Nitto Denko (TSE:6988): Evaluating Valuation After Upgraded Profit Outlook, Dividend Lift, and New Earnings Results

Reviewed by Simply Wall St

Nitto Denko (TSE:6988) caught fresh attention as it raised its full-year revenue and profit forecasts. The company announced these changes together with updated half-year results and a higher dividend payout. Investors took notice as all three updates arrived at the same time.

See our latest analysis for Nitto Denko.

Nitto Denko’s upgraded outlook, paired with a fresh dividend boost, has energized investor sentiment. The stock now trades at ¥3,879, enjoying a strong run with a 6.3% one-month share price return and an impressive 57.3% total shareholder return over the past year. Notably, momentum has accelerated throughout 2024, which suggests growing confidence in the company’s longer-term growth prospects even as earnings in the recent half lagged last year’s mark.

If strong annual returns have you scanning the market for what’s picking up steam next, now’s the perfect moment to discover fast growing stocks with high insider ownership

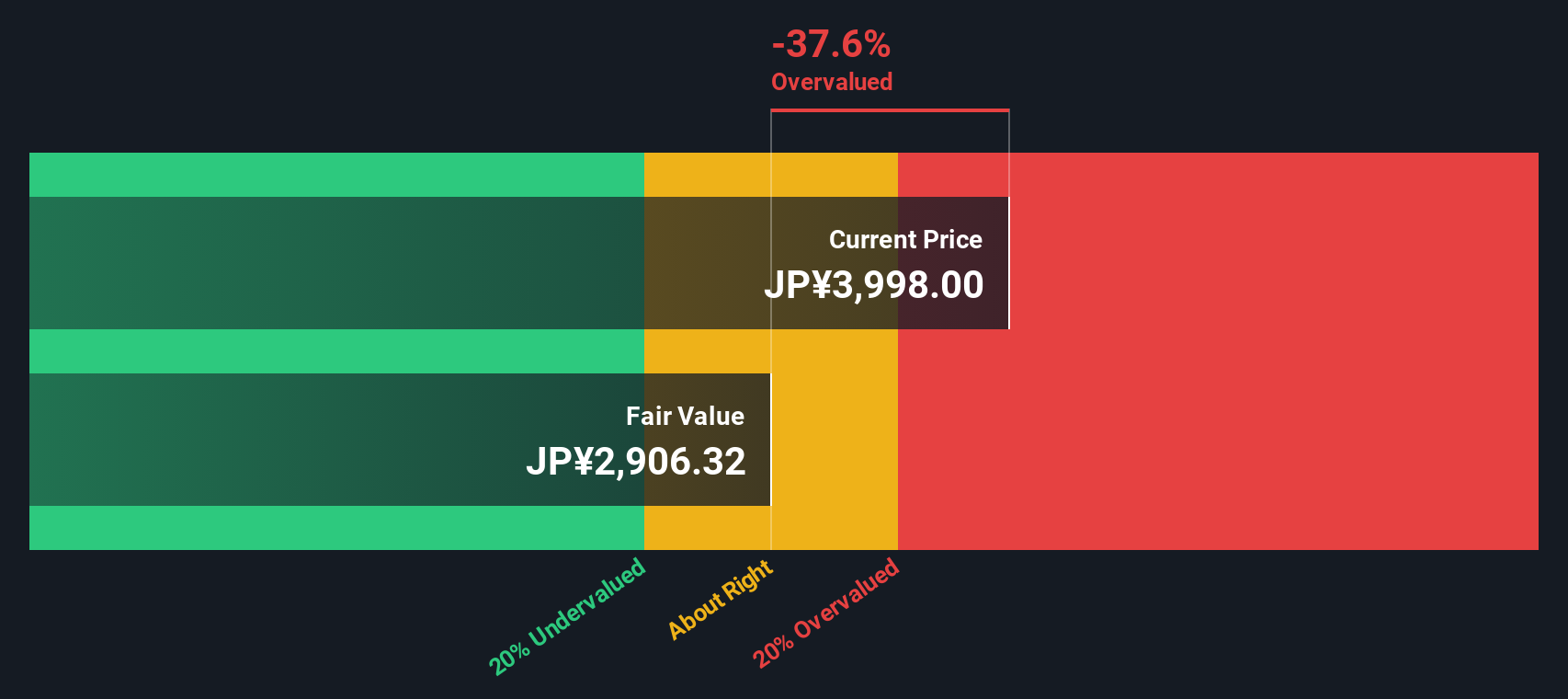

With the recent upgrades and a powerful share price rally, investors are left wondering if Nitto Denko’s strong outlook and dividend are already fully reflected in the stock, or if the current momentum signals more room to run.

Price-to-Earnings of 20.7: Is it justified?

Nitto Denko’s stock currently trades at a Price-to-Earnings (P/E) multiple of 20.7, making it noticeably expensive when compared to its industry and peer benchmarks. At the last close of ¥3,879, investors are paying up for near-term momentum, but the valuation stands in stark contrast to other chemicals stocks in Japan.

The P/E ratio is a key indicator reflecting how much investors are willing to pay for a company's earnings. In the chemicals sector, this measure helps investors gauge whether profit expectations and recent growth warrant paying a premium for the stock.

At 20.7 times earnings, Nitto Denko is valued above the Japanese chemicals industry average of 13.2 and also above the peer group average of 20.3. This premium suggests that the market is either pricing in further growth or strong future profitability. However, the stock also exceeds the estimated ‘fair’ P/E ratio of 18.6, indicating that expectations may be running ahead of fundamentals. If market sentiment shifts, this premium could be at risk.

Explore the SWS fair ratio for Nitto Denko

Result: Price-to-Earnings of 20.7 (OVERVALUED)

However, a dip in market sentiment or disappointing earnings growth could quickly challenge the current optimism around Nitto Denko’s valuation.

Find out about the key risks to this Nitto Denko narrative.

Another View: What Does the DCF Model Say?

While the current P/E ratio signals that Nitto Denko might be overvalued compared to industry norms, our SWS DCF model tells a similar story. The model estimates a fair value of ¥3,051.6, which is well below today’s share price. This raises the question of whether the market is too optimistic, or if there could be future potential not fully captured in these models.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nitto Denko for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 843 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nitto Denko Narrative

If you prefer to dive into the numbers yourself and shape your own perspective on Nitto Denko’s future, you can easily build your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Nitto Denko.

Looking for More Smart Investment Moves?

Don’t let your next opportunity get away. Great ideas are waiting. Make sure you spot tomorrow’s winners before everyone else does with these top stock screens:

- Unlock amazing growth potential by targeting companies with strong fundamentals delivering standout returns via these 843 undervalued stocks based on cash flows.

- Turn consistent income into a reality and see which businesses are paying healthy yields, all starting with these 18 dividend stocks with yields > 3%.

- Catch innovation early by checking out companies at the cutting edge of blockchain and digital finance through these 82 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nitto Denko might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6988

Nitto Denko

Primarily engages in the adhesive tapes business in Japan, the Americas, Europe, Asia, and Oceania.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives