- Japan

- /

- Metals and Mining

- /

- TSE:5711

Mitsubishi Materials Corporation's (TSE:5711) P/S Still Appears To Be Reasonable

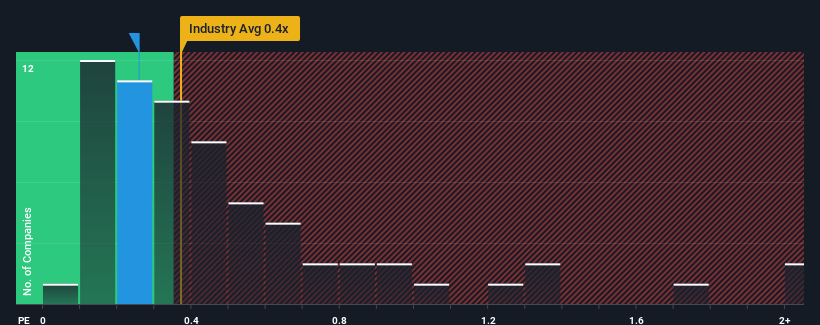

With a median price-to-sales (or "P/S") ratio of close to 0.4x in the Metals and Mining industry in Japan, you could be forgiven for feeling indifferent about Mitsubishi Materials Corporation's (TSE:5711) P/S ratio of 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Mitsubishi Materials

What Does Mitsubishi Materials' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Mitsubishi Materials' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Mitsubishi Materials.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Mitsubishi Materials' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 5.3% each year as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 5.5% per year, which is not materially different.

With this in mind, it makes sense that Mitsubishi Materials' P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Mitsubishi Materials' P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look at Mitsubishi Materials' revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

You need to take note of risks, for example - Mitsubishi Materials has 2 warning signs (and 1 which can't be ignored) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5711

Mitsubishi Materials

Engages in the manufacture and sale of processed copper products and electronic materials, cemented carbide products, and businesses related to renewable energy in Japan.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives