- Japan

- /

- Interactive Media and Services

- /

- TSE:4689

Does LY’s (TSE:4689) Enhanced Dividend Signal a Shift in Its Long-Term Growth Priorities?

Reviewed by Sasha Jovanovic

- On November 4, 2025, LY Corporation revised its dividend guidance for the fiscal year ending March 31, 2026, raising its expected payout to ¥7.30 per share from ¥7.00 and reaffirming its goal of maintaining a cumulative payout ratio of at least 70% over five years.

- This update highlights the company’s intent to balance reinvestment in growth initiatives with direct shareholder returns, signaling management's focus on both long-term expansion and sustained dividend policy.

- Next, we'll examine how this increased dividend commitment may influence LY's broader investment narrative and outlook for shareholder value.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

LY Investment Narrative Recap

To believe in LY as a shareholder, you need confidence in its ability to translate its strong digital services footprint and expanding ecosystem into reliable earnings and growing returns, even as its core advertising business faces structural headwinds. The recent dividend increase, while underscoring management’s ongoing commitment to shareholder returns, does not fundamentally shift the near-term catalyst of integrating and monetizing its LINE Mini apps platform; nor does it mitigate the biggest risk, which remains the long-term decline in search advertising revenue.

A recent relevant development is LY’s ongoing share repurchase program, which wrapped up its most recent tranche in August 2025. While this, along with the increased dividend, signals consistent capital returns, the central focus for most investors will likely remain on whether the company’s new AI-driven personalization and e-commerce expansions can offset sluggish performance in core media segments.

On the other hand, investors should pay particular attention to the risks around ongoing softness in the search ad market, especially if alternative revenue streams fail to scale rapidly...

Read the full narrative on LY (it's free!)

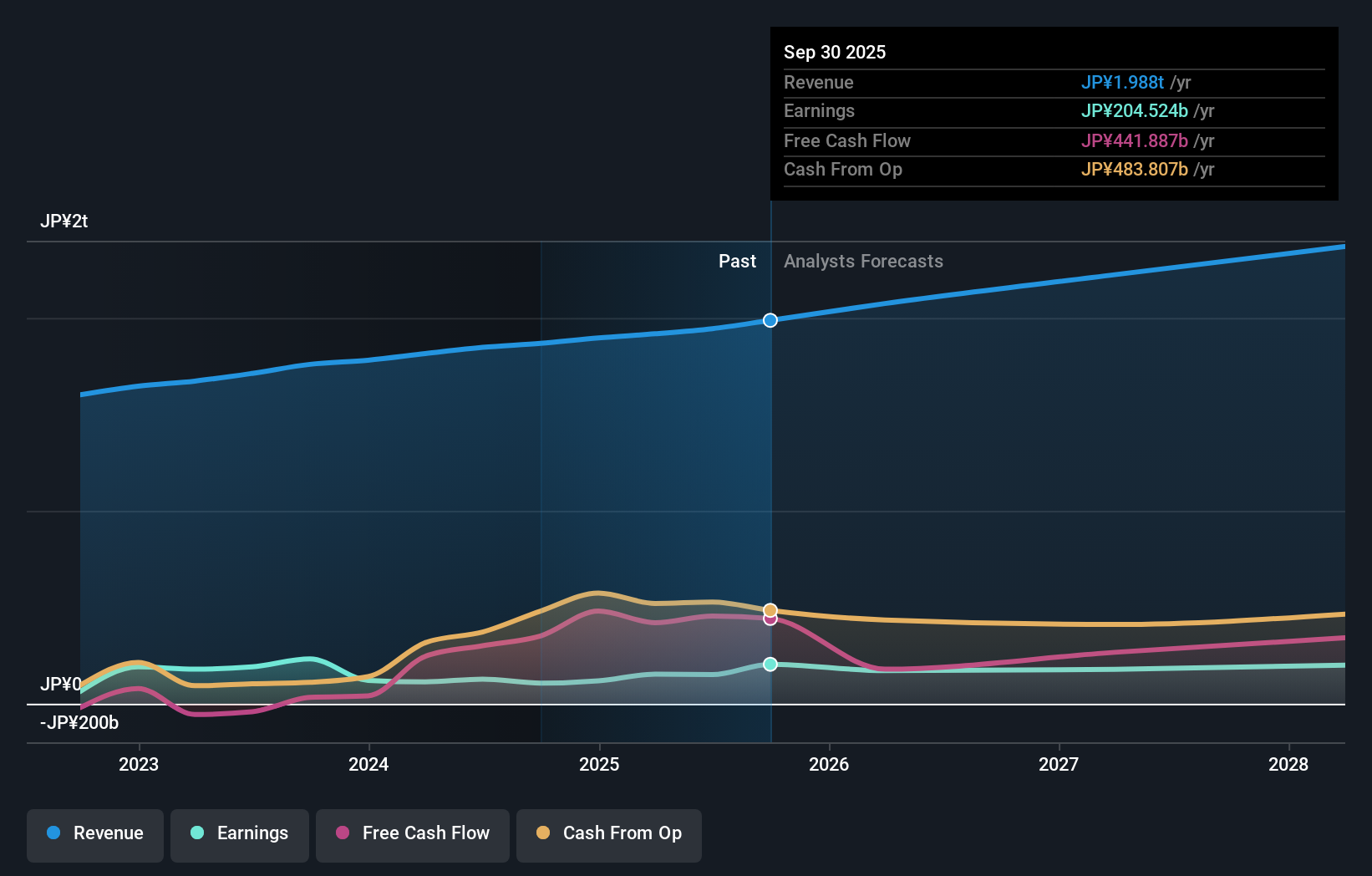

LY's narrative projects ¥2,383.0 billion in revenue and ¥208.9 billion in earnings by 2028. This requires 7.0% yearly revenue growth and a ¥58.2 billion earnings increase from the current earnings of ¥150.7 billion.

Uncover how LY's forecasts yield a ¥583 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community show a broad span from ¥457.19 to ¥628.46 per share. While the range highlights varied assessments, many investors remain focused on whether new digital initiatives can offset core revenue risks and support sustainable value creation.

Explore 3 other fair value estimates on LY - why the stock might be worth as much as 46% more than the current price!

Build Your Own LY Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LY research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free LY research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LY's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4689

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives