurant Business, contributing ¥65.50 billion. The Music Soft segment adds ¥6.50 billion to the total revenue.

This entertainment company, known for its karaoke systems, has shown impressive earnings growth of 49.7% over the past year, outpacing the industry average by a significant margin. Its net debt to equity ratio stands at a satisfactory 19.5%, and interest payments are well-covered with an EBIT coverage of 402 times. Despite being dropped from the FTSE All-World Index recently, it completed a share buyback program worth ¥3.10 billion and projects strong future earnings with expected annual sales of ¥152.70 billion.

- Click to explore a detailed breakdown of our findings in Daiichikosho's health report.

Review our historical performance report to gain insights into Daiichikosho's's past performance.

Okinawa Cellular Telephone (TSE:9436)

Simply Wall St Value Rating: ★★★★★★

Overview: Okinawa Cellular Telephone Company offers telecommunication and mobile phone services in Japan, with a market capitalization of ¥202.67 billion.

Operations: The company's primary revenue stream is from its telecommunications business, generating ¥79.30 billion.

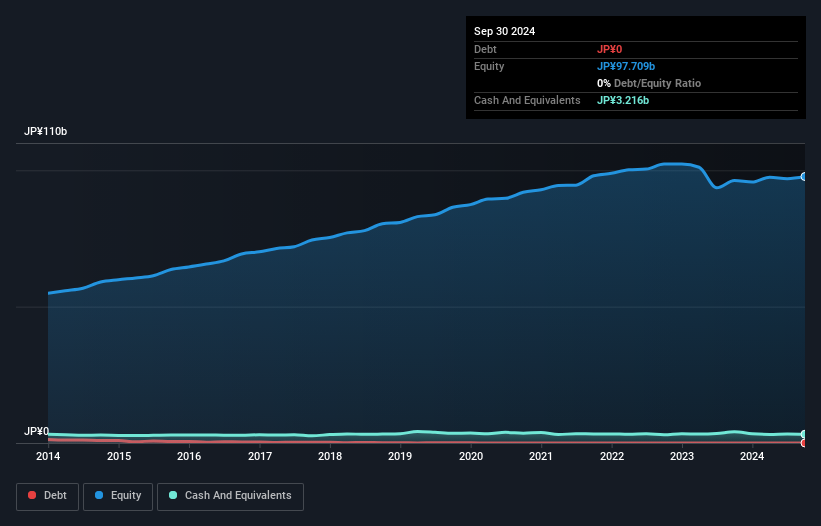

Okinawa Cellular, a compact player in Japan's telecom sector, boasts no debt, contrasting its 0.1% debt to equity ratio five years ago. The company repurchased 708,300 shares for ¥2.8 billion recently and trades at 28.7% below its estimated fair value. With earnings growth of 6.2% last year outpacing the industry’s -6%, it showcases high-quality earnings and positive free cash flow, hinting at solid financial health and potential undervaluation in the market.

Key Takeaways

- Click here to access our complete index of 733 Japanese Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2659

Flawless balance sheet with solid track record and pays a dividend.