- Japan

- /

- Construction

- /

- TSE:1885

Asian Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As China's economy shows signs of slowing and Japan's markets react to policy shifts, investors are increasingly looking towards stable income sources in the Asian market. In this context, dividend stocks offer a compelling option for those seeking consistent returns amidst economic uncertainties.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 3.82% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.03% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 4.25% | ★★★★★★ |

| NCD (TSE:4783) | 4.64% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.81% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.98% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.99% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.62% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.78% | ★★★★★★ |

Click here to see the full list of 1079 stocks from our Top Asian Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

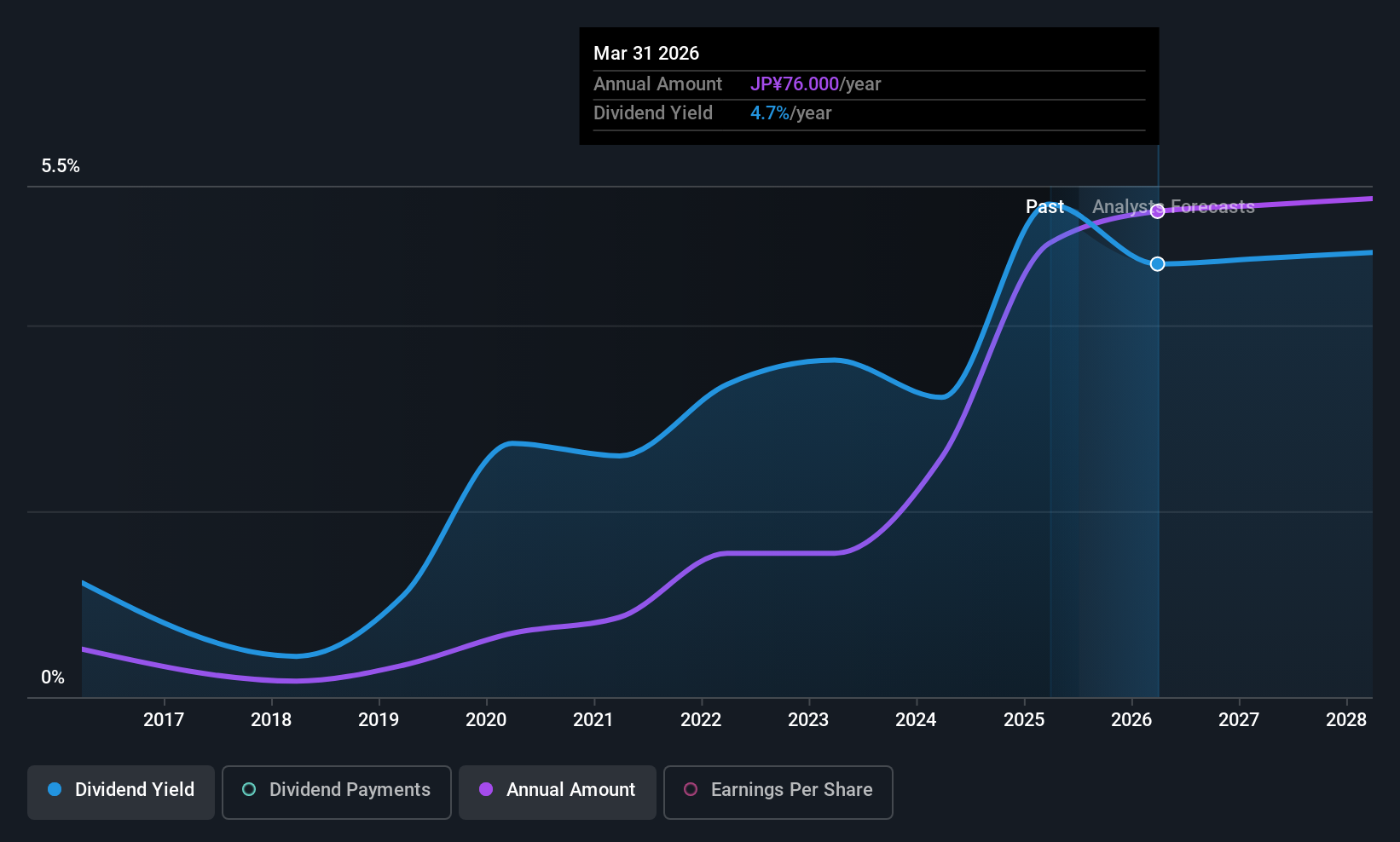

TOA (TSE:1885)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TOA Corporation, with a market cap of ¥195.09 billion, provides construction and engineering services in Japan.

Operations: TOA Corporation's revenue comes from its construction and engineering services in Japan.

Dividend Yield: 3.1%

TOA Corporation's dividend payments are well covered by earnings and cash flows, with payout ratios of 37.7% and 48.3%, respectively. However, its dividend history is marked by volatility, with significant annual drops in the past decade, making it less reliable for consistent income seekers. Recently, TOA raised its earnings guidance for FY2026 due to improved profit margins from large-scale projects but announced a lower year-end dividend compared to last year (JPY 39 vs JPY 76).

- Delve into the full analysis dividend report here for a deeper understanding of TOA.

- Insights from our recent valuation report point to the potential overvaluation of TOA shares in the market.

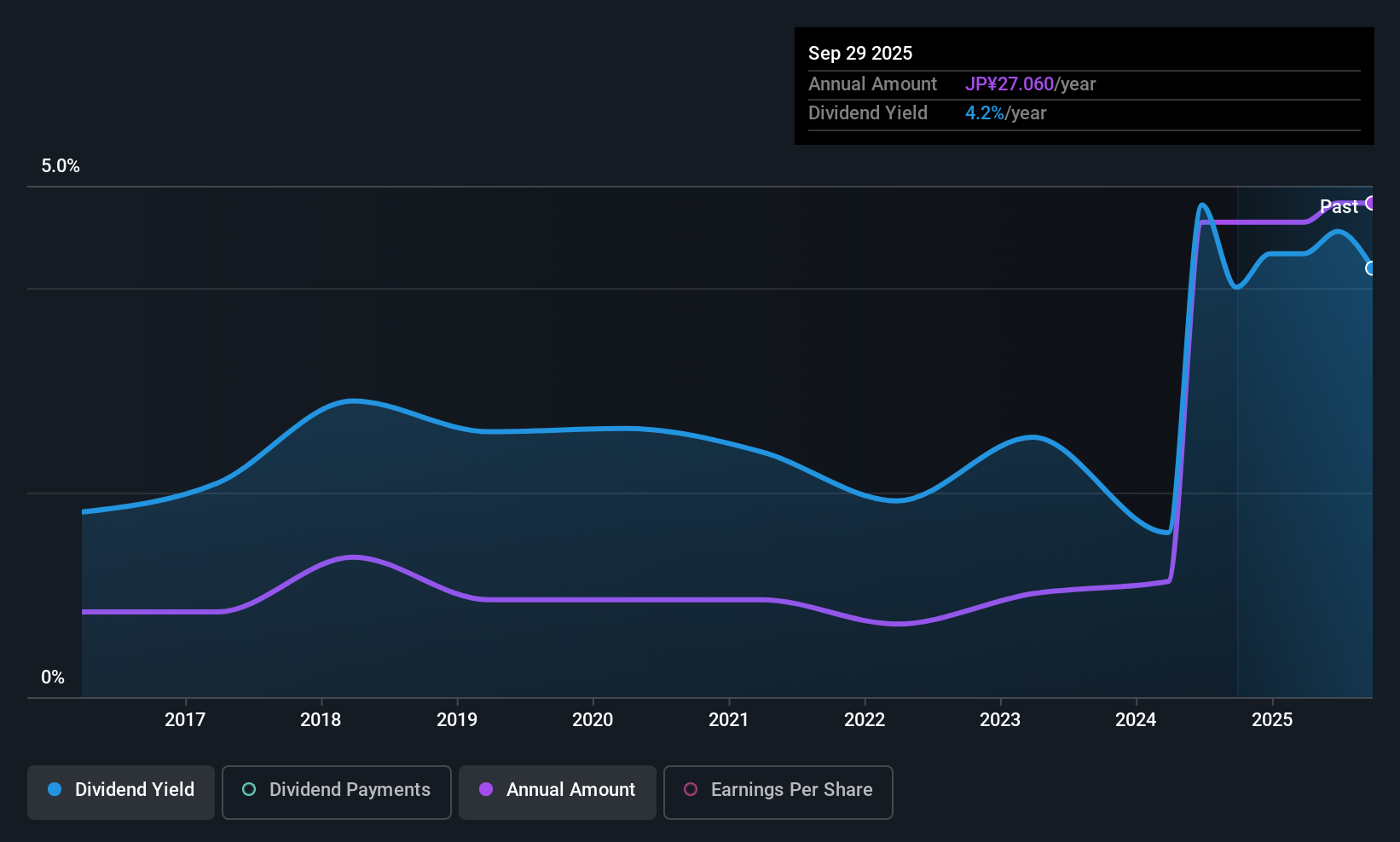

Tohokushinsha Film (TSE:2329)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tohokushinsha Film Corporation operates as a media business company in Japan, with a market cap of ¥88.22 billion.

Operations: Tohokushinsha Film Corporation generates its revenue from various segments within the media industry in Japan.

Dividend Yield: 4.2%

Tohokushinsha Film's dividend yield of 4.22% ranks in the top quarter of Japan's market, yet its dividends have been volatile over the past decade with significant drops. Despite a low payout ratio of 19.8%, suggesting earnings coverage, dividends are not supported by free cash flows and have been unreliable historically. The company's price-to-earnings ratio of 9.5x indicates good value relative to the market average, but large one-off items affect earnings quality.

- Take a closer look at Tohokushinsha Film's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Tohokushinsha Film is trading beyond its estimated value.

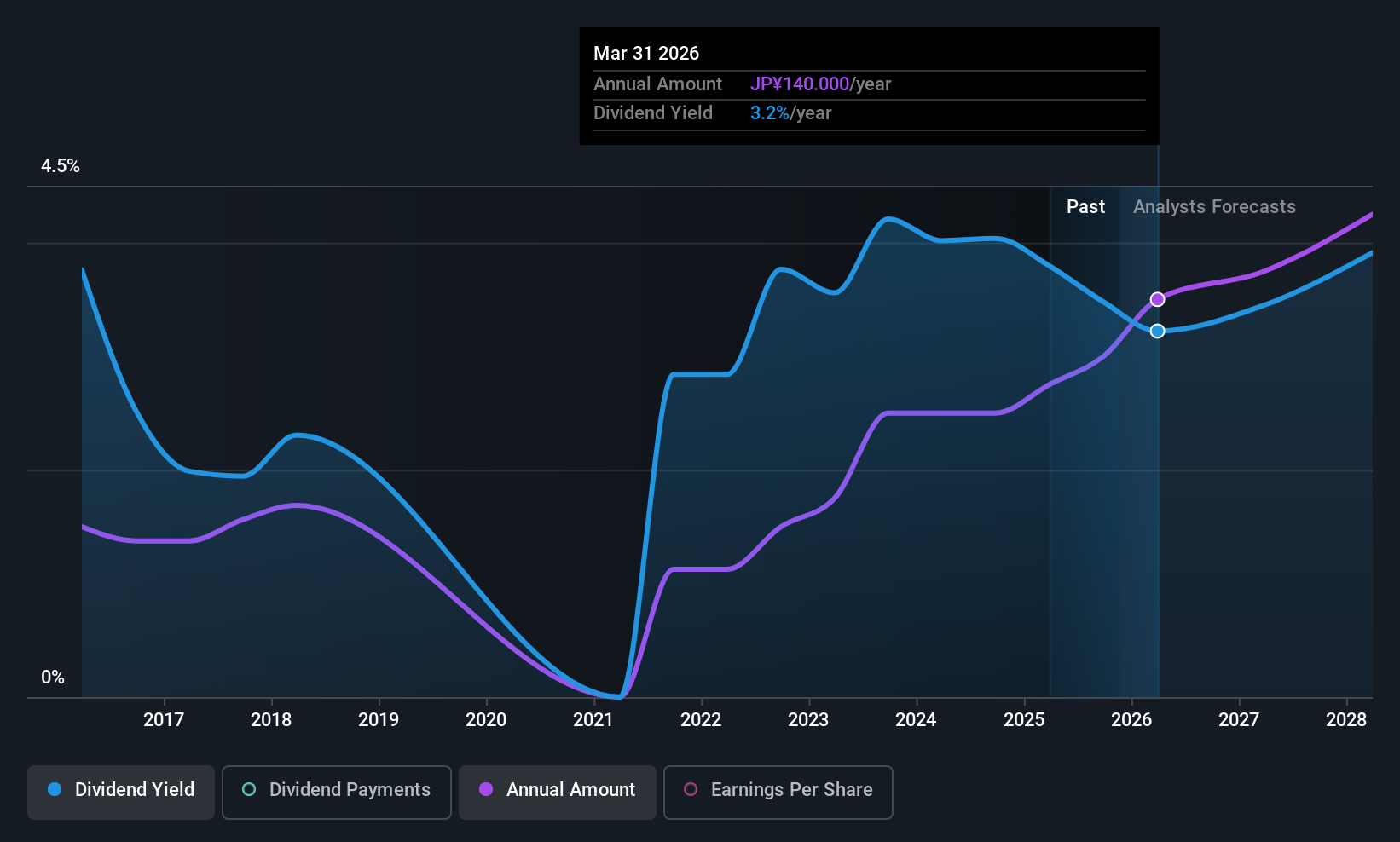

KYB (TSE:7242)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KYB Corporation manufactures and sells automotive, hydraulic, and aircraft components worldwide with a market cap of ¥202.71 billion.

Operations: KYB Corporation's revenue is primarily derived from its Automotive Components segment at ¥324.38 billion and Hydraulic Components (including System Products) at ¥119 billion, with additional contributions from Aircraft Components totaling ¥5.47 billion.

Dividend Yield: 3.4%

KYB's dividend yield of 3.44% is below the top tier in Japan, and its dividend history has been volatile, with payments not consistently growing over the past decade. However, dividends are well covered by both earnings (payout ratio of 13.6%) and cash flows (cash payout ratio of 29.6%). The company's recent share buyback program indicates a focus on returning value to shareholders despite forecasted earnings declines and a highly volatile share price recently.

- Navigate through the intricacies of KYB with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, KYB's share price might be too pessimistic.

Seize The Opportunity

- Reveal the 1079 hidden gems among our Top Asian Dividend Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TOA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1885

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives