- Japan

- /

- Metals and Mining

- /

- TSE:5706

Mitsui Mining & Smelting Co., Ltd. (TSE:5706) Stock Rockets 27% As Investors Are Less Pessimistic Than Expected

Mitsui Mining & Smelting Co., Ltd. (TSE:5706) shares have continued their recent momentum with a 27% gain in the last month alone. The annual gain comes to 141% following the latest surge, making investors sit up and take notice.

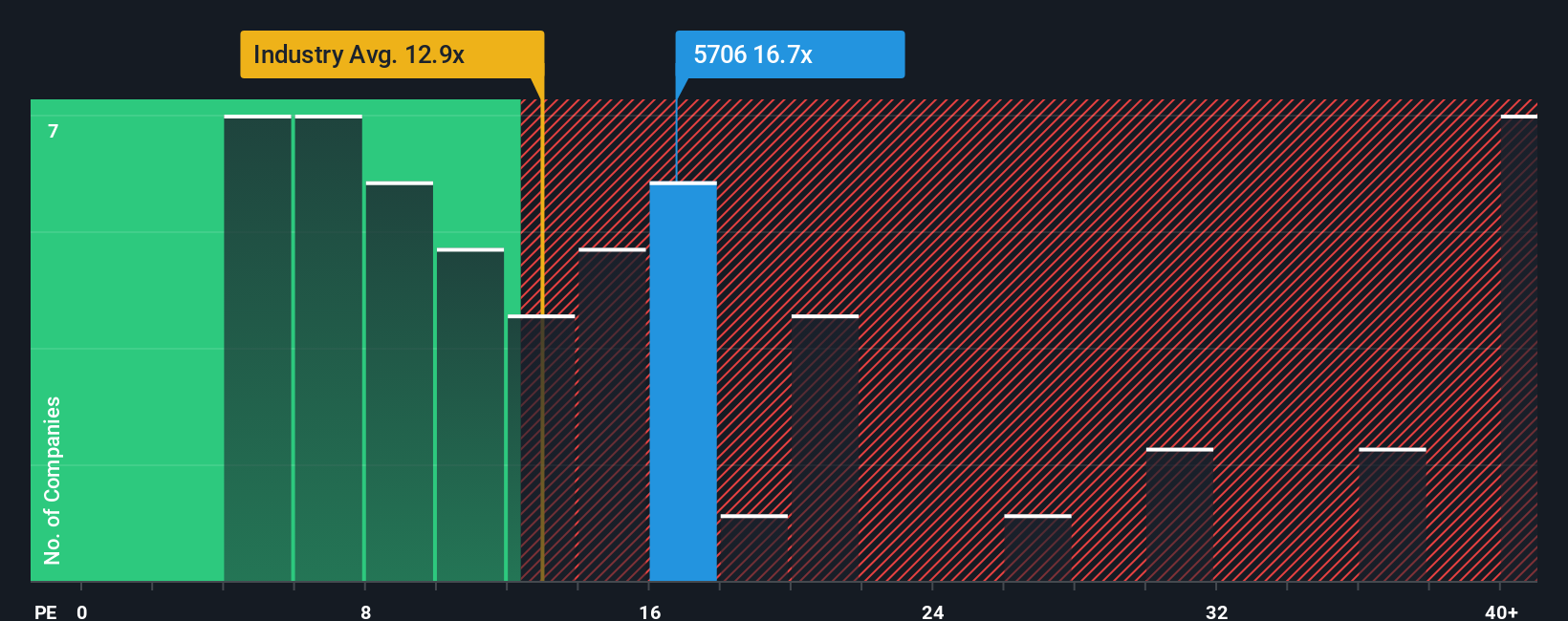

Since its price has surged higher, Mitsui Mining & Smelting may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 16.7x, since almost half of all companies in Japan have P/E ratios under 14x and even P/E's lower than 10x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Mitsui Mining & Smelting could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Mitsui Mining & Smelting

How Is Mitsui Mining & Smelting's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as Mitsui Mining & Smelting's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered a frustrating 20% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 34% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 7.9% each year as estimated by the nine analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 9.4% per annum, which is not materially different.

In light of this, it's curious that Mitsui Mining & Smelting's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Mitsui Mining & Smelting's P/E is getting right up there since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Mitsui Mining & Smelting's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 3 warning signs for Mitsui Mining & Smelting that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5706

Mitsui Kinzoku Company

Engages in the manufacture and sale of metal products in Japan and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives