- Japan

- /

- Metals and Mining

- /

- TSE:5714

Dowa Holdings (TSE:5714): Assessing Valuation After Upgraded Earnings Outlook on Strong Metal Prices and Profits

Reviewed by Simply Wall St

Dowa Holdings (TSE:5714) has raised both its earnings and dividend forecasts for the fiscal year ending March 2026, following better-than-expected profit due to higher metal prices and a supportive currency shift.

See our latest analysis for Dowa Holdings.

After a remarkable run so far this year, momentum is clearly in Dowa Holdings’ favor. The company’s latest guidance boost follows an impressive year-to-date share price return of 33.8%, with its 1-year total shareholder return sitting even higher at 38%. That blend of short-term price energy and robust long-term gains suggests investors are factoring in both improved earnings prospects and a supportive commodity environment.

If surging profit forecasts have you rethinking what’s possible in materials, consider broadening your search and discover fast growing stocks with high insider ownership

After such impressive gains and rosy forecasts, the core question is clear: Is Dowa Holdings still trading at an attractive valuation, or have expectations for future growth already been fully reflected in the current share price?

Price-to-Earnings of 17.5x: Is it justified?

Dowa Holdings shares are trading at a price-to-earnings (P/E) ratio of 17.5x, noticeably higher than both the industry and what models suggest as a “fair” multiple.

The P/E ratio measures how much investors are willing to pay today for every ¥1 of earnings generated by the company. In materials and mining, this metric gives a quick read on whether enthusiasm for future profit growth has run ahead of reality or not.

For Dowa Holdings, investors are paying a marked premium compared to the Metals and Mining industry average of 12.1x. Even when pitted against the company's own fair P/E ratio estimate of 15.7x, the current multiple comes out more expensive. This indicates the market is factoring in optimism not just relative to its competitors, but also compared to the projected earnings potential based on historical trends.

Explore the SWS fair ratio for Dowa Holdings

Result: Price-to-Earnings of 17.5x (OVERVALUED)

However, elevated valuations could face pressure if metal prices reverse or if profit growth slows more than the current forecast anticipates.

Find out about the key risks to this Dowa Holdings narrative.

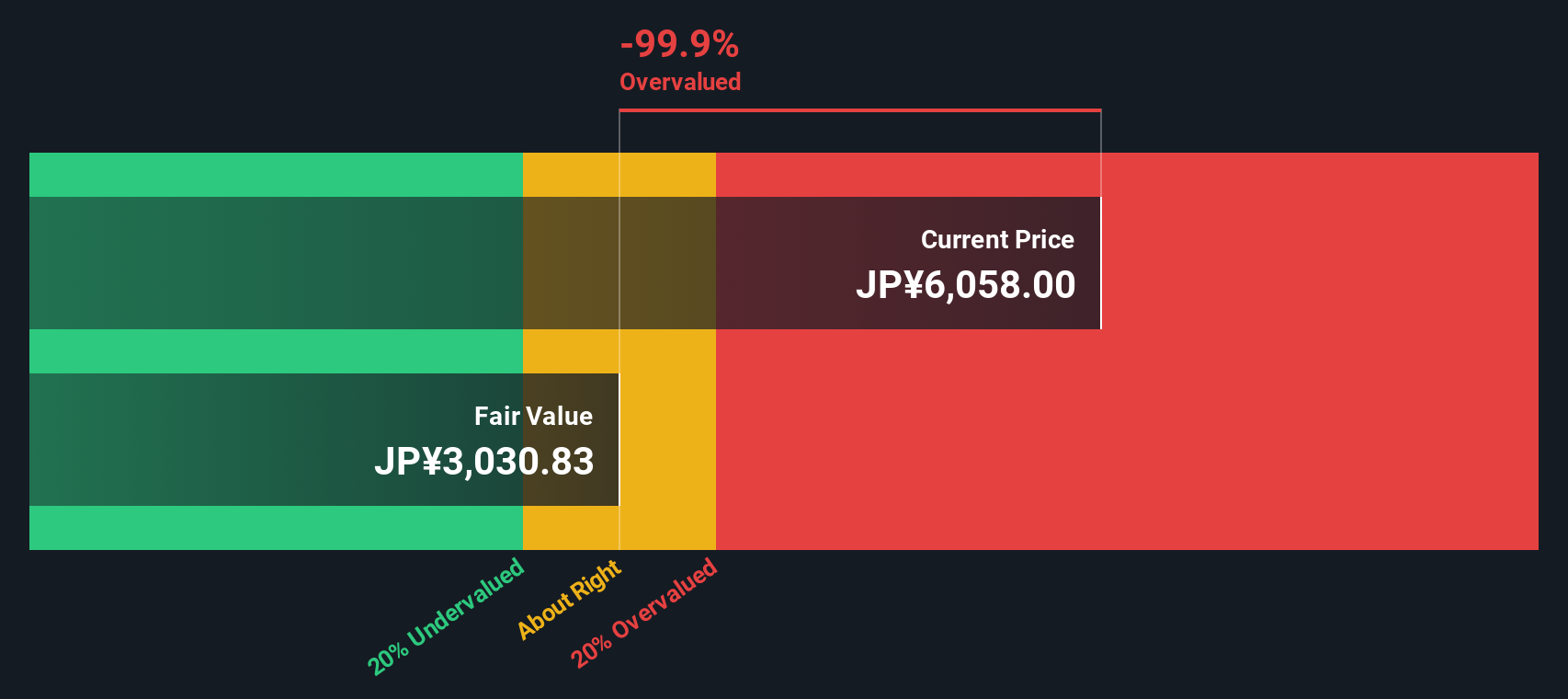

Another View: Our DCF Model Paints a Different Picture

While multiples hint at optimism, the SWS DCF model delivers a starker assessment. According to our DCF model, Dowa Holdings' shares trade well above their calculated fair value. This suggests the market might be pricing in more future growth than fundamentals support. Does this model see risks others are missing, or is it too conservative?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dowa Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 932 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dowa Holdings Narrative

If you see the numbers differently or want to draw your own conclusions, you can explore the data and craft your perspective in just a few minutes. Do it your way

A great starting point for your Dowa Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for only one opportunity. Expand your horizons and get ahead of the crowd with powerful screeners that uncover unique growth and value plays beyond Dowa Holdings.

- Boost your potential returns with high-yield picks as you check out these 14 dividend stocks with yields > 3% boasting reliable income and attractive yields over 3%.

- Seize the future by tracking breakthrough advancements in healthcare. Uncover next-generation health innovators through these 30 healthcare AI stocks right now.

- Find hidden gems trading below their real worth and grab tomorrow’s value standouts by starting your search with these 932 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5714

Dowa Holdings

Engages in the environmental management and recycling, nonferrous metals, electronic materials, metal processing, and heat treatment businesses.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success