FP Corporation (TSE:7947): Valuation Perspectives Following Upgraded Earnings Outlook and Dividend Hike

Reviewed by Simply Wall St

FP (TSE:7947) just raised its earnings guidance for both the first half and full fiscal year. Along with the improved outlook, the company announced a notable interim dividend increase, signaling a stronger sense of confidence from management.

See our latest analysis for FP.

FP’s recent guidance boost and dividend hike have given the share price a gentle lift in the short term, with a 2.93% gain over the past month, but momentum remains muted as longer-term total shareholder returns are still negative. The stock is down 1.7% over the past year and 35% over five years. The latest moves from management hint at a turning point, but investors are still looking for sustained improvement to reverse the longer-term trend.

If this renewed optimism has you curious about broader opportunities, now’s a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With analyst price targets well above the current share price and recent positive revisions, does FP represent an undervalued opportunity for investors? Or is the market already accounting for all the expected future growth?

Price-to-Earnings of 14.2x: Is it justified?

FP trades at a price-to-earnings (P/E) ratio of 14.2x, standing well above industry peers and benchmarks. This signals that, despite recent earnings growth, the market is pricing FP more aggressively than direct competitors.

The price-to-earnings ratio compares a company's share price to its annual net earnings per share, providing investors with a sense of how much is being paid for each unit of current net income. For manufacturing and packaging businesses like FP, the P/E gives insight into market expectations for future profitability and business stability.

When contrasted with the industry average P/E of 10.1x, FP's higher multiple highlights elevated expectations or a potential overvaluation. Compared to our fair price-to-earnings estimate of 13.5x, the current figure suggests that the company's shares are not only priced above sector norms but also above where regression analysis points the shares should be. This gap could narrow if market sentiment changes based on earnings consistency, management actions, or industry momentum.

Explore the SWS fair ratio for FP

Result: Price-to-Earnings of 14.2x (OVERVALUED)

However, slower revenue and net income growth or further declines in total returns could challenge the optimism around FP's improved outlook.

Find out about the key risks to this FP narrative.

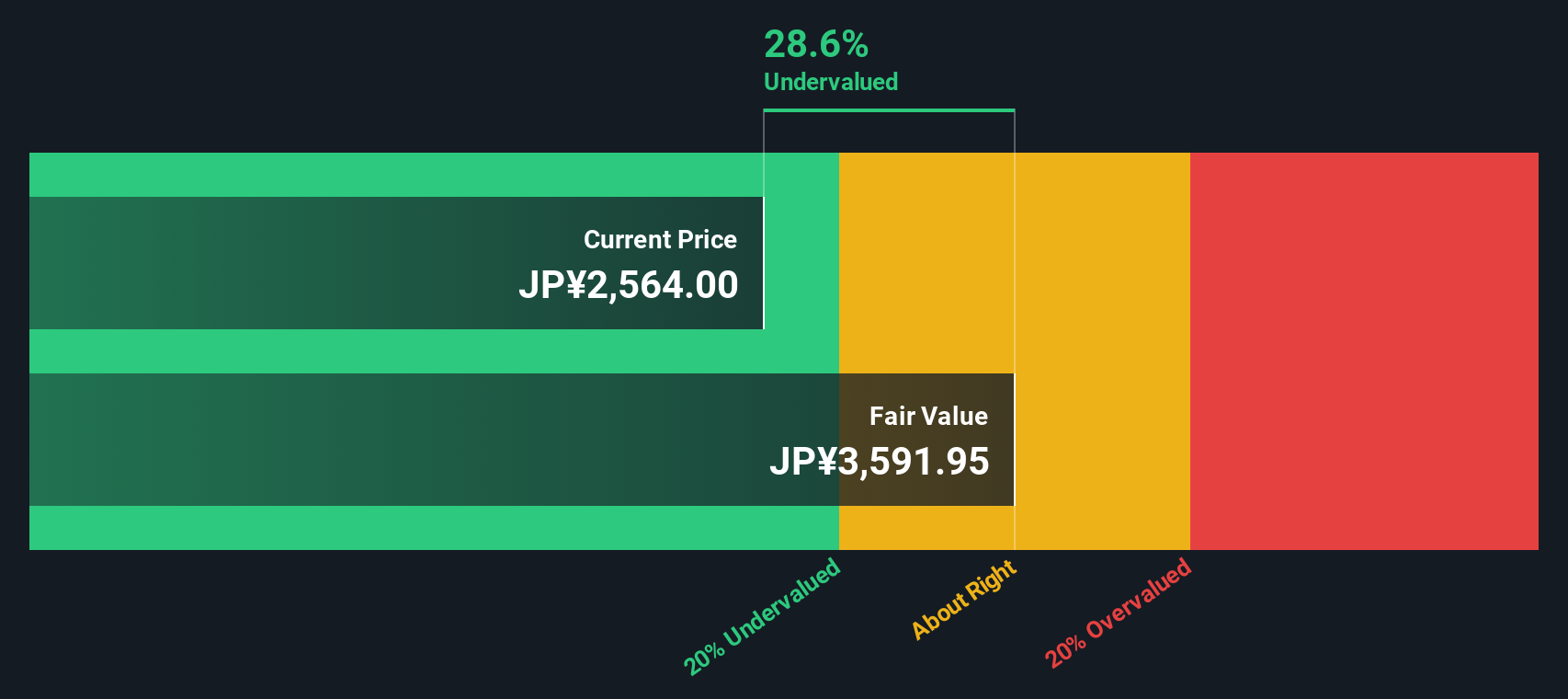

Another View: SWS DCF Model Suggests Upside

While the price-to-earnings ratio paints FP as potentially overvalued, our DCF model reaches a different conclusion. The SWS DCF model values FP at ¥3,586 per share, around 28.5% above the current market price. This suggests the stock may be undervalued from a long-term cash flow perspective. Does the disconnect between today’s price and future value signal a true opportunity or a value trap?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out FP for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own FP Narrative

If you want to dig deeper or come to your own conclusions, you can quickly build a personal view of FP using the available data. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding FP.

Looking for more investment ideas?

Smart investing means staying ahead of the crowd. Take the next step now or watch as others seize opportunities you might wish you hadn’t missed.

- Unlock high-yield potential with reliable payers by checking out these 16 dividend stocks with yields > 3% for stocks boasting attractive dividend returns above 3%.

- Capitalize on the growth of artificial intelligence as you scan the market for leaders with these 24 AI penny stocks who are reshaping industries worldwide.

- Spot value others might be missing by browsing these 870 undervalued stocks based on cash flows where strong cash flows signal potential bargain opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7947

FP

Manufactures and markets polystyrene and compound resin disposable food containers in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives