In recent weeks, global markets have experienced significant shifts, with major U.S. indices like the S&P 500 and Russell 2000 posting gains amid optimism over potential policy changes following a "red sweep" in the U.S. elections. As investors navigate these dynamic conditions, particularly in small-cap stocks that have shown resilience despite not reaching record highs, identifying high-growth tech companies such as ParTec becomes crucial; these firms often exhibit strong innovation potential and adaptability to evolving market trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 26.75% | 31.99% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1279 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

ParTec (DB:JY0)

Simply Wall St Growth Rating: ★★★★★★

Overview: ParTec AG is engaged in the development, manufacturing, and supply of supercomputer and quantum computer solutions, with a market capitalization of €680 million.

Operations: ParTec AG focuses on the development, manufacturing, and supply of advanced computing solutions, including supercomputers and quantum computers. The company's market capitalization stands at €680 million.

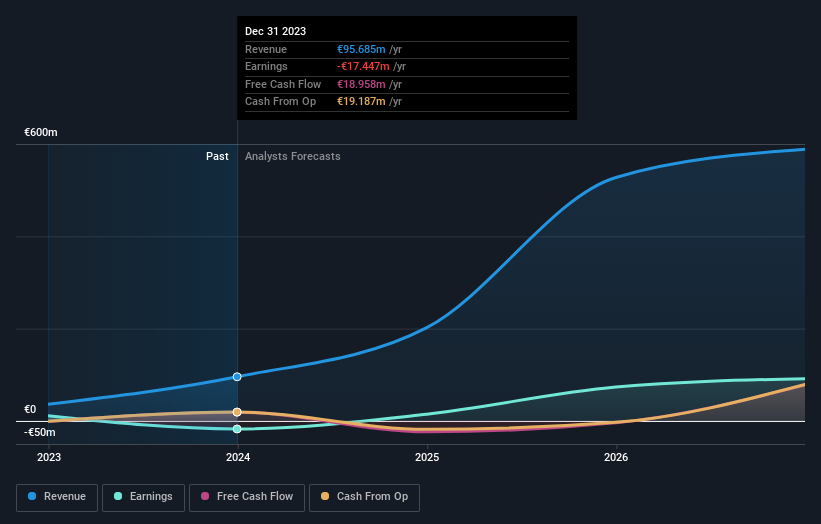

ParTec, amidst a volatile tech landscape, has demonstrated robust growth with a 164% revenue increase over the past year. With earnings expected to surge by 63.3% annually, the company is on track to outpace the general market's growth. Notably, its R&D investments have been substantial, aligning with its revenue which is projected to grow at an impressive rate of 41.2% per year—significantly higher than Germany's average of 5.6%. These figures underscore ParTec’s aggressive strategy in innovation and market expansion despite current unprofitability. Recent engagements like their presentation at the Munich Quantum Software Forum signal their active role in shaping tech discussions globally, positioning them well for future profitability forecasted within three years.

- Click here and access our complete health analysis report to understand the dynamics of ParTec.

Gain insights into ParTec's past trends and performance with our Past report.

Kingboard Laminates Holdings (SEHK:1888)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingboard Laminates Holdings Limited is an investment holding company that manufactures and sells laminates across the People's Republic of China, Europe, other Asian countries, and the United States, with a market capitalization of HK$22.46 billion.

Operations: The company's primary revenue stream is derived from its laminates segment, generating HK$17.06 billion. Additional income comes from properties and investments, contributing HK$121.11 million and HK$99.14 million, respectively.

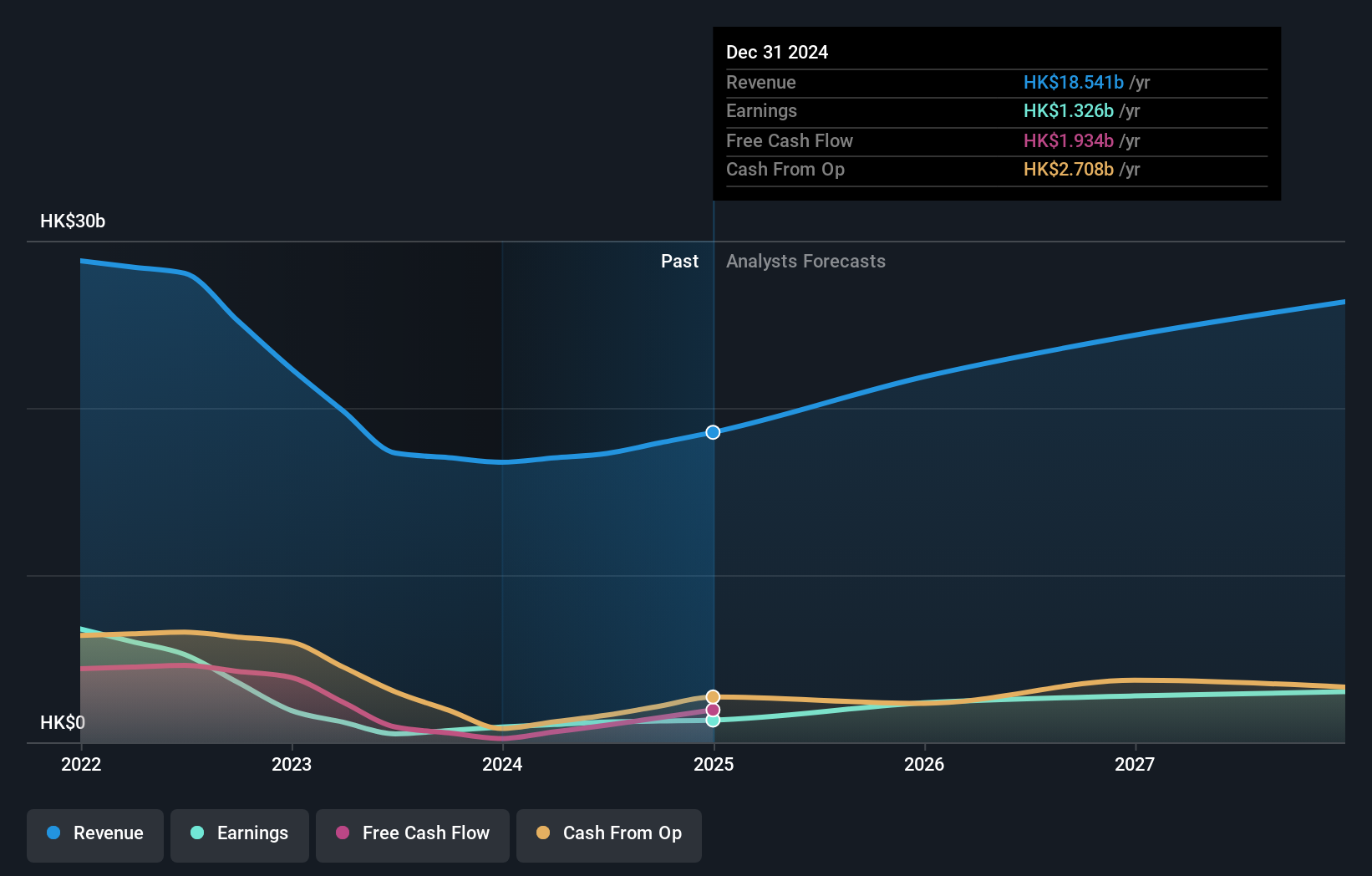

Kingboard Laminates Holdings has shown a notable uptick in performance, with sales rising to HKD 8.64 billion, up from HKD 8.11 billion year-over-year, and net income more than doubling to HKD 727.8 million. This financial uplift is mirrored by a robust earnings growth forecast of 33.7% annually, significantly outpacing the broader Hong Kong market's expectations. The company's commitment to innovation and market expansion is evident from its R&D investments which are aligned with these ambitious growth targets. Moreover, Kingboard’s recent interim dividend announcement enhances its shareholder appeal amidst this positive trajectory. With an impressive earnings surge of nearly 140% over the past year—surpassing the electronic industry average by over tenfold—Kingboard not only demonstrates strong sector leadership but also signals potential for sustained high performance. Its strategic focus on enhancing product offerings and operational efficiency could further solidify its position in the competitive tech landscape, promising an intriguing future for both the company and its stakeholders in a rapidly evolving industry.

Shenzhen Fortune Trend technology (SHSE:688318)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Fortune Trend Technology Co., Ltd. operates in the technology sector with a market capitalization of CN¥36.18 billion.

Operations: Fortune Trend Technology primarily generates revenue through its technology-related products and services. The company's business model focuses on leveraging its technological expertise to cater to various market needs within the sector.

Shenzhen Fortune Trend Technology has demonstrated resilience with a notable 34.9% forecasted annual revenue growth, outpacing the broader Chinese market's average of 14%. This growth is supported by a robust R&D commitment, translating into a significant 39.2% expected annual profit increase. Despite recent dips in sales and net income as reported for the nine months ending September 2024, the firm continues to innovate in its tech offerings, positioning itself well within the competitive landscape. The company's strategic focus on research and development not only fuels its product enhancements but also aligns with industry trends towards advanced technological solutions, ensuring its relevance in an ever-evolving sector.

- Delve into the full analysis health report here for a deeper understanding of Shenzhen Fortune Trend technology.

Understand Shenzhen Fortune Trend technology's track record by examining our Past report.

Taking Advantage

- Investigate our full lineup of 1279 High Growth Tech and AI Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688318

Shenzhen Fortune Trend technology

Shenzhen Fortune Trend Technology Co., Ltd.

High growth potential with excellent balance sheet.