- South Korea

- /

- Biotech

- /

- KOSDAQ:A145020

High Growth Tech Stocks in Asia to Watch

Reviewed by Simply Wall St

As global markets grapple with geopolitical tensions and trade uncertainties, Asian tech stocks have become a focal point for investors seeking growth opportunities. In this environment, identifying high-growth tech companies involves assessing their innovation potential and adaptability to shifting economic landscapes.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.78% | 30.32% | ★★★★★★ |

| Fositek | 26.94% | 33.90% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| PharmaResearch | 24.65% | 26.40% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Hugel (KOSDAQ:A145020)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hugel, Inc. is a company that develops and manufactures biopharmaceuticals both in South Korea and internationally, with a market cap of ₩3.90 trillion.

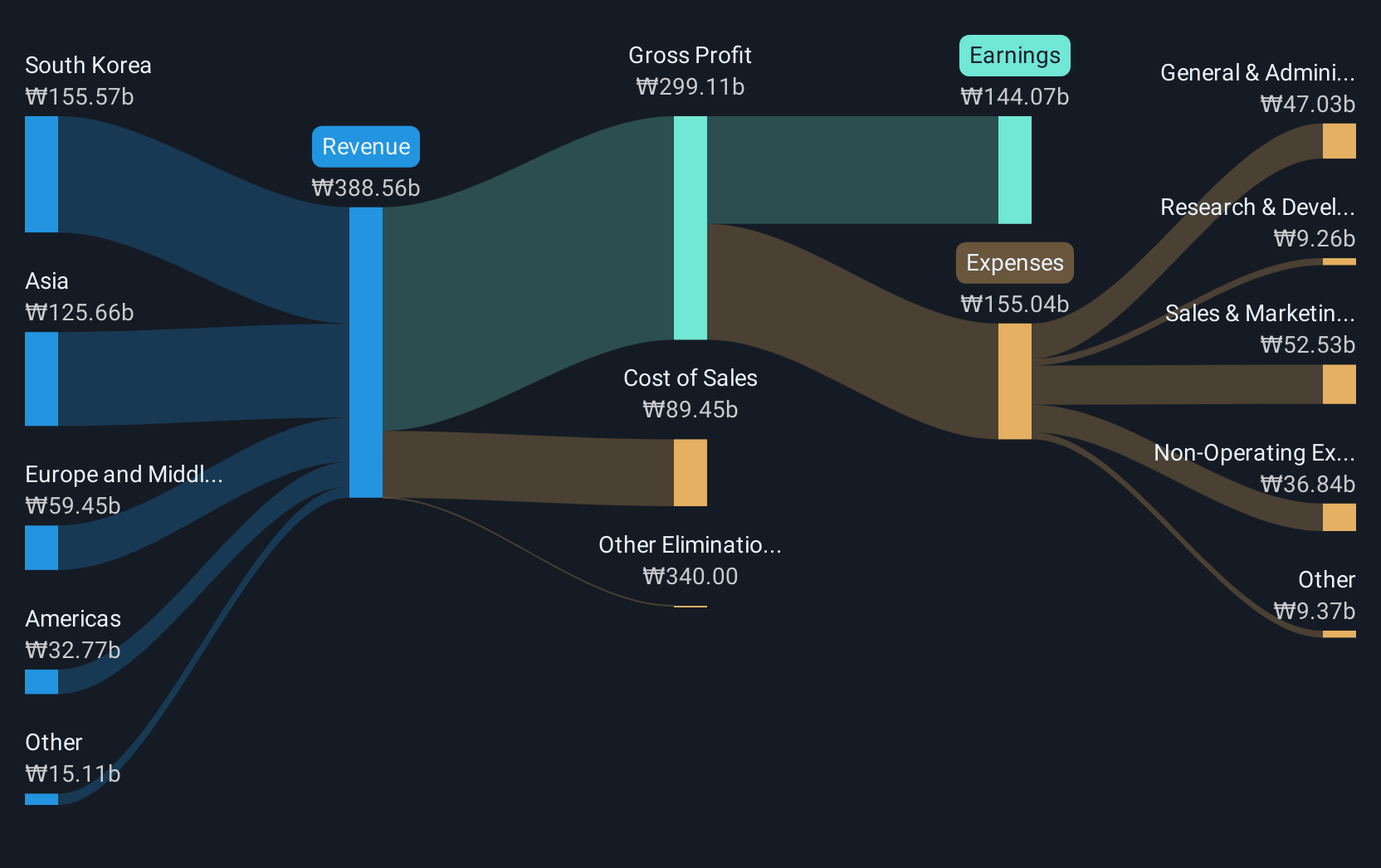

Operations: The company primarily generates revenue from its pharmaceuticals segment, amounting to ₩388.56 billion.

Hugel's dynamic presence in the biotech sector is underscored by a robust 47.8% earnings growth over the past year, outpacing its industry average. With an anticipated annual earnings growth of 22.1%, Hugel is set to exceed Korea's market forecast of 20.9%. The company has strategically repurchased shares, completing a buyback of 253,000 shares for KRW 69.69 billion, reinforcing shareholder value amidst expanding operations. Additionally, Hugel's active engagement at major conferences across Asia highlights its commitment to maintaining a prominent industry position and fostering investor relations.

- Navigate through the intricacies of Hugel with our comprehensive health report here.

Review our historical performance report to gain insights into Hugel's's past performance.

Zhejiang Lante Optics (SHSE:688127)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Lante Optics Co., Ltd. is a company that manufactures and sells optical products in China, with a market cap of CN¥10 billion.

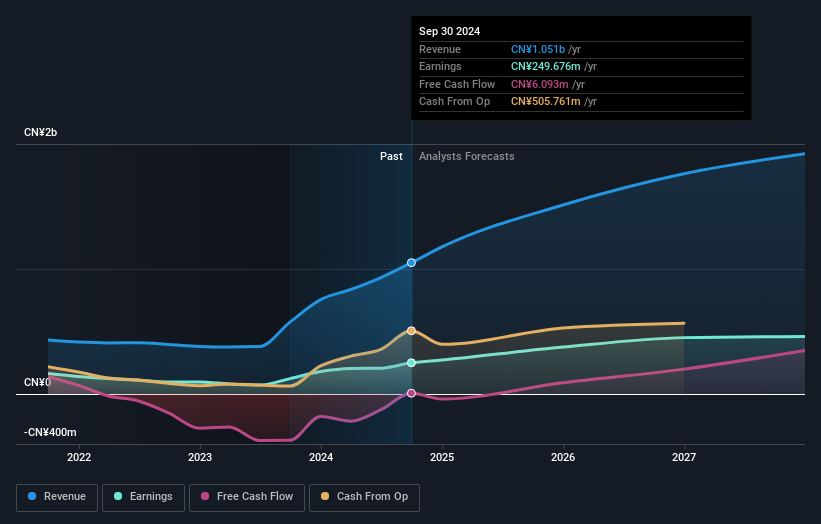

Operations: Lante Optics generates revenue primarily from its Photographic Equipment & Supplies segment, amounting to CN¥1.12 billion.

Zhejiang Lante Optics is distinguishing itself in the high-growth tech sector of Asia with a notable 22.6% annual revenue growth, outpacing the Chinese market average of 12.3%. This performance is bolstered by a significant leap in net income, rising from CNY 29.29 million to CNY 45.55 million year-over-year as reported in their latest quarterly results. The company's commitment to innovation and market expansion is further evidenced by its R&D investments, aligning with its strategy to enhance technological capabilities and maintain competitive advantage amidst evolving industry demands.

- Dive into the specifics of Zhejiang Lante Optics here with our thorough health report.

Explore historical data to track Zhejiang Lante Optics' performance over time in our Past section.

Fuji Media Holdings (TSE:4676)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fuji Media Holdings, Inc. operates in Japan through its subsidiaries by engaging in broadcasting activities and has a market cap of ¥628.18 billion.

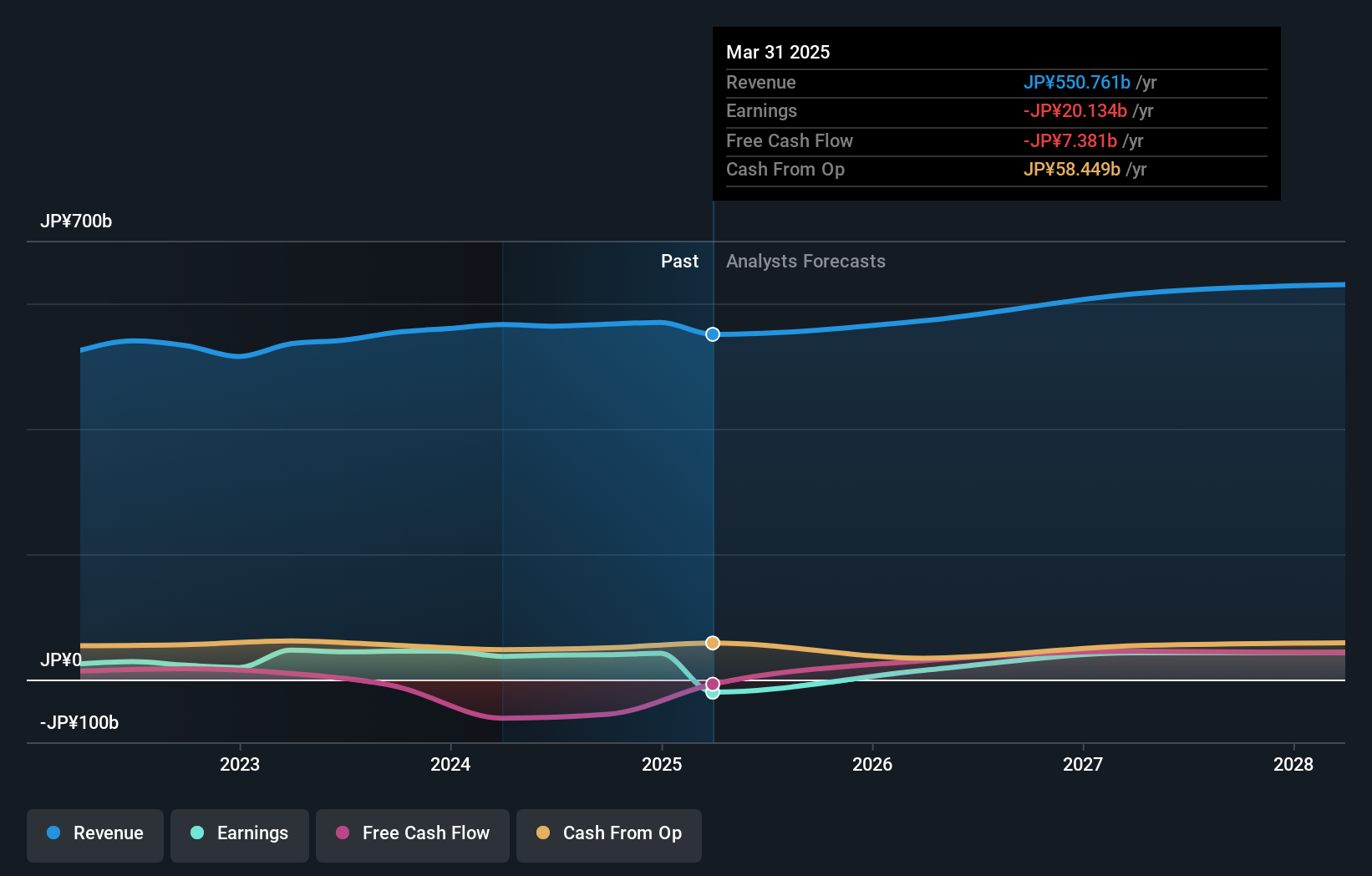

Operations: Fuji Media Holdings generates revenue primarily through its broadcasting operations in Japan. It operates multiple subsidiaries involved in television and radio broadcasting, contributing significantly to its financial performance.

Amidst activist pressures and corporate governance debates, Fuji Media Holdings is navigating a transformative landscape. With an expected revenue growth of 3.9% per year, slightly outpacing the Japanese market's 3.8%, the company is also poised to become profitable in the next three years. Recent events underscore strategic shifts; notably, investor Dalton Investments has advocated for a spin-off of its real estate arm to potentially double its value, highlighting both opportunities and challenges in aligning growth with shareholder interests. This backdrop sets the stage for Fuji Media as it continues to invest in sectors believed to drive future expansion, balancing innovation with strategic restructuring efforts underlined by recent shareholder engagements and proposals for board changes.

- Delve into the full analysis health report here for a deeper understanding of Fuji Media Holdings.

Examine Fuji Media Holdings' past performance report to understand how it has performed in the past.

Where To Now?

- Delve into our full catalog of 488 Asian High Growth Tech and AI Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hugel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A145020

Hugel

Develops and manufactures biopharmaceuticals in South Korea and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives