- Japan

- /

- Metals and Mining

- /

- TSE:5482

Aichi Steel (TSE:5482) Earnings Soar 134%, Strengthening Bullish Growth Narratives Ahead of Valuation Debate

Reviewed by Simply Wall St

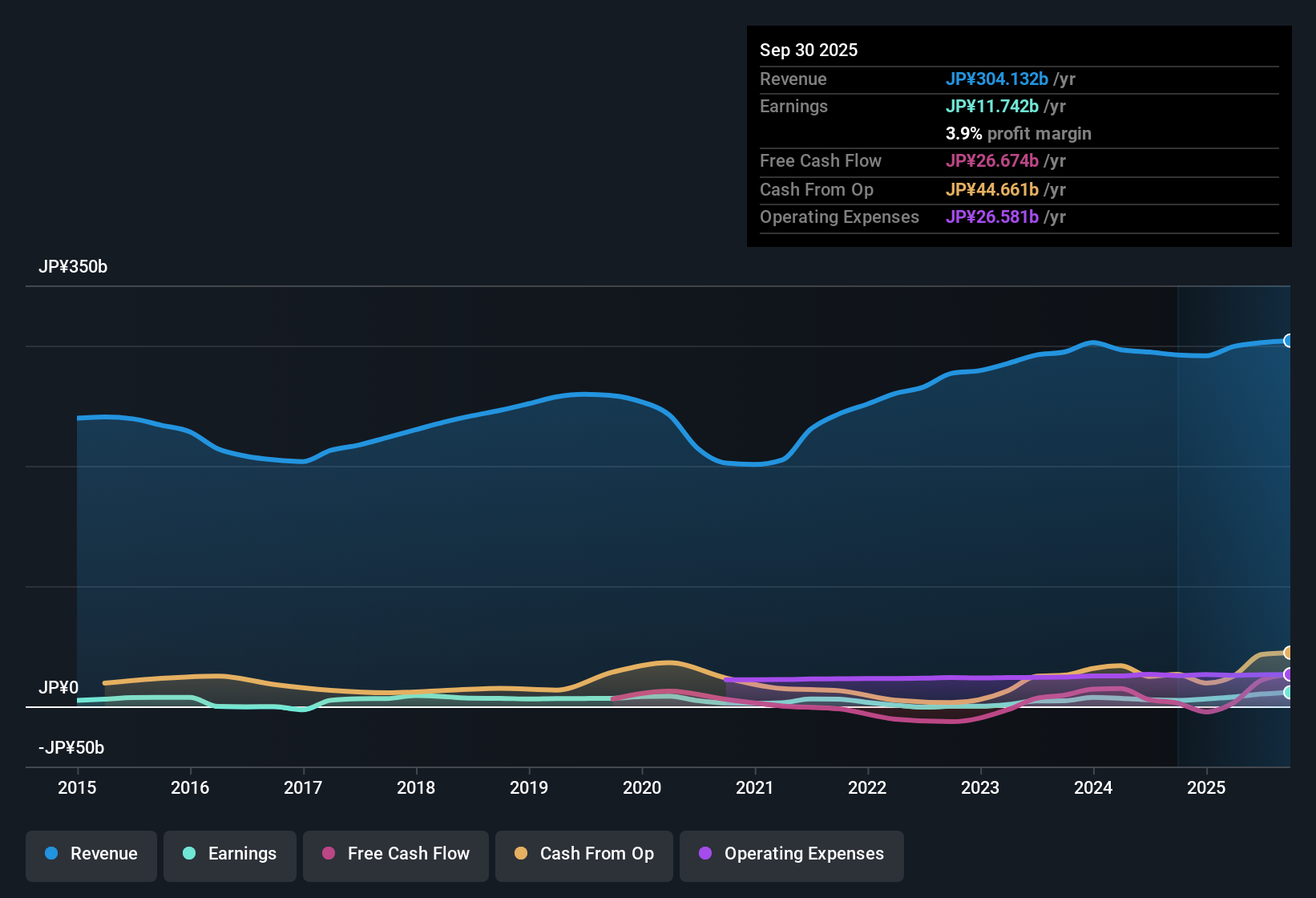

Aichi Steel (TSE:5482) delivered a remarkable earnings performance, with net profit jumping 133.8% year-over-year and five-year annualized earnings growth averaging 29.3%. The company’s net profit margin climbed to 3.9%, up from 1.7% last year. This signals a strong improvement in profitability that is likely to draw investor interest this earnings season. With earnings momentum and healthier margins, there is renewed attention on how these metrics fit into the broader investment picture.

See our full analysis for Aichi Steel.Next, we will see how these headline results compare with the leading market narratives and whether the numbers confirm or challenge the most widely held views.

Curious how numbers become stories that shape markets? Explore Community Narratives

DCF Fair Value Gap Highlights Potential Upside

- Aichi Steel's share price sits at ¥2,658, far below its DCF fair value estimate of ¥22,066.99. This signals the market is currently assigning a deep discount to the company.

- There is a sharp contrast between this discount and the company’s relatively high price-to-earnings ratio of 14.5x, which is higher than the JP Metals and Mining industry average of 12.9x and its peer group at 10.2x.

- This gap supports the view that while traditional valuation metrics like P/E might flag caution, the discounted cash flow perspective suggests the stock could be underappreciated based on long-term fundamentals.

- Notably, this undervaluation on a cash flow basis stands out despite the sector’s current challenges, including input costs and competitive pressures. This could indicate that investors are not fully considering the company’s improved profitability and margin momentum.

- Strong earnings growth also reinforces the notion that the company’s valuation disconnect is not supported by its operational improvement, presenting a possible value opportunity for investors willing to look beyond headline P/E multiples.

Profit Margin at 3.9%: More Than a Blip?

- This year’s rise in net profit margin from 1.7% to 3.9% is a substantial improvement, especially when compared to the broader sector’s margin pressures.

- The prevailing analysis notes that companies with higher specialty steel exposure and strong manufacturing partnerships are better positioned to weather sector volatility.

- Aichi Steel’s margin gain signals successful adaptation as the company leverages specialty products and long-term contracts in the face of industry headwinds.

- At the same time, the ability to expand margins in a challenging industry environment highlights management’s focus on operational resilience and cost control, two important factors that underpin the company’s positive trajectory.

P/E Ratio Flags Near-Term Caution

- The price-to-earnings multiple of 14.5x is not only above the 12.9x sector average but also above peers at 10.2x. This puts Aichi Steel at a premium by this measure, even though the stock is deeply discounted on cash flow analysis.

- Some investors may question whether the current P/E is justified given the sector’s ongoing supply chain and input challenges.

- This premium could reflect market optimism about the company’s structural improvements and margin momentum, but it leaves little room for disappointment if operational momentum slows or industry headwinds intensify.

- The current premium also raises the bar for future performance, so continued earnings delivery and visible progress on cost control are essential to justify or expand on this valuation multiple.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Aichi Steel's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite improving profit margins, Aichi Steel’s premium price-to-earnings ratio raises concerns about whether future growth will justify its higher valuation.

If paying up for uncertain earnings is not your preference, discover better value in companies trading below intrinsic worth by starting with these 831 undervalued stocks based on cash flows today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5482

Aichi Steel

Manufactures and sells steel materials, forged products, electronic functional materials and components, and magnetic products in Japan, the United States, Thailand, China, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives