- Japan

- /

- Metals and Mining

- /

- TSE:5706

With Mitsui Mining & Smelting Co., Ltd. (TSE:5706) It Looks Like You'll Get What You Pay For

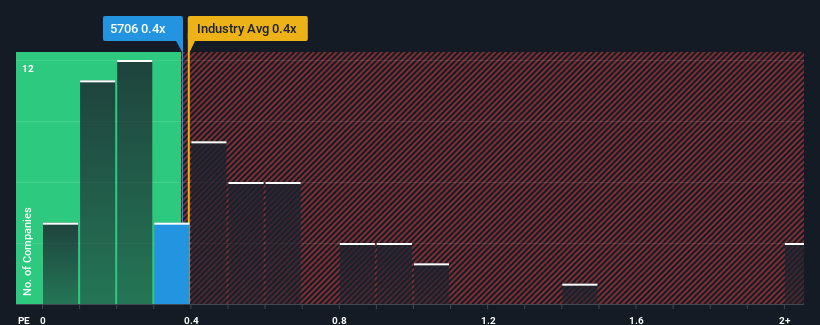

It's not a stretch to say that Mitsui Mining & Smelting Co., Ltd.'s (TSE:5706) price-to-sales (or "P/S") ratio of 0.4x seems quite "middle-of-the-road" for Metals and Mining companies in Japan, seeing as it matches the P/S ratio of the wider industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Mitsui Mining & Smelting

How Mitsui Mining & Smelting Has Been Performing

Mitsui Mining & Smelting certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Mitsui Mining & Smelting.Is There Some Revenue Growth Forecasted For Mitsui Mining & Smelting?

The only time you'd be comfortable seeing a P/S like Mitsui Mining & Smelting's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 10%. The solid recent performance means it was also able to grow revenue by 11% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 1.9% per annum during the coming three years according to the nine analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 0.8% per year, which is not materially different.

With this in mind, it makes sense that Mitsui Mining & Smelting's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What Does Mitsui Mining & Smelting's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've seen that Mitsui Mining & Smelting maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Mitsui Mining & Smelting (1 can't be ignored!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5706

Mitsui Kinzoku Company

Engages in the manufacture and sale of metal products in Japan and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives