- Japan

- /

- Metals and Mining

- /

- TSE:5706

Does Mitsui Kinzoku’s Higher Dividend Guidance Signal Lasting Growth for TSE:5706 Investors?

Reviewed by Sasha Jovanovic

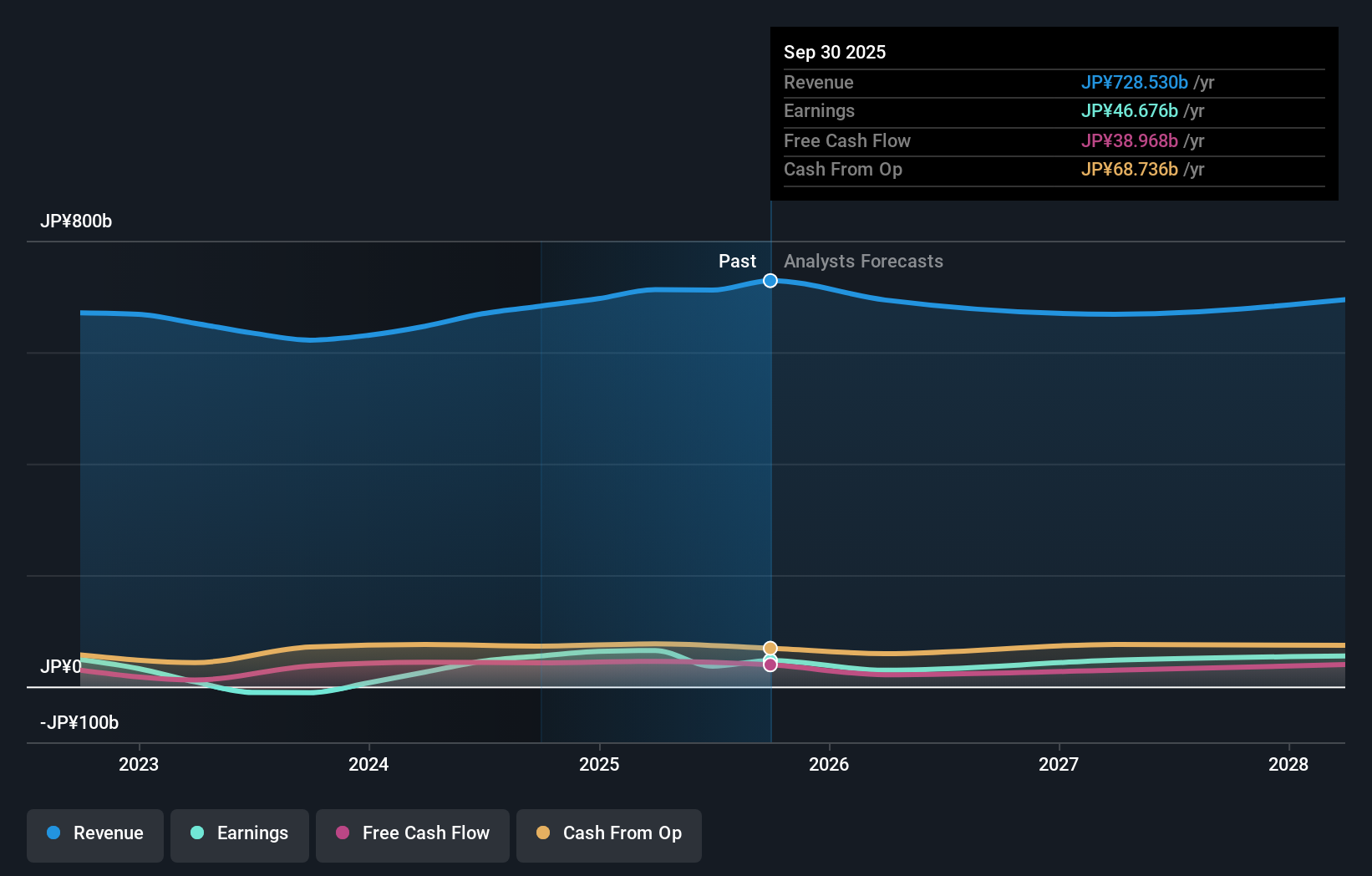

- On November 11, 2025, Mitsui Kinzoku Company announced increases to both its interim and full-year dividend guidance for the fiscal year ending March 31, 2026, alongside a significant upward revision in earnings forecasts due to strengthened demand and improved market conditions.

- The company is adopting a progressive dividend policy targeting a dividend on equity of about 3.5%, reflecting its reinforced confidence in sustained profitability and growth within engineered materials and metals segments.

- We'll explore how Mitsui Kinzoku's new progressive dividend policy and higher forecasts could influence the company's investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Mitsui Kinzoku Company's Investment Narrative?

To be a shareholder in Mitsui Kinzoku right now, you’d need to have confidence that the company’s recent upward revisions for both dividends and earnings represent a real, sustainable shift in its operating outlook. The new dividend policy at a 3.5% DOE target and the boosted annual dividend guidance combine with increased earnings forecasts, sending a clear message that management believes recent market tailwinds, such as solid demand for engineered materials in AI-related applications and metals price strength, could persist. These announcements directly change the near-term catalysts for the stock; whereas prior catalysts had been focused on recovering after a period of weaker results and large one-off expenses, the improved earnings guidance and raised dividends now put ongoing demand strength and continued favorable pricing at the forefront. However, with a high share price volatility, a relatively expensive PE versus peers, recent board turnover, and single-period profit spikes helped by exogenous factors like a weaker yen, there are still significant business risks. How long these positive market forces can last remains a core question for anyone considering the stock now.

But with strong headlines, don't miss the concern about sustainability amid volatile markets.

Exploring Other Perspectives

Explore another fair value estimate on Mitsui Kinzoku Company - why the stock might be worth as much as ¥16325!

Build Your Own Mitsui Kinzoku Company Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsui Kinzoku Company research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Mitsui Kinzoku Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsui Kinzoku Company's overall financial health at a glance.

No Opportunity In Mitsui Kinzoku Company?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5706

Mitsui Kinzoku Company

Engages in the manufacture and sale of metal products in Japan and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives