- Japan

- /

- Metals and Mining

- /

- TSE:5706

Mitsui Kinzoku (TSE:5706): Exploring Valuation After a 30% Monthly Share Price Surge

Reviewed by Simply Wall St

Mitsui Kinzoku Company (TSE:5706) stock has kept investors curious, especially after the noticeable price movements over the past month. With shares up nearly 30%, many are closely watching for signals about what could come next.

See our latest analysis for Mitsui Kinzoku Company.

Mitsui Kinzoku’s striking 1-month share price return of 29.9% has injected real momentum, coming after an extraordinary 297% gain year-to-date and a 294% total return over the last twelve months. This rapid upswing suggests investors are recalibrating their expectations, possibly reflecting renewed optimism about the company’s growth outlook despite recent pullbacks.

If this surge has sparked your appetite for fresh opportunities, now could be the perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

With such explosive gains, investors are left wondering if Mitsui Kinzoku’s current share price still underestimates its future. Alternatively, has the recent rally already factored in all its growth potential, leaving little room to buy in now?

Price-to-Earnings of 22.4x: Is it justified?

Based on the prevailing price-to-earnings multiple, Mitsui Kinzoku Company stock trades at 22.4 times its earnings, signaling a premium valuation compared to industry norms and its last close price of ¥18,290. This high multiple positions the stock as relatively expensive in its sector.

The price-to-earnings (P/E) ratio reflects how much investors are willing to pay for a company’s earnings power. For Mitsui Kinzoku, this P/E can indicate either confidence in future profitability or perhaps an overheated outlook, especially notable within the cyclical materials and mining sector.

Compared to the Japanese metals and mining industry average of 12.1x, Mitsui Kinzoku’s 22.4x P/E stands out as substantially higher. Even when measured against the estimated fair P/E of 17.2x, the stock’s current valuation remains well above what regression analysis might justify. This could suggest that the shares may face pressure to move toward this level.

Explore the SWS fair ratio for Mitsui Kinzoku Company

Result: Price-to-Earnings of 22.4x (OVERVALUED)

However, slowing annual revenue growth and a share price that is now trading above analyst targets could signal potential headwinds for sustained momentum.

Find out about the key risks to this Mitsui Kinzoku Company narrative.

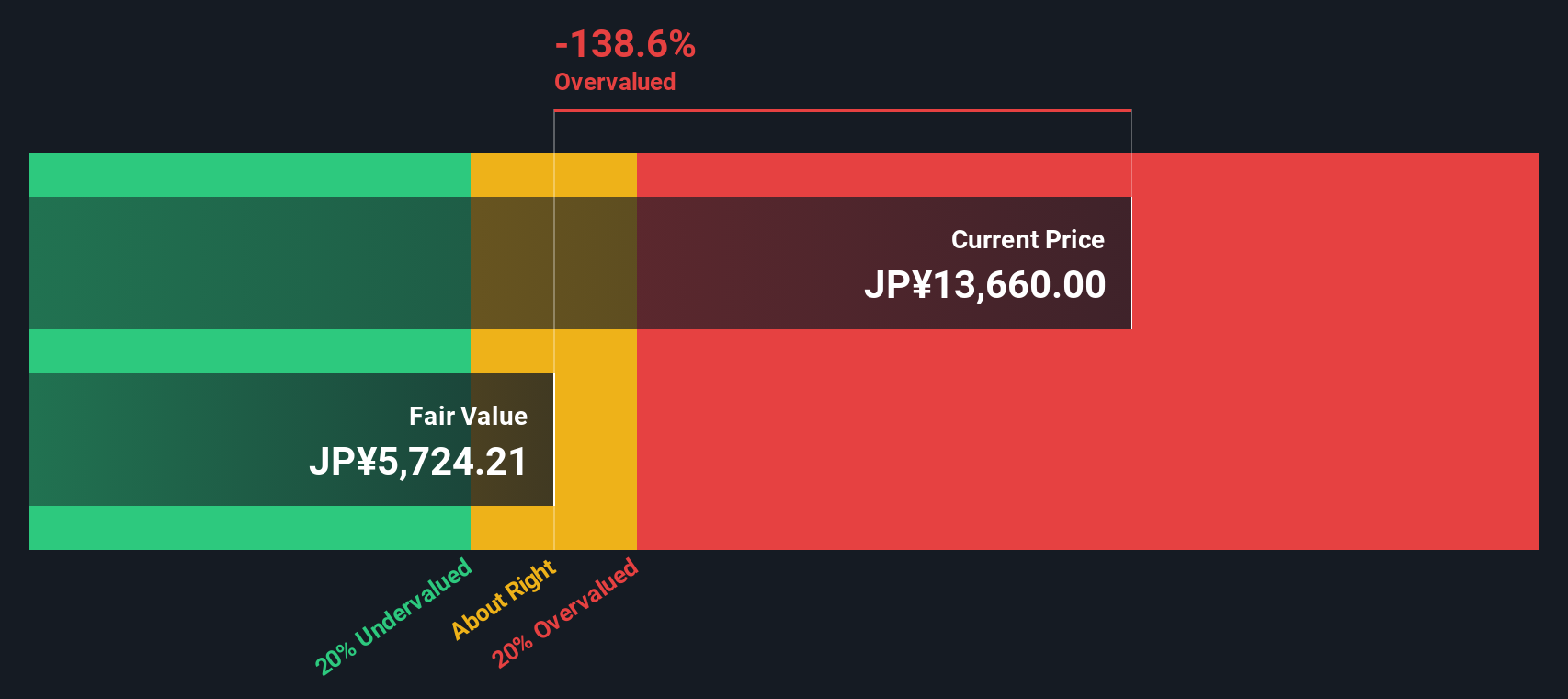

Another View: Discounted Cash Flow Sheds Light

Looking at our DCF model, Mitsui Kinzoku's stock appears even more expensive, trading at ¥18,290 compared to an estimated fair value of just ¥5,899. This suggests the market is pricing in expectations well above what the company's projected cash flows support. Does this highlight risk for new buyers, or is there a disconnect with growth potential that fundamentals have not captured?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mitsui Kinzoku Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 922 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mitsui Kinzoku Company Narrative

If this perspective does not align with your own, or you are inclined to investigate the fundamentals yourself, you can craft a personalized analysis in just a few minutes with Do it your way

A great starting point for your Mitsui Kinzoku Company research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why settle for just one opportunity? Open the door to fresh possibilities by using the Simply Wall Street Screener and stay ahead in your investing journey.

- Capture rising income streams by checking out these 15 dividend stocks with yields > 3%, offering yields above 3% and putting stable returns within easy reach.

- Tap into the future of artificial intelligence through these 26 AI penny stocks, featuring standout companies that are pushing the boundaries of smart technology.

- Uncover market gems trading below their estimated worth with these 922 undervalued stocks based on cash flows, and position yourself for potential upside before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5706

Mitsui Kinzoku Company

Engages in the manufacture and sale of metal products in Japan and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives