- Japan

- /

- Entertainment

- /

- TSE:3667

Subdued Growth No Barrier To enish,inc. (TSE:3667) With Shares Advancing 37%

enish,inc. (TSE:3667) shares have had a really impressive month, gaining 37% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 24% in the last twelve months.

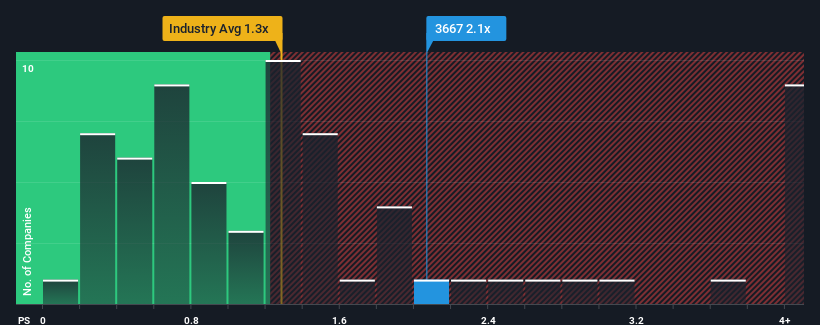

Since its price has surged higher, you could be forgiven for thinking enishinc is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.1x, considering almost half the companies in Japan's Entertainment industry have P/S ratios below 1.3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for enishinc

What Does enishinc's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at enishinc over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on enishinc will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, enishinc would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 18% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to shrink 3.2% in the next 12 months, the company's downward momentum is still inferior based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that enishinc's P/S exceeds that of its industry peers. In general, when revenue shrink rapidly the P/S premium often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Key Takeaway

enishinc shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that enishinc currently trades on a much higher than expected P/S since its recent three-year revenues are even worse than the forecasts for a struggling industry. When we see below average revenue, we suspect the share price is at risk of declining, sending the high P/S lower. We're also cautious about the company's ability to stay its recent medium-term course and resist even greater pain to its business from the broader industry turmoil. Unless the company's relative performance improves markedly, it's very challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 4 warning signs for enishinc (1 shouldn't be ignored!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3667

Flawless balance sheet with low risk.

Market Insights

Community Narratives