Here's Why Neo Marketing (TSE:4196) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Neo Marketing (TSE:4196), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Neo Marketing with the means to add long-term value to shareholders.

How Quickly Is Neo Marketing Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Neo Marketing has managed to grow EPS by 18% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The previous 12 months are something that Neo Marketing will want to put behind them after seeing a drop in EBIT margin and revenue for the period. This is less than stellar for the company.

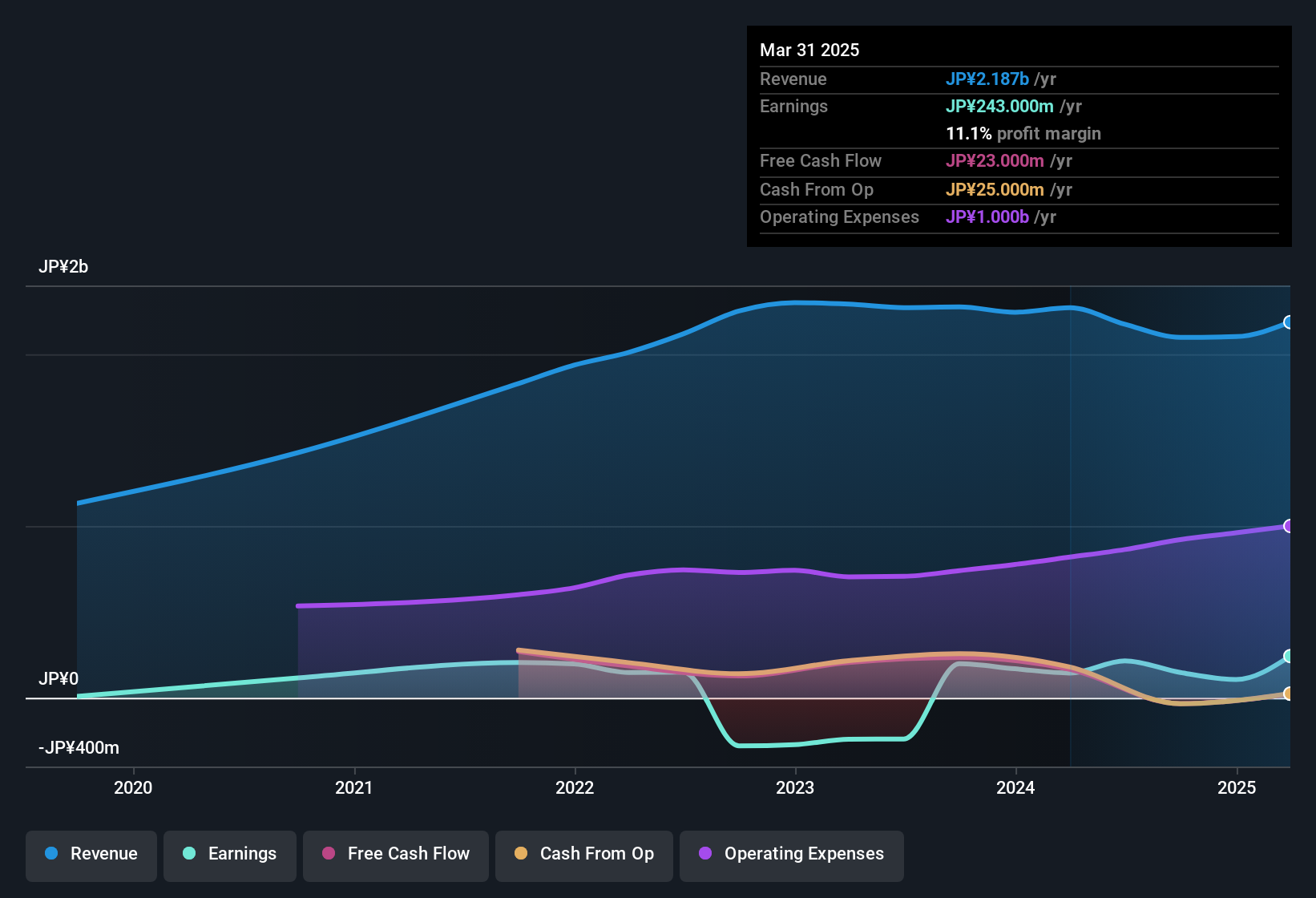

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

View our latest analysis for Neo Marketing

Since Neo Marketing is no giant, with a market capitalisation of JP¥3.4b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Neo Marketing Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So those who are interested in Neo Marketing will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. To be exact, company insiders hold 58% of the company, so their decisions have a significant impact on their investments. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. Although, with Neo Marketing being valued at JP¥3.4b, this is a small company we're talking about. That means insiders only have JP¥2.0b worth of shares, despite the large proportional holding. That might not be a huge sum but it should be enough to keep insiders motivated!

Does Neo Marketing Deserve A Spot On Your Watchlist?

For growth investors, Neo Marketing's raw rate of earnings growth is a beacon in the night. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. However, before you get too excited we've discovered 2 warning signs for Neo Marketing (1 shouldn't be ignored!) that you should be aware of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in JP with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Neo Marketing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4196

Adequate balance sheet with low risk.

Market Insights

Community Narratives