How Investors May Respond To Nitto Denko (TSE:6988) Raising Dividend and Earnings Outlook Amid Lower Sales

Reviewed by Sasha Jovanovic

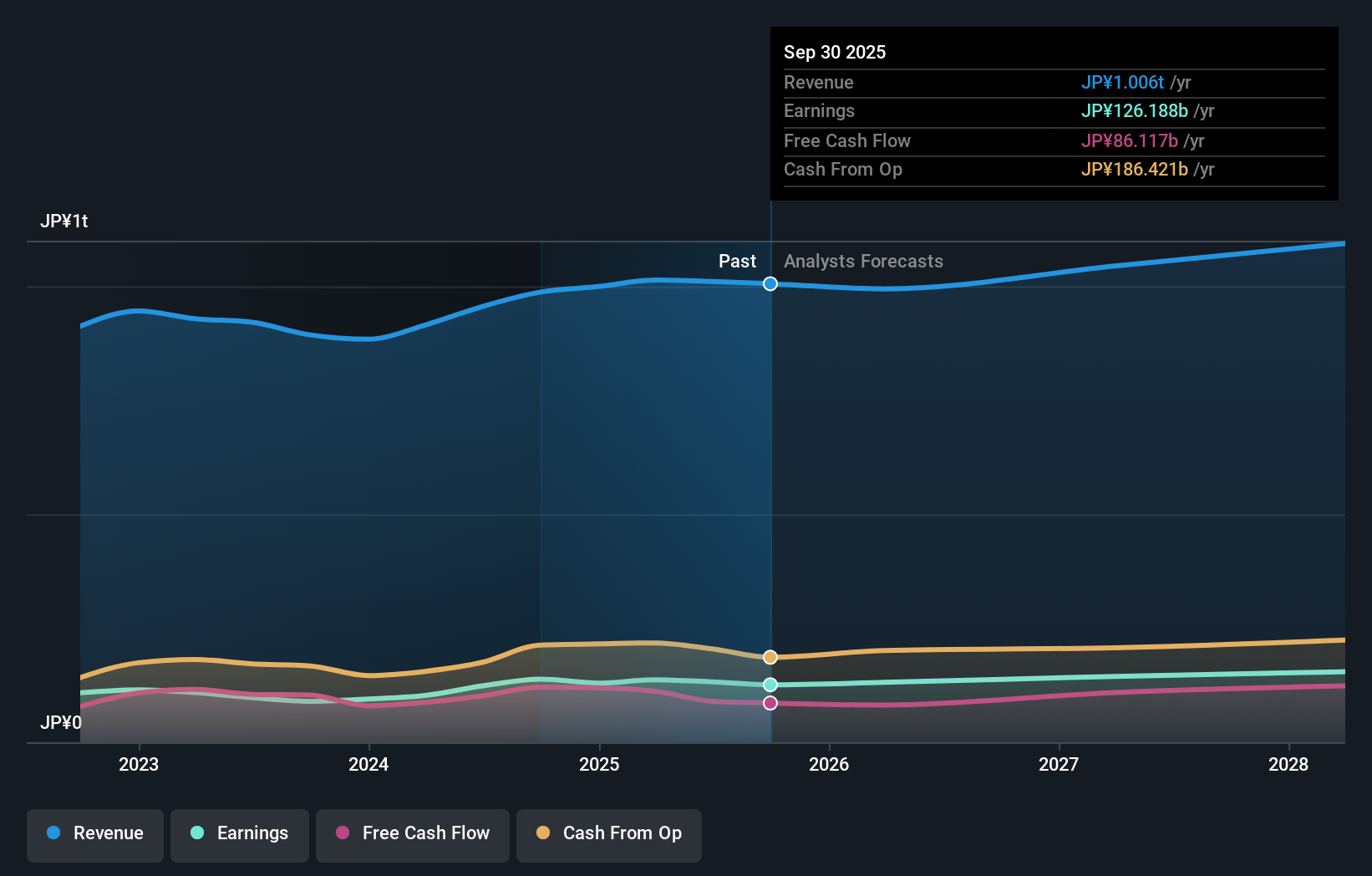

- Nitto Denko Corporation recently announced a JPY 30.00 per share interim dividend for the second quarter ended September 30, 2025, up from JPY 28.00 a year earlier, alongside raised full-year earnings guidance despite lower half-year sales and net profit compared to the previous year.

- The simultaneous dividend increase and upward revision of earnings guidance signal management’s positive outlook on the company’s future cash flow and financial stability.

- We’ll explore how the increased dividend mirrors strengthened expectations for future profitability and shapes Nitto Denko’s broader investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Nitto Denko's Investment Narrative?

Being a shareholder in Nitto Denko means believing in its ability to steadily return capital to investors, underpinned by management’s confidence despite recent hiccups in profit and revenue growth. The latest dividend increase and upgraded earnings guidance, coming just as half-year numbers showed a dip, may help ease concerns about softness in core operations and position cash flow as a near-term catalyst. While this boost in shareholder returns and improved guidance could renew optimism, elevated valuation and slower expected growth versus the broader market remain important considerations. If analyst price targets and current pricing hold weight, the news may temper some immediate downside risks but doesn’t fully offset challenges like margin compression and questions about the sustainability of recent performance. Market reactions so far suggest these updates will matter, but the extent may depend on trends in profitability and uptake from the share buyback.

Yet, beneath the dividend news, margin pressures could be a concern for some investors. Nitto Denko's share price has been on the slide but might be up to 33% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore another fair value estimate on Nitto Denko - why the stock might be worth as much as ¥3539!

Build Your Own Nitto Denko Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nitto Denko research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Nitto Denko research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nitto Denko's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nitto Denko might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6988

Nitto Denko

Primarily engages in the adhesive tapes business in Japan, the Americas, Europe, Asia, and Oceania.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives