- China

- /

- Electrical

- /

- SHSE:688032

3 Growth Stocks With High Insider Ownership To Watch

Reviewed by Simply Wall St

In a week marked by a flurry of earnings reports and economic data, global markets experienced notable volatility, with major indices such as the Nasdaq Composite and S&P MidCap 400 Index reaching record highs before retreating sharply. Amidst this backdrop of cautious optimism and uncertainty, growth stocks have generally lagged behind their value counterparts due to mixed corporate earnings results. In such a climate, companies with high insider ownership often attract attention as potential investment opportunities because insiders' significant stakes can align their interests closely with shareholders', potentially driving long-term growth strategies despite short-term market fluctuations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 49.1% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 14.8% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

We're going to check out a few of the best picks from our screener tool.

Hoymiles Power Electronics (SHSE:688032)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hoymiles Power Electronics Inc. manufactures and sells module level power electronics solutions in China and internationally, with a market cap of CN¥17.29 billion.

Operations: Hoymiles Power Electronics Inc. generates revenue through the production and distribution of module level power electronics solutions both domestically and globally.

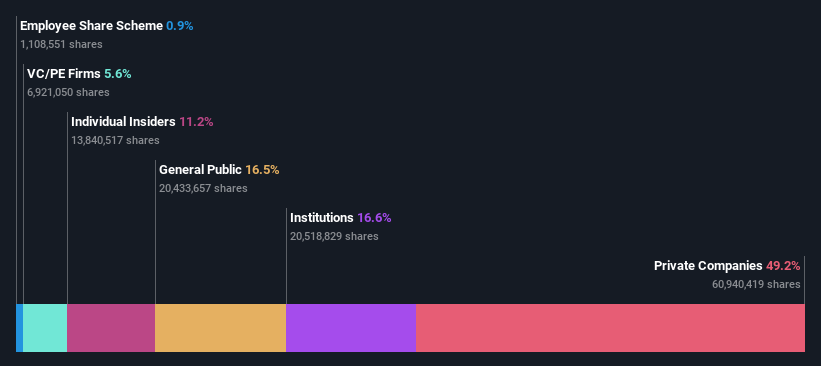

Insider Ownership: 11.2%

Earnings Growth Forecast: 46.6% p.a.

Hoymiles Power Electronics shows potential as a growth company with high insider ownership. Despite recent earnings declines, with revenue at CNY 1.27 billion and net income dropping to CNY 245.61 million for the first nine months of 2024, forecasts indicate strong annual earnings growth of 46.6%, outpacing the Chinese market's average. However, profit margins have decreased from last year, and return on equity is expected to remain modest at 13% in three years.

- Navigate through the intricacies of Hoymiles Power Electronics with our comprehensive analyst estimates report here.

- Our valuation report here indicates Hoymiles Power Electronics may be overvalued.

Sansec Technology (SHSE:688489)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sansec Technology Co., Ltd. focuses on the research, development, and production of commercial cryptographic products and solutions for internet information security in China, with a market cap of CN¥4.32 billion.

Operations: Sansec Technology Co., Ltd. generates revenue through its commercial cryptographic products and solutions aimed at enhancing internet information security within China.

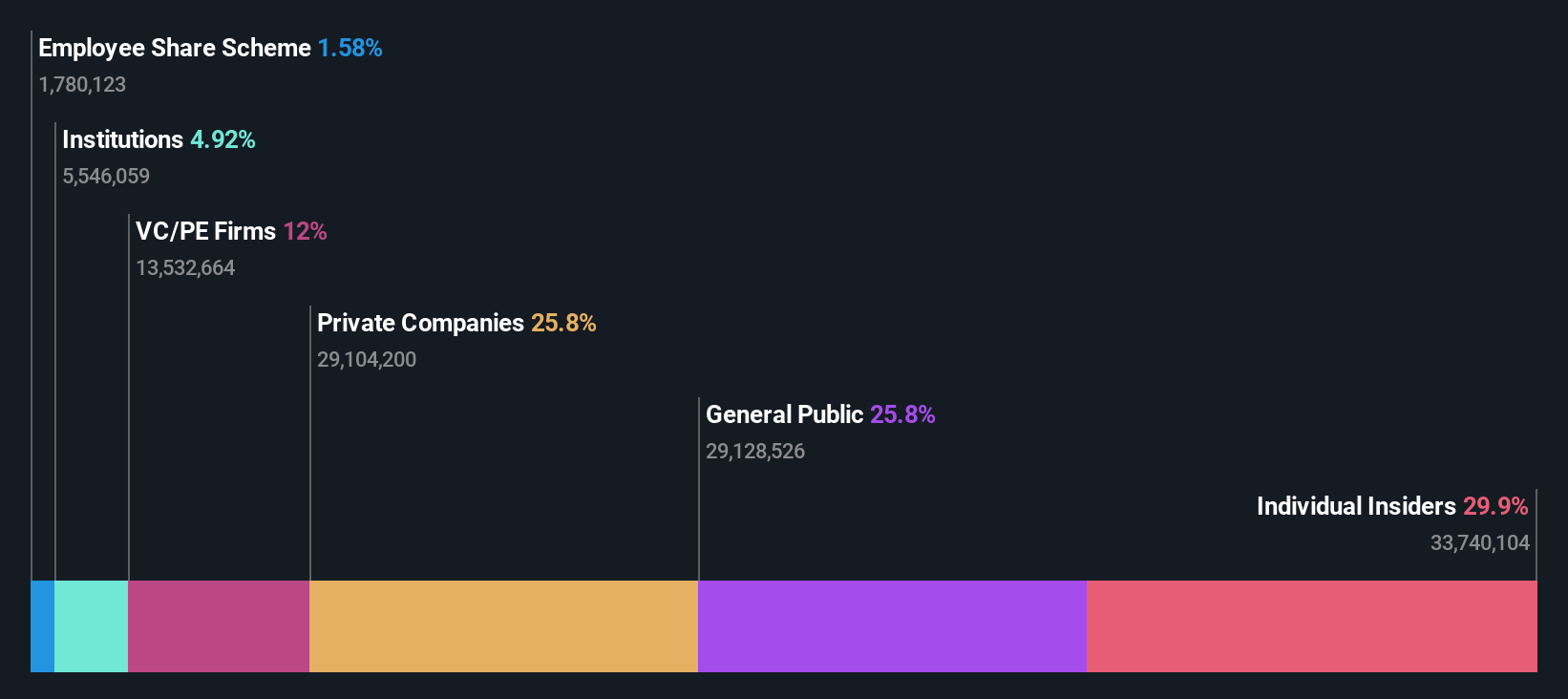

Insider Ownership: 29.9%

Earnings Growth Forecast: 44.5% p.a.

Sansec Technology demonstrates potential for growth, with revenue forecasted to increase by 26.1% annually, surpassing the Chinese market's average. Despite a recent decline in net income to CNY 14.16 million for the first nine months of 2024, earnings are expected to grow significantly at 44.5% per year. However, profit margins have dropped from last year's levels due to large one-off items affecting results, and return on equity is projected to be low at 7.2%.

- Click to explore a detailed breakdown of our findings in Sansec Technology's earnings growth report.

- Our valuation report unveils the possibility Sansec Technology's shares may be trading at a premium.

IG Port (TSE:3791)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: IG Port, Inc. is an animation production company operating in Japan and internationally, with a market cap of ¥38.45 billion.

Operations: The company's revenue segments include animation production, content management, and publishing.

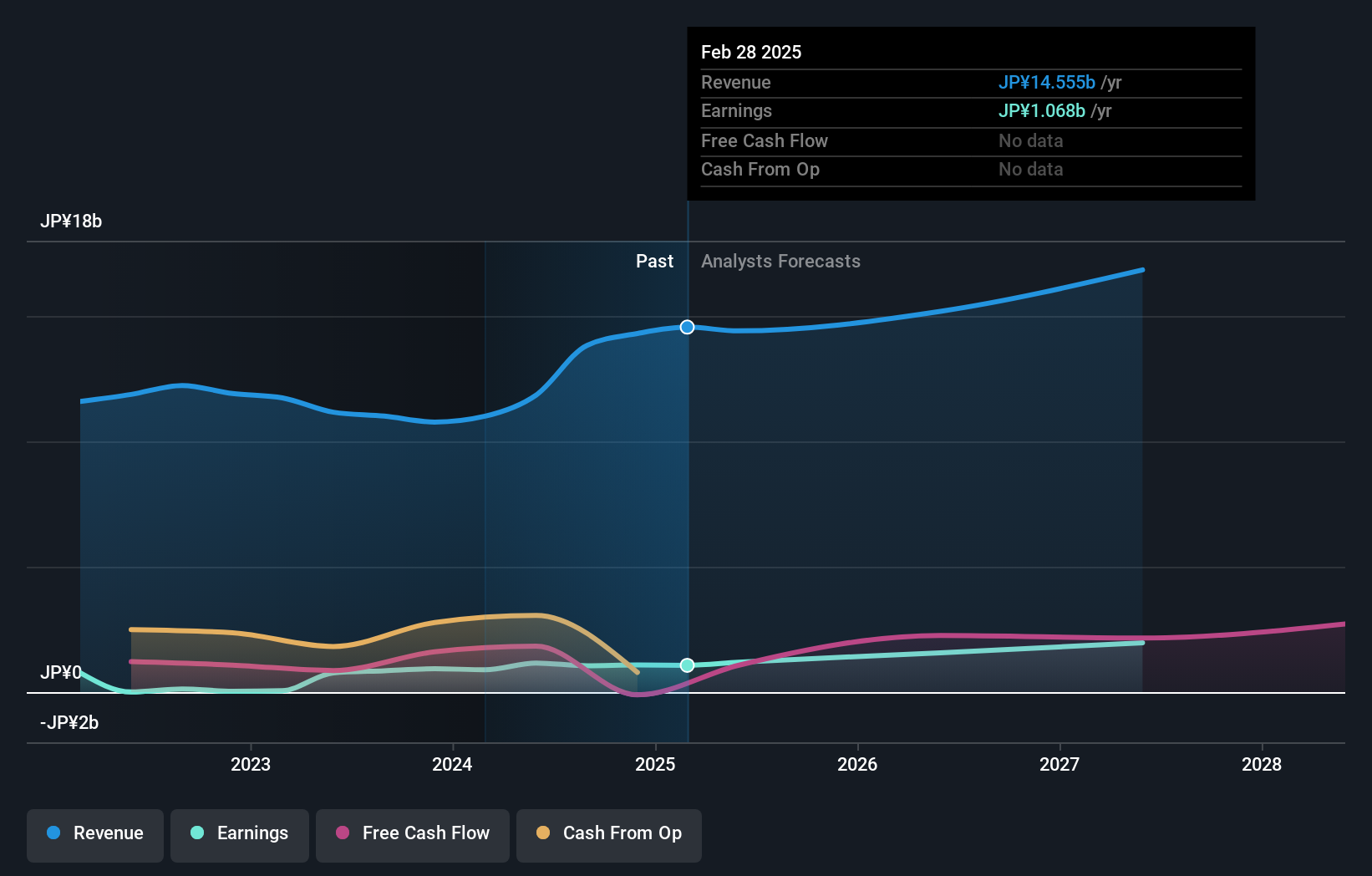

Insider Ownership: 28.7%

Earnings Growth Forecast: 23% p.a.

IG Port is experiencing significant earnings growth, projected at 23% annually over the next three years, outpacing the Japanese market average. Despite a low forecasted return on equity of 17.9%, its revenue growth of 9% per year exceeds the market rate. The company was recently added to the S&P Global BMI Index, potentially increasing its visibility among investors. However, its share price has been highly volatile in recent months.

- Dive into the specifics of IG Port here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that IG Port is trading beyond its estimated value.

Where To Now?

- Get an in-depth perspective on all 1531 Fast Growing Companies With High Insider Ownership by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hoymiles Power Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688032

Hoymiles Power Electronics

Engages in the manufacture and sale of module level power electronics (MLPE) solutions in China and internationally.

Flawless balance sheet with high growth potential.