Stock Analysis

Exploring SAKURA Internet And 2 Other High Growth Tech Stocks In Japan

Reviewed by Simply Wall St

Japan's stock markets have recently experienced a downturn, with the Nikkei 225 Index and TOPIX Index both declining amid easing domestic inflation and speculation about future interest rate adjustments by the Bank of Japan. In this environment, identifying high-growth tech stocks like SAKURA Internet becomes crucial as investors look for companies that can thrive despite broader market challenges, focusing on innovation and adaptability to sustain growth.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 21.22% | 71.29% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

SAKURA Internet (TSE:3778)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SAKURA Internet Inc. is a Japanese company that offers cloud computing services, with a market capitalization of ¥164.91 billion.

Operations: The company generates revenue primarily through its Internet Infrastructure Business, which reported ¥22.66 billion.

SAKURA Internet, a player in Japan's tech scene, is navigating a dynamic growth trajectory with projected annual revenue and earnings increases of 33.9% and 55.6%, respectively—outpacing the broader Japanese market significantly. This robust expansion is supported by its recent guidance for consolidated earnings, expecting net sales to hit JPY 28 billion this fiscal year, alongside an operating profit forecast of JPY 2 billion. The firm's commitment to innovation is underscored by its R&D spending trends which align closely with its strategic goals to enhance service offerings and technological capabilities in a competitive landscape. Despite facing challenges like share dilution over the past year, SAKURA's forward-looking strategies and financial outlook suggest it remains poised to capitalize on emerging opportunities within the high-growth tech sector in Japan.

- Navigate through the intricacies of SAKURA Internet with our comprehensive health report here.

Evaluate SAKURA Internet's historical performance by accessing our past performance report.

Sansan (TSE:4443)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sansan, Inc. is a Japanese company that specializes in the planning, development, and sale of cloud-based solutions, with a market capitalization of approximately ¥285.32 billion.

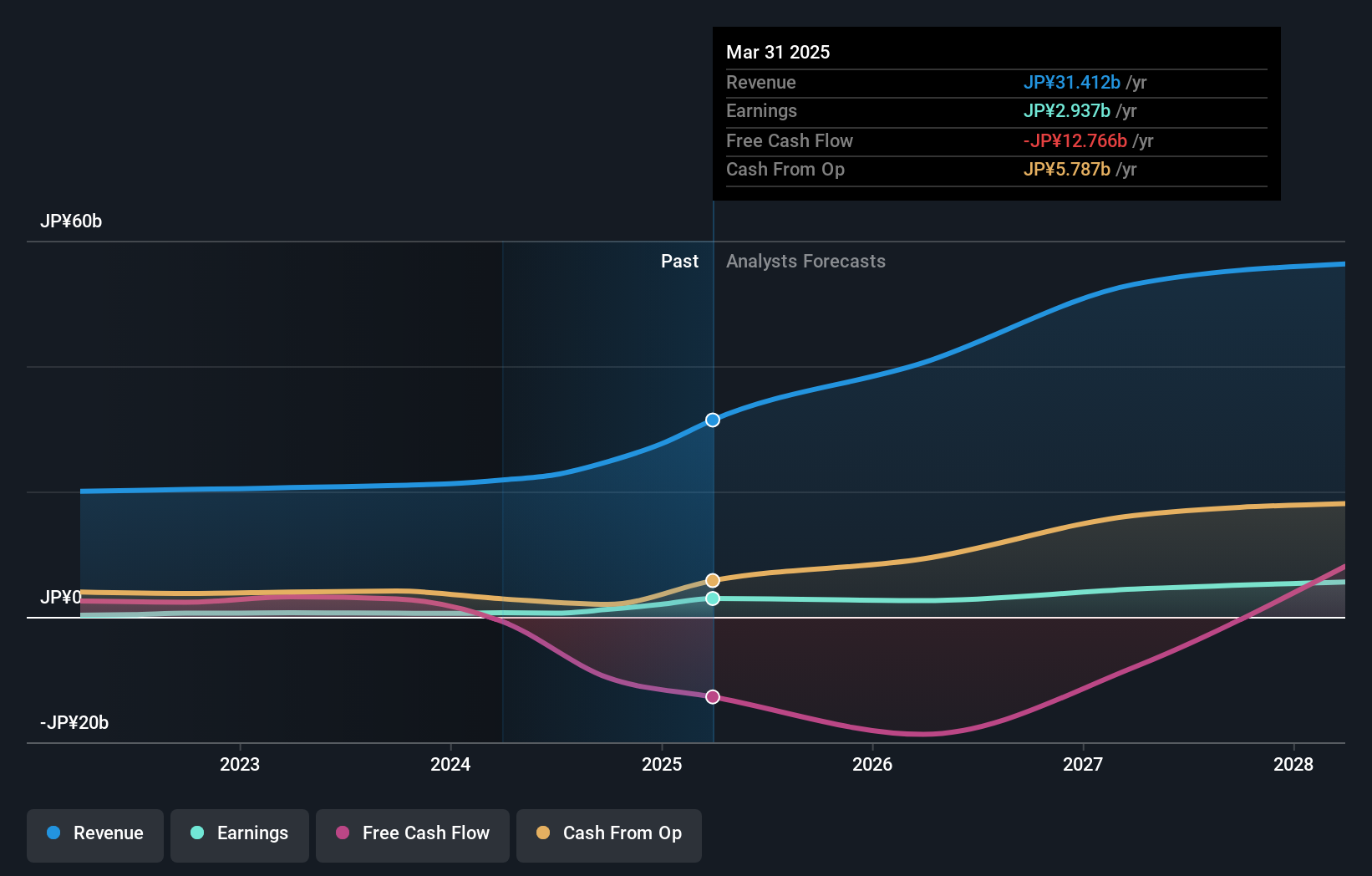

Operations: Sansan, Inc. focuses on cloud-based solutions in Japan, primarily generating revenue through its Sansan/Bill One Business segment, which accounts for ¥31.79 billion. The Eight Business segment also contributes to the company's revenue with ¥3.80 billion.

Sansan, Inc., a Japanese tech firm, is making significant strides in the competitive landscape with its robust revenue growth forecast at 16.2% annually, outpacing the broader market's 4.2%. This growth is underpinned by a remarkable expected annual earnings increase of 39.5%, highlighting its operational efficiency and market adaptability. The company's dedication to innovation is evident from its R&D spending trends which are strategically aligned to bolster technological capabilities and service offerings. Recently, Sansan repurchased shares for ¥299.95 million, signaling confidence in its financial health and future prospects despite facing challenges like one-off losses of ¥401 million last fiscal year that impacted financial results. With high-profile clients and a clear focus on expanding its digital solutions portfolio, Sansan remains poised to leverage emerging opportunities within Japan's high-growth tech sector.

- Unlock comprehensive insights into our analysis of Sansan stock in this health report.

Assess Sansan's past performance with our detailed historical performance reports.

Vector (TSE:6058)

Simply Wall St Growth Rating: ★★★★☆☆

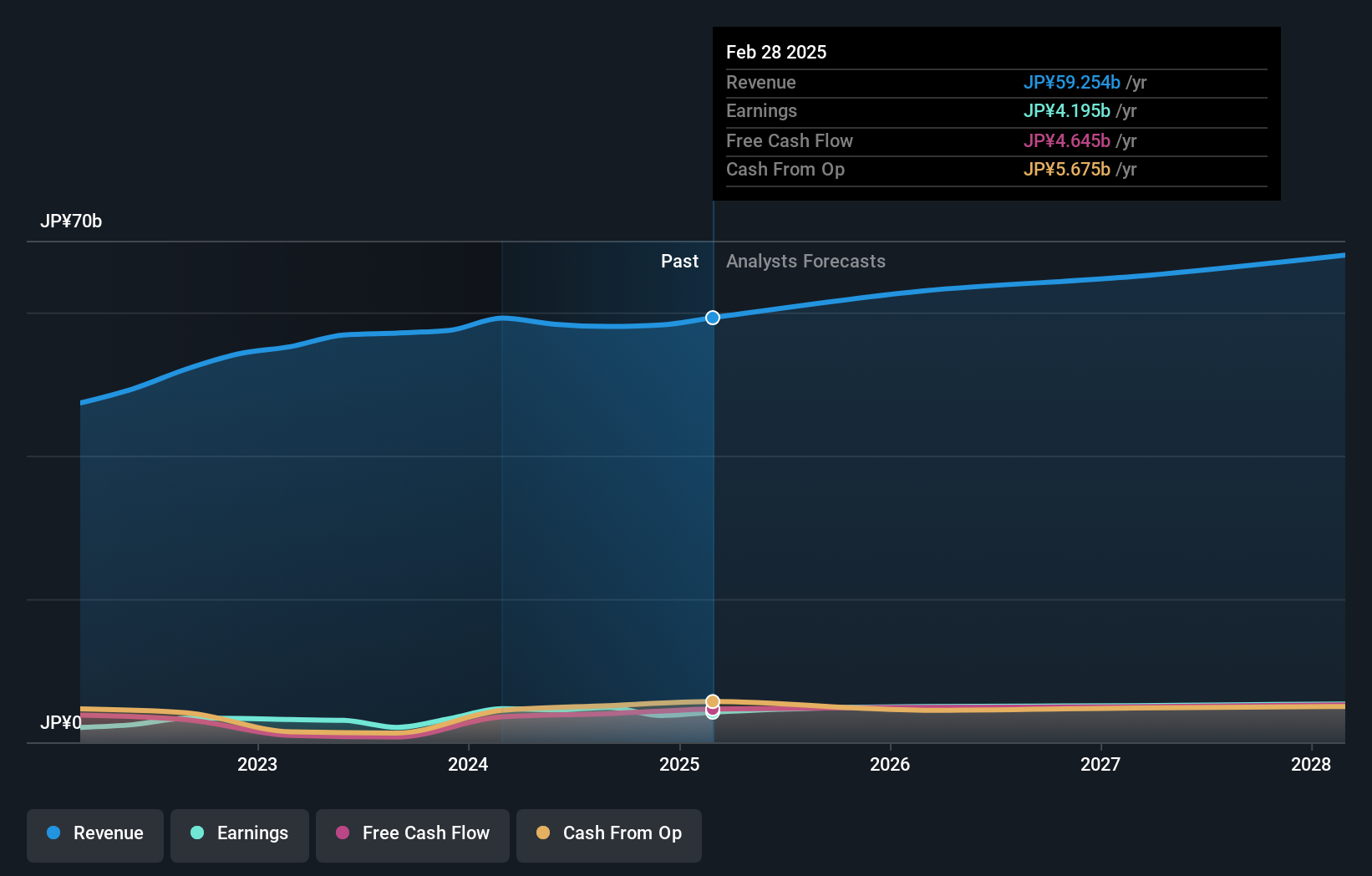

Overview: Vector Inc. operates in public relations, advertising, press release distribution, video release distribution, direct marketing, media, investment, and human resources across Japan, China, and internationally with a market cap of ¥43.57 billion.

Operations: Vector Inc. generates revenue through its diverse operations in PR, advertising, and various distribution services across multiple regions. The company's business model includes direct marketing and media ventures, complemented by investments and human resources services.

Vector Inc., despite revising its earnings forecast downward, maintains a robust growth trajectory with expected revenue and earnings growth rates of 7.3% and 10.1% per year, respectively—outperforming the Japanese market average. The company's commitment to shareholder value is evident from its revised dividend policy, increasing the payout to JPY 32 per share. With significant R&D investments aligning with strategic goals, Vector is well-positioned to capitalize on technological advancements and maintain its competitive edge in Japan's tech sector. This approach not only underscores their operational resilience but also enhances their capacity for sustained innovation and market responsiveness in a dynamic industry landscape.

- Get an in-depth perspective on Vector's performance by reading our health report here.

Review our historical performance report to gain insights into Vector's's past performance.

Where To Now?

- Delve into our full catalog of 118 Japanese High Growth Tech and AI Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4443

Sansan

Engages in the planning, development, and selling of cloud- based solutions in Japan.