In recent weeks, global markets have experienced significant shifts, with U.S. stocks rallying to record highs amid expectations of economic growth and tax reforms following the election results. As investors navigate these dynamic conditions, dividend stocks remain an attractive option for those seeking steady income streams and potential capital appreciation. In this environment, selecting a good dividend stock involves considering factors such as the company's financial health, consistent payout history, and resilience in varying market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.51% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.88% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.57% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.37% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.15% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.36% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.37% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.90% | ★★★★★★ |

Click here to see the full list of 1946 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

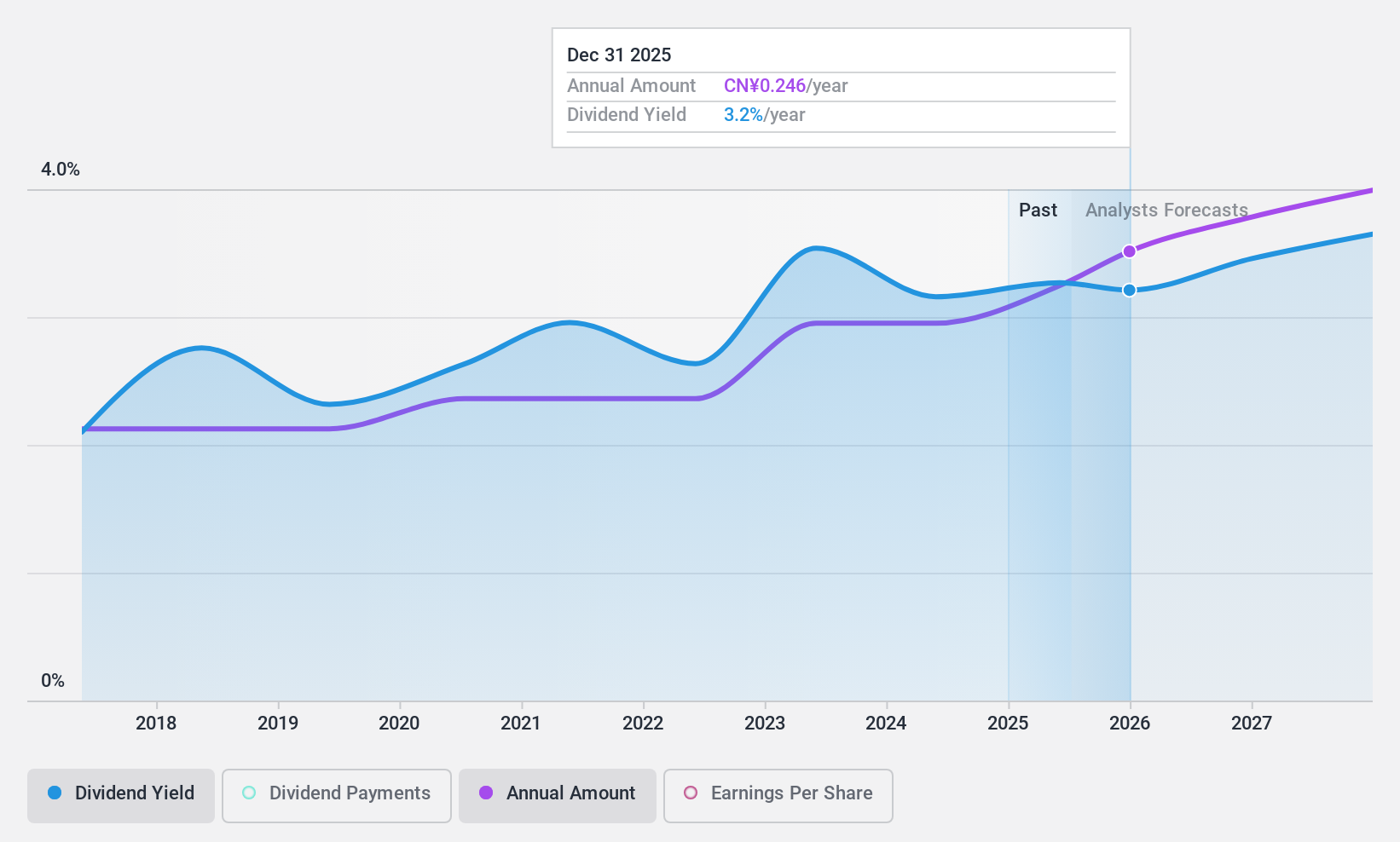

Jiangsu Changshu Rural Commercial Bank (SHSE:601128)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangsu Changshu Rural Commercial Bank Co., Ltd. operates as a regional commercial bank providing financial services and products in China, with a market cap of approximately CN¥21.35 billion.

Operations: Jiangsu Changshu Rural Commercial Bank Co., Ltd. generates its revenue primarily through its financial services and products offered within China.

Dividend Yield: 3%

Jiangsu Changshu Rural Commercial Bank's dividend payments are well-covered by earnings, with a payout ratio of 18.4%, indicating sustainability. The bank's dividend yield of 3.03% places it in the top tier among Chinese market payers. Despite having only seven years of dividend history, the dividends have been stable and growing with minimal volatility. Recent earnings growth supports this stability, as net income rose to CNY 2.98 billion for the first nine months of 2024 from CNY 2.52 billion last year.

- Unlock comprehensive insights into our analysis of Jiangsu Changshu Rural Commercial Bank stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Jiangsu Changshu Rural Commercial Bank is priced higher than what may be justified by its financials.

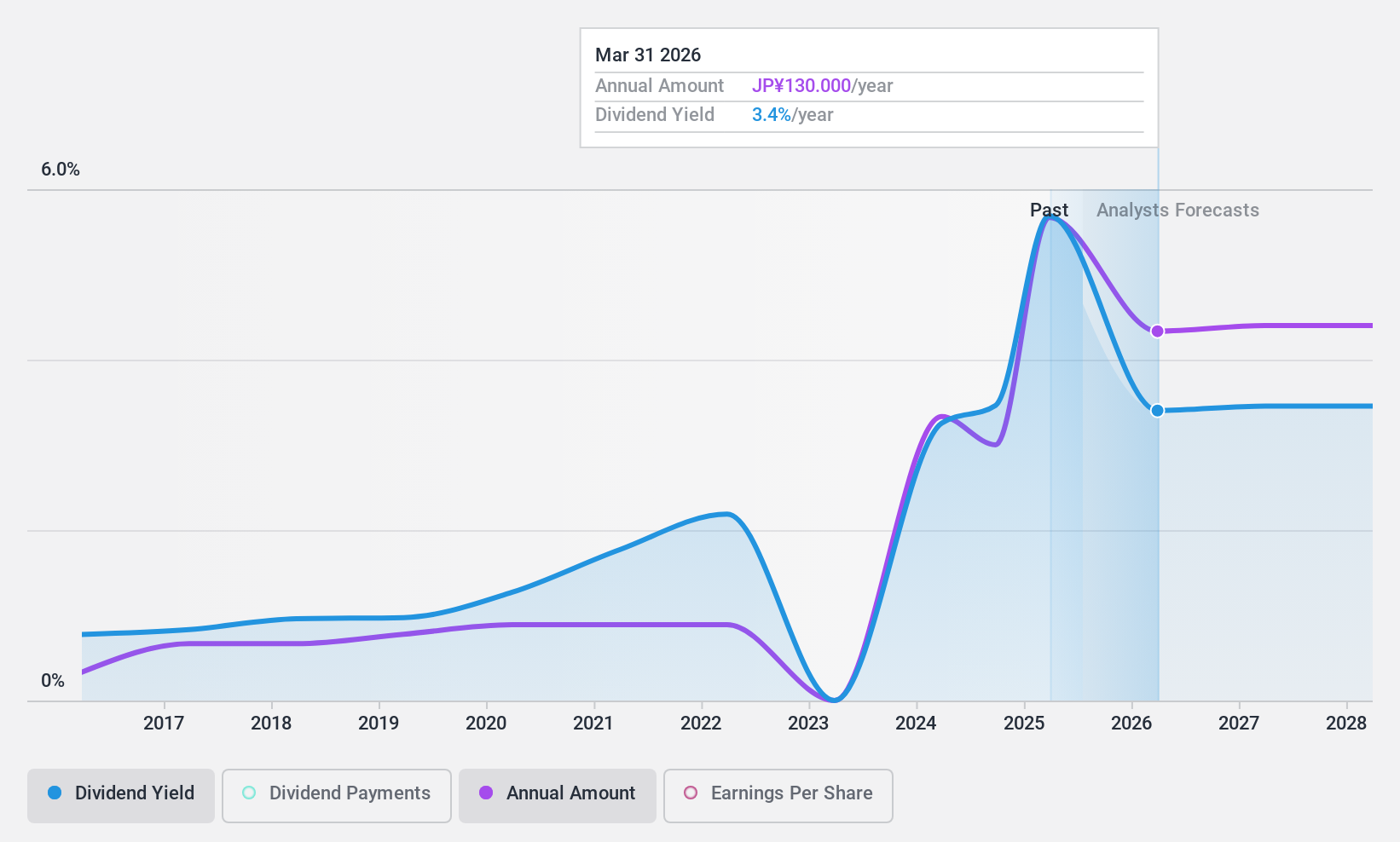

Kawada Technologies (TSE:3443)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kawada Technologies, Inc. operates in Japan's steel, civil engineering, architecture, and IT service sectors with a market cap of ¥42.65 billion.

Operations: Kawada Technologies, Inc. generates revenue through its operations in the steel, civil engineering, architecture, and IT service sectors in Japan.

Dividend Yield: 3.5%

Kawada Technologies' dividend payments are well-covered by both earnings and cash flows, with a payout ratio of 25.3% and a cash payout ratio of 14.8%, ensuring sustainability. However, the dividends have been volatile over the past decade, despite some growth during this period. The company's dividend yield of 3.48% is below the top tier in Japan's market but remains attractive given its current valuation at 20.6% below estimated fair value.

- Navigate through the intricacies of Kawada Technologies with our comprehensive dividend report here.

- The analysis detailed in our Kawada Technologies valuation report hints at an deflated share price compared to its estimated value.

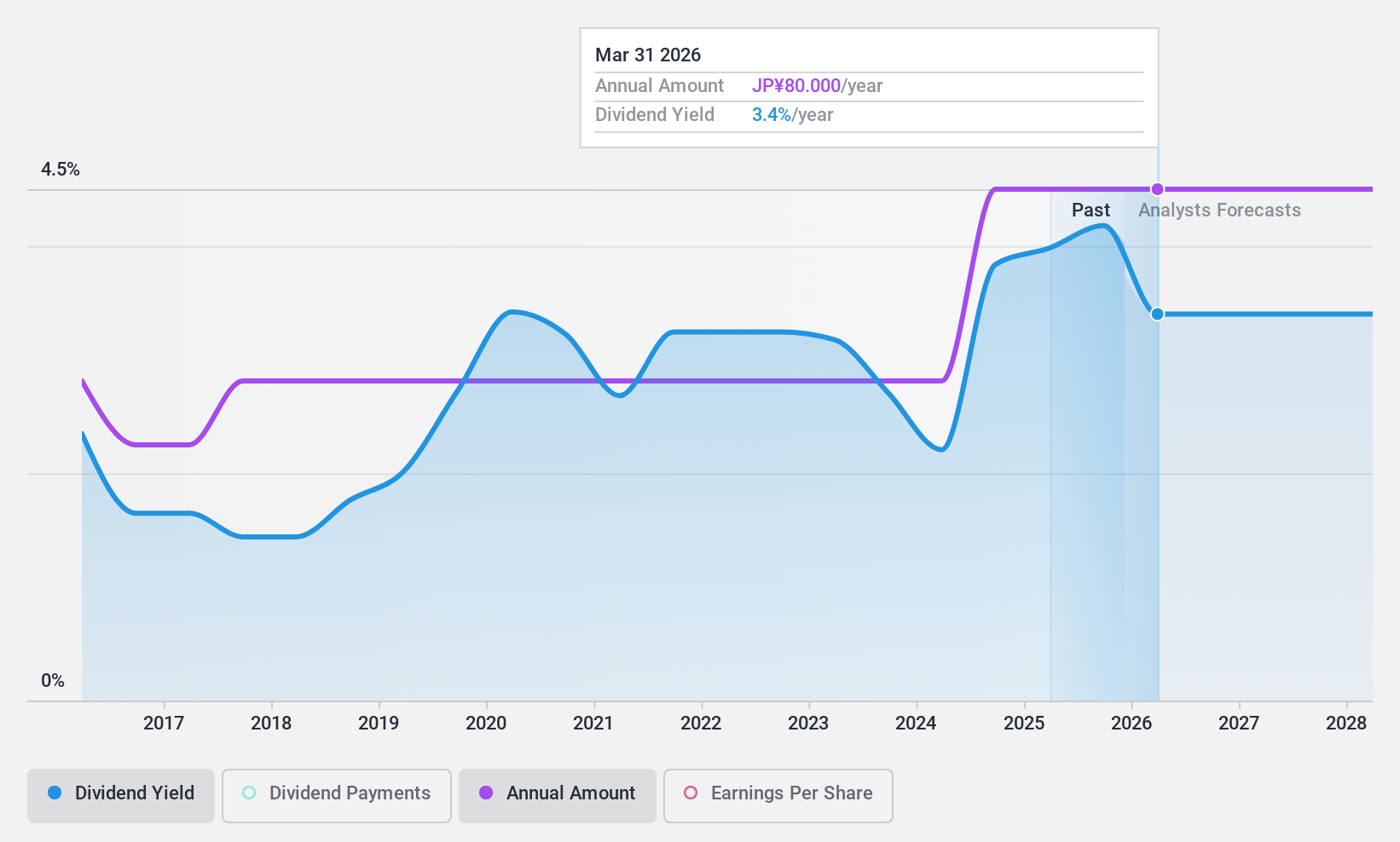

JSP (TSE:7942)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: JSP Corporation manufactures and sells expanded polymers globally, with a market capitalization of ¥52.68 billion.

Operations: JSP Corporation's revenue is primarily derived from its Bead Business, which generates ¥92.84 billion, and its Extrusion Business, contributing ¥45.55 billion.

Dividend Yield: 3.9%

JSP's dividends are well-covered by earnings and cash flows, with payout ratios of 35% and 35.7%, respectively, indicating sustainability. Despite a history of volatility over the past decade, dividend payments have increased during this period. The current yield of 3.92% ranks in the top quartile among Japanese dividend payers. JSP is trading at a significant discount to its estimated fair value and offers good relative value compared to peers in its industry.

- Take a closer look at JSP's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of JSP shares in the market.

Taking Advantage

- Unlock our comprehensive list of 1946 Top Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7942

Flawless balance sheet, undervalued and pays a dividend.