- China

- /

- Electronic Equipment and Components

- /

- SHSE:688127

Asian Value Stocks Estimated Below Intrinsic Worth For June 2025

Reviewed by Simply Wall St

Amid rising geopolitical tensions in the Middle East and fluctuating trade dynamics, Asian markets have shown resilience with mixed performances across major indices. As investors navigate these uncertainties, identifying stocks that are undervalued relative to their intrinsic worth can present potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Taiyo Yuden (TSE:6976) | ¥2358.50 | ¥4704.64 | 49.9% |

| Taiwan Union Technology (TPEX:6274) | NT$214.50 | NT$423.20 | 49.3% |

| Shenzhen KSTAR Science and Technology (SZSE:002518) | CN¥21.79 | CN¥43.47 | 49.9% |

| Pansoft (SZSE:300996) | CN¥14.14 | CN¥28.02 | 49.5% |

| J&T Global Express (SEHK:1519) | HK$6.78 | HK$13.33 | 49.1% |

| Good Will Instrument (TWSE:2423) | NT$44.20 | NT$87.18 | 49.3% |

| Global Tax Free (KOSDAQ:A204620) | ₩6980.00 | ₩13838.97 | 49.6% |

| GCH Technology (SHSE:688625) | CN¥30.65 | CN¥60.45 | 49.3% |

| Dajin Heavy IndustryLtd (SZSE:002487) | CN¥31.69 | CN¥62.66 | 49.4% |

| China Kings Resources GroupLtd (SHSE:603505) | CN¥21.54 | CN¥42.48 | 49.3% |

Let's uncover some gems from our specialized screener.

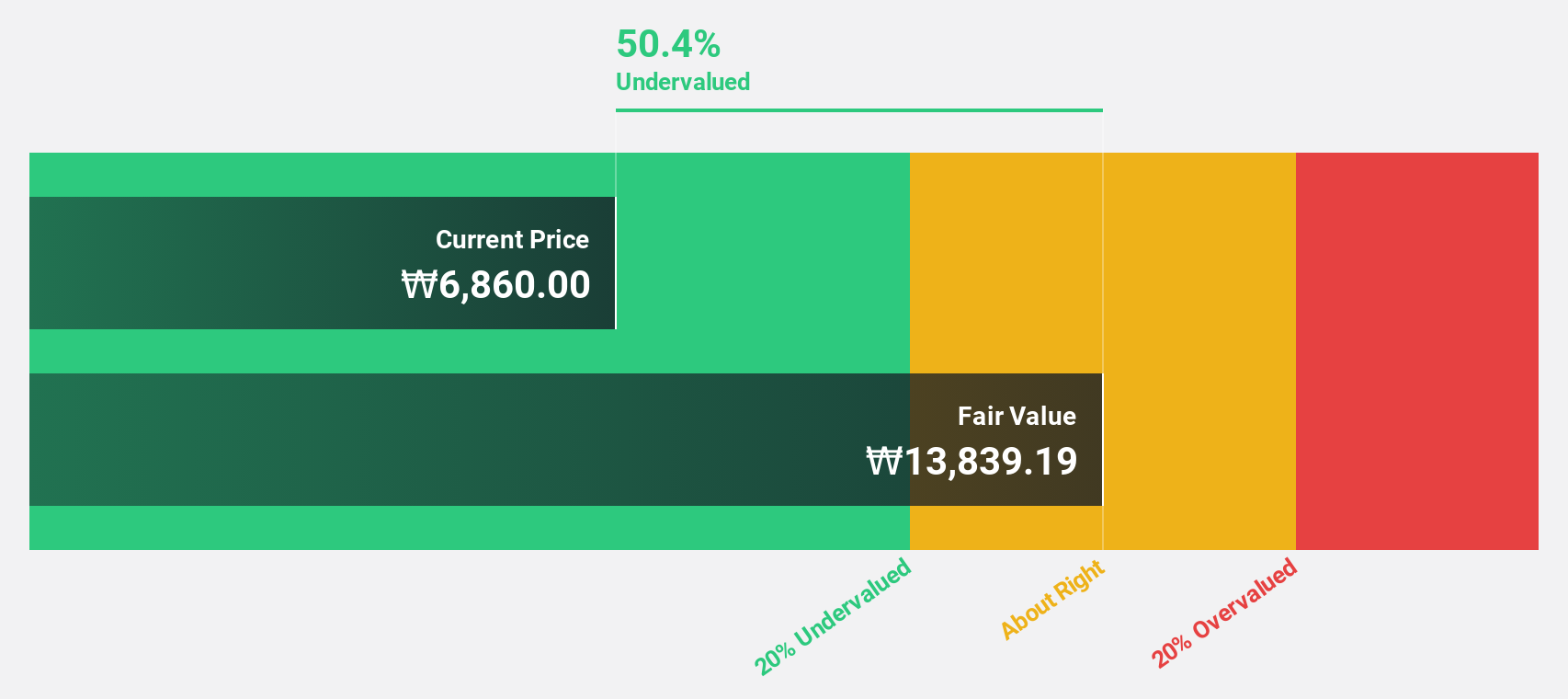

Global Tax Free (KOSDAQ:A204620)

Overview: Global Tax Free Co., Ltd. operates as a tax refund company for foreign tourists in South Korea, Singapore, Japan, and France, with a market cap of ₩490.50 billion.

Operations: The company's revenue segments include ₩18.10 billion from the Online Content Business, ₩2.70 billion from the Cosmetics Business Sector, and ₩118.29 billion from the Tax Refund Business Sector.

Estimated Discount To Fair Value: 49.6%

Global Tax Free appears undervalued, trading at ₩6980, significantly below its estimated fair value of ₩13838.97. Recently profitable, the company is expected to see earnings grow 27.04% annually over the next three years, outpacing both revenue growth of 22.3% and the broader Korean market's growth rates. Despite high levels of non-cash earnings affecting quality metrics, its strong projected financial performance highlights potential for investors focusing on cash flow valuation in Asia.

- Our comprehensive growth report raises the possibility that Global Tax Free is poised for substantial financial growth.

- Click here to discover the nuances of Global Tax Free with our detailed financial health report.

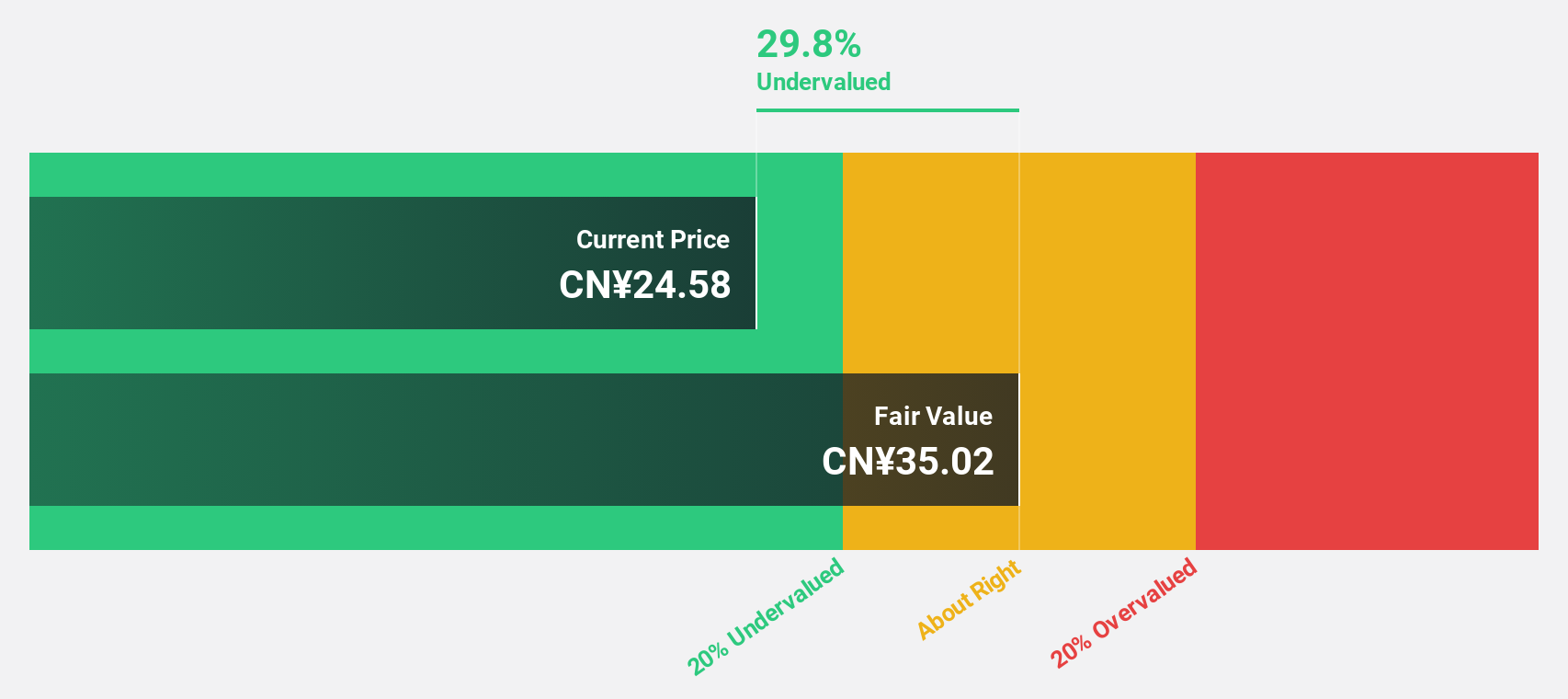

Zhejiang Lante Optics (SHSE:688127)

Overview: Zhejiang Lante Optics Co., Ltd. manufactures and sells optical products in China with a market capitalization of CN¥10 billion.

Operations: The company generates revenue from its Photographic Equipment & Supplies segment, amounting to CN¥1.12 billion.

Estimated Discount To Fair Value: 29.3%

Zhejiang Lante Optics is trading at CN¥24.81, significantly below its estimated fair value of CN¥35.07, presenting a potential opportunity for investors focused on cash flow valuation. The company's earnings grew by 15.8% last year and are forecast to grow 27.2% annually over the next three years, surpassing market expectations. Despite recent share price volatility and a dividend not fully covered by free cash flows, revenue growth remains robust at 22.6% annually.

- The analysis detailed in our Zhejiang Lante Optics growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Zhejiang Lante Optics stock in this financial health report.

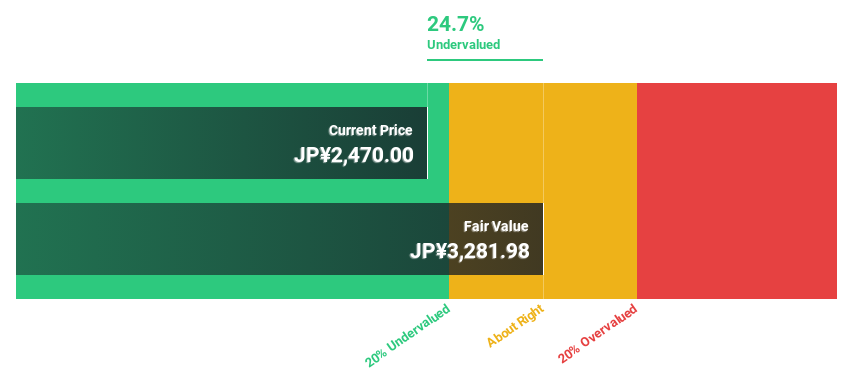

IG Port (TSE:3791)

Overview: IG Port, Inc. is an animation production company operating in Japan and internationally, with a market capitalization of ¥43.44 billion.

Operations: The company's revenue is primarily derived from video production (¥6.94 billion), copyright business (¥4.82 billion), and publishing (¥2.22 billion).

Estimated Discount To Fair Value: 37.5%

IG Port, trading at ¥2,271, is undervalued relative to its estimated fair value of ¥3,631.71. The company's earnings have grown significantly at 34% annually over the past five years and are expected to continue growing at 27.33% per year, outpacing the Japanese market's growth rate. Recent strategic moves include a private placement with Sanrio for gross proceeds of approximately ¥1.63 billion and a promising gaming venture based on the popular Kaiju No. 8 series.

- Our growth report here indicates IG Port may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of IG Port.

Seize The Opportunity

- Reveal the 291 hidden gems among our Undervalued Asian Stocks Based On Cash Flows screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Lante Optics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688127

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives