Kohsoku (TSE:7504) Earnings Growth Tops Narrative Despite Margin Dip

Reviewed by Simply Wall St

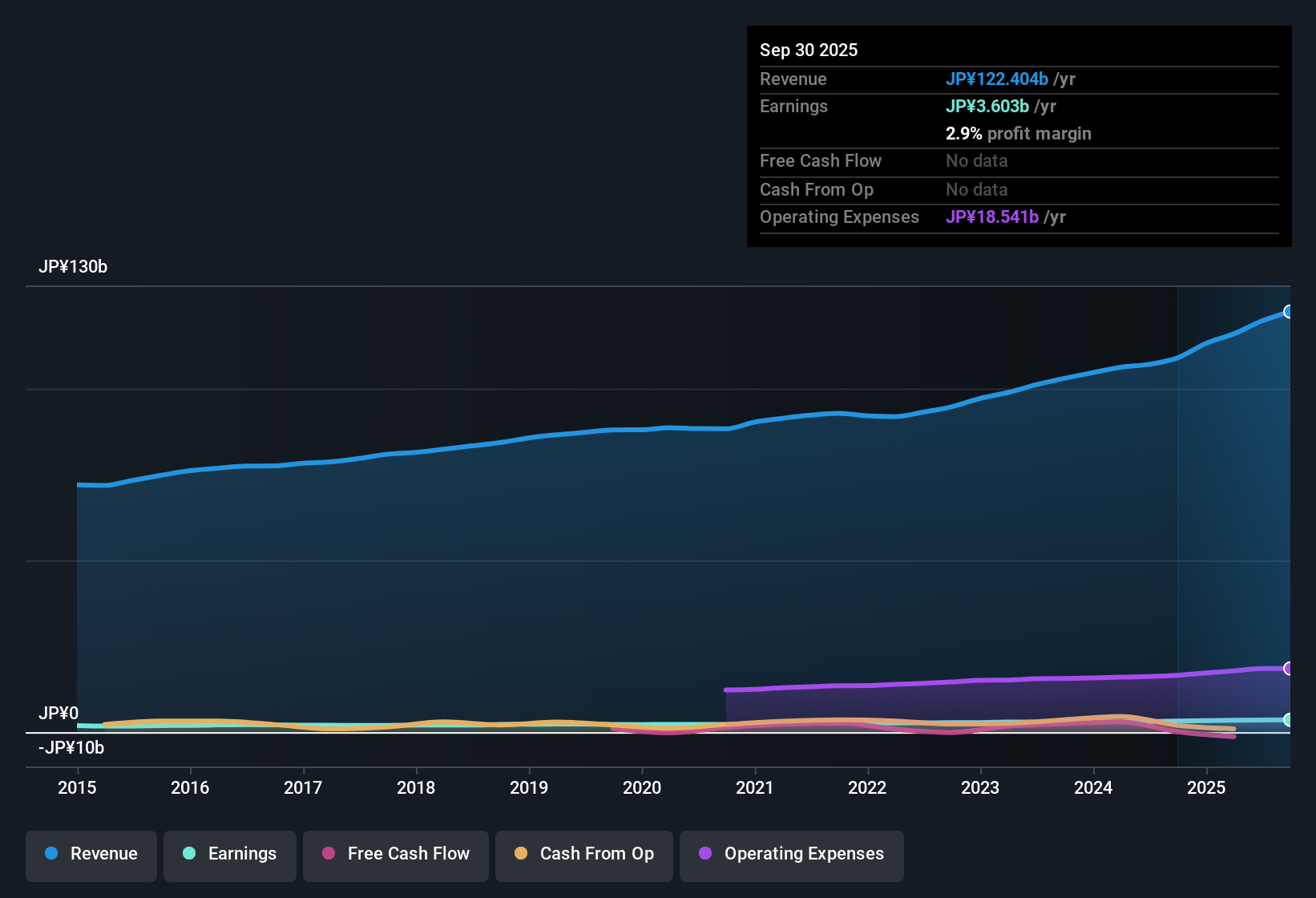

Kohsoku (TSE:7504) reported a net profit margin of 2.9%, just below last year’s 3%, as earnings grew 10.4%, beating its 5-year average annual growth of 8%. Over that five-year span, annual earnings have climbed by 8%, with the company’s earnings consistently considered high quality. Despite these strong growth figures, shares trade at 15.5x earnings, notably higher than both peer and sector averages, and well above an estimated fair value of ¥1177.08.

See our full analysis for Kohsoku.Next, we’ll put Kohsoku’s latest results in context by seeing how the company’s numbers compare to the widely followed narratives on Simply Wall St, spotlighting areas where the story holds up and where it might be tested.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Consistency Despite Slight Dip

- Kohsoku’s net profit margin slipped to 2.9%, down from last year’s 3%. Despite this, profit growth still topped its 5-year average pace of 8% per year.

- The prevailing market view highlights how consistently high-quality earnings and strong annual growth rates offset a minor margin decline.

- High quality profits have been recognized over the last five years, signaling operational discipline that supports continued investor interest.

- The 10.4% earnings growth in the most recent year outpaces sector averages and serves as a counterpoint to any short-term margin compression.

Dividend Sustainability in the Spotlight

- The key risk flagged by investors centers on the sustainability of Kohsoku’s dividend, which is not directly discussed in recent filings but remains under scrutiny.

- The prevailing market view notes that while robust earnings growth is an encouraging signal,

- Bears highlight that unless cash flow growth matches profit growth, questions around ongoing dividend safety may keep pressure on the share price.

- Persistent dividends depend not just on profitability, but also on the ability to generate and retain cash, which is not detailed in reported results.

Valuation Premium Over Peers Widens

- Shares currently trade at 15.5x earnings, which is significantly above the peer group’s 10.3x and the broader industry’s 10x. The share price of ¥2856 exceeds a DCF fair value of ¥1177.08.

- The prevailing market view notes investors are grappling with whether sustained profit growth justifies this substantial premium.

- Bulls can point to historical growth as a reason for the higher multiple, while skeptics argue that exceeding DCF fair value by more than 140% increases risk of a correction.

- The balance between dependable earnings quality and the high price tag is likely to be a critical factor for forward sentiment.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Kohsoku's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite impressive profit growth, Kohsoku’s valuation appears stretched relative to its underlying fundamentals. This raises the risk of an overvalued share price.

If overpaying is a concern, consider using our these 832 undervalued stocks based on cash flows to quickly spot companies trading well below their intrinsic value and reduce the risk of buying at a premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kohsoku might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7504

Kohsoku

Kohsoku Corporation is involved in the manufacture and sale of light food packaging materials in Japan.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives