- Japan

- /

- Entertainment

- /

- TSE:2432

DeNA (TSE:2432) Valuation in Focus After Murakami Group’s Rapid Stake Buy and Sell

Reviewed by Simply Wall St

DeNA (TSE:2432) shares saw a sharp change in direction after the Murakami Group rapidly sold off its recently acquired stake. This trading move, viewed as a pump-and-dump, has drawn fresh attention from investors.

See our latest analysis for DeNA.

DeNA’s share price was initially lifted by aggressive buying from the Murakami Group, but that upside quickly faded as rapid selling erased the gains, which is typical of pump-and-dump volatility. Despite a choppy ride this year, including a recent board meeting focused on new investment partnerships, the company’s 1-year total shareholder return sits slightly below zero, though its 5-year total return remains a solid 43%. Momentum has clearly shifted, with investors watching for lasting signals rather than short-term trading swings.

If you’re interested in seeing how other fast-moving companies with strong insider backing are faring, broaden your search and discover fast growing stocks with high insider ownership

With this turbulence shaking up recent performance, the debate intensifies: does DeNA’s share price reflect just temporary volatility, or is there real long-term value still on the table for investors seeking growth?

Most Popular Narrative: 24.7% Undervalued

Compared to its last closing price of ¥2,420.5, the most widely followed narrative assigns DeNA a materially higher fair value. This raises questions about what is driving that target and whether the market is missing an opportunity.

Expansion into digital healthcare services, including the scaling of the Join platform and mobile medical initiatives, aligns with growing demand for digital wellness solutions driven by aging populations. This supports resilient recurring revenues and potential margin expansion in the Healthcare & Medical segment.

Want to know which healthcare gambits and digital bets underpin this bold valuation? Discover the surprising financial projections and competitive edges fueling the narrative’s bullish stance. Click through to uncover how analysts are pricing in growth beyond games and into new markets.

Result: Fair Value of ¥3,214 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, reliance on a few hit titles and the challenges from Japan’s shrinking population could pose real headwinds to DeNA’s future growth story.

Find out about the key risks to this DeNA narrative.

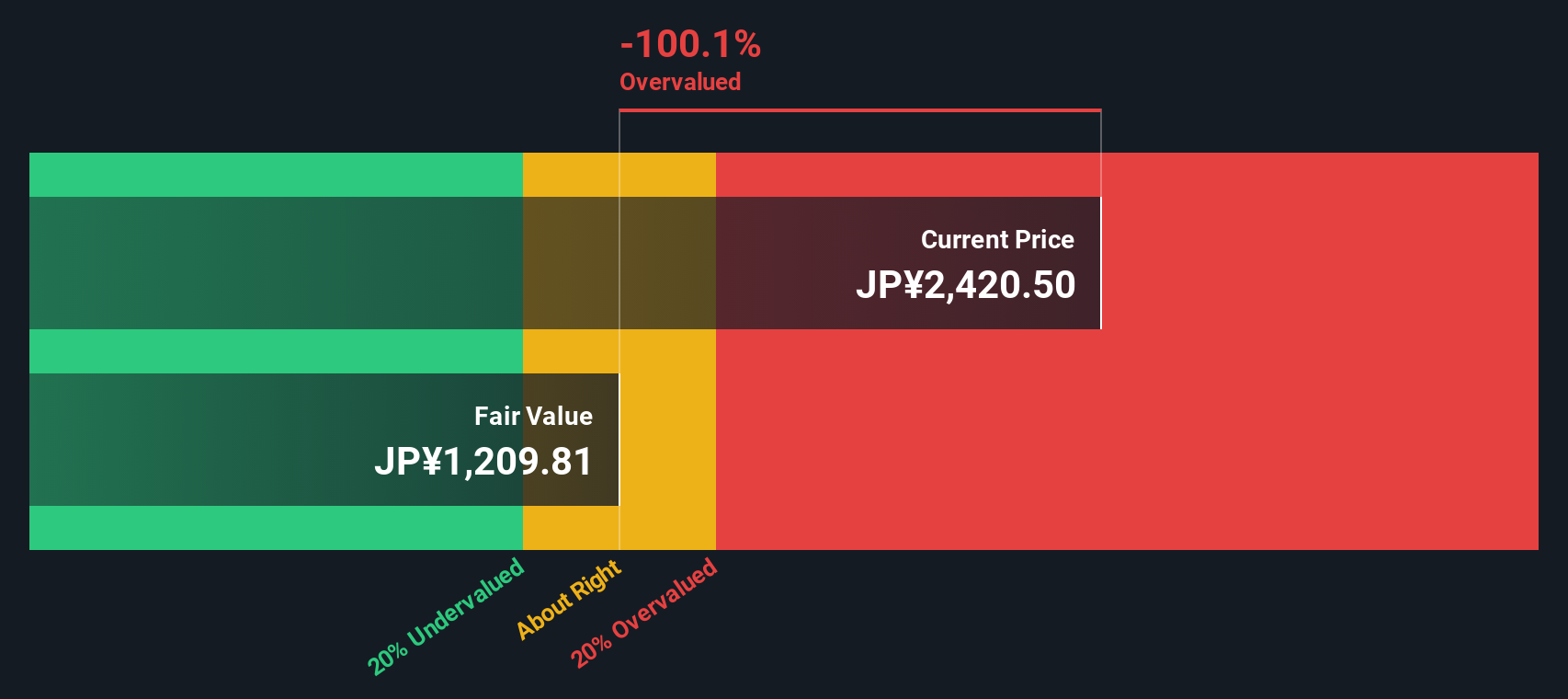

Another View: Discounted Cash Flow Sends a Different Signal

While consensus price targets point to DeNA being undervalued, our SWS DCF model comes to a different conclusion. According to this method, DeNA is currently trading above its estimated fair value. This prompts a big question: is the market missing downside risks that simple multiples do not capture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DeNA for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 919 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DeNA Narrative

If you have a different perspective or want to dive deeper into DeNA’s numbers yourself, it takes just a few minutes to build and share your own view, Do it your way

A great starting point for your DeNA research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Don’t let smart investments slip through your fingers. Use these powerful tools to zero in on stocks poised for strong performance and unique market advantages.

- Maximize your returns by tapping into these 17 dividend stocks with yields > 3% and target companies offering attractive yields above 3%.

- Catch innovation’s next wave by jumping into these 25 AI penny stocks and focus on firms harnessing artificial intelligence breakthroughs.

- Uncover exceptional bargains using these 919 undervalued stocks based on cash flows to highlight stocks trading below their intrinsic cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2432

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives