- Japan

- /

- Metals and Mining

- /

- TSE:5471

Daido Steel (TSE:5471) Margin Dip Reinforces Narrative of Slower-Than-Market Growth Outlook

Reviewed by Simply Wall St

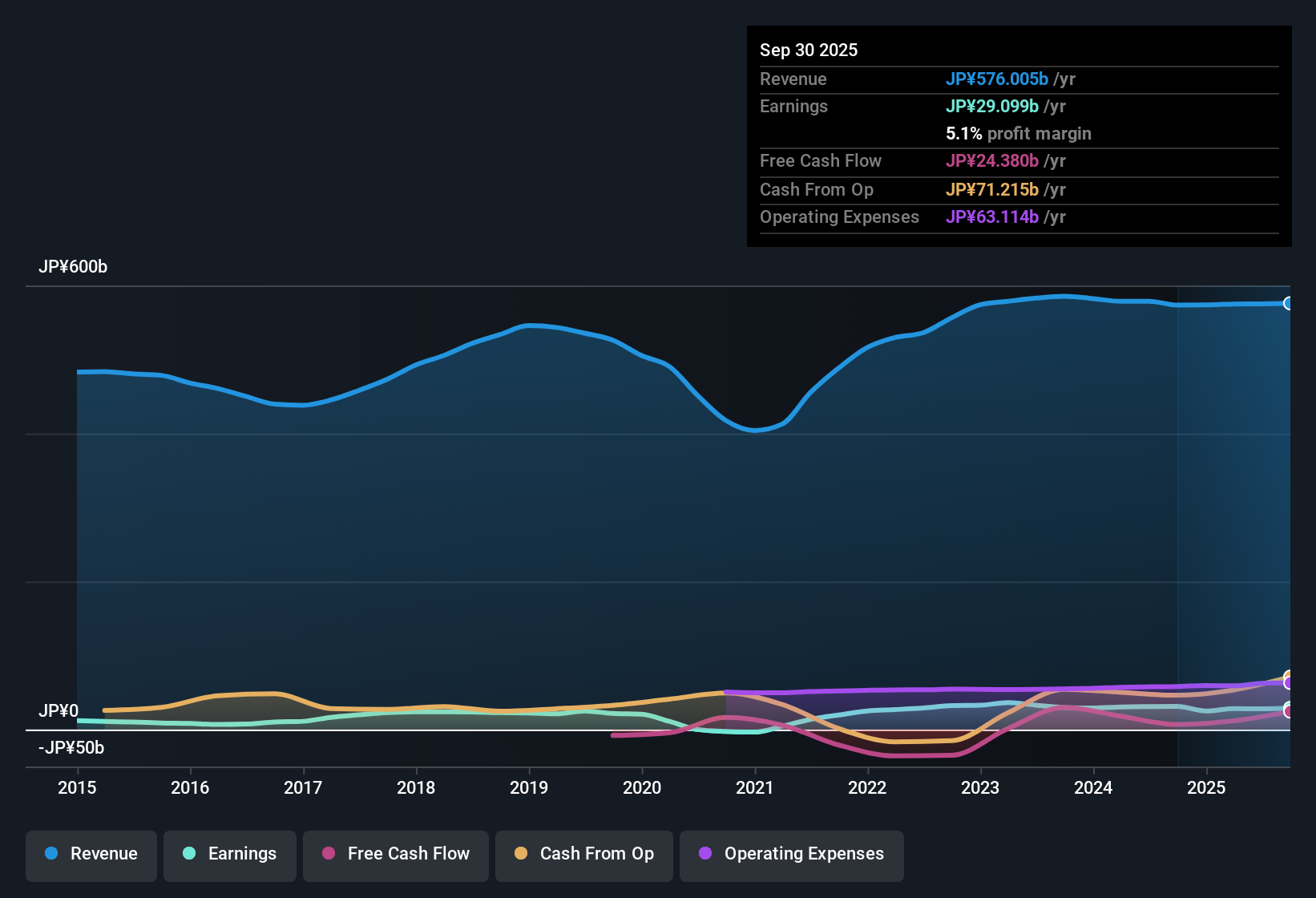

Daido Steel (TSE:5471) has posted a solid earnings story, with annual profit growth averaging 20.4% over the past five years and a return to profitability. However, the most recent year saw earnings decline alongside a dip in net profit margin to 5.1% from last year's 5.4%. Looking ahead, earnings are forecast to grow by 4.45% per year, lagging behind the Japanese market average of 7.9%, and revenue growth is also set to trail the industry at 2.6% versus 4.5%. On valuation, shares change hands at a P/E of 10x, which is more attractive than both the industry and peer averages. However, the stock currently trades above internal fair value estimates. Investors are watching a mix of supportive valuation metrics and more modest profit growth, plus the flagged risk around dividend sustainability, as they gauge the company’s next steps.

See our full analysis for Daido Steel.Let’s dig into how these earnings results compare to the broader market narratives. We will see which stories hold up or get challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Hold, but Trails Last Year

- Daido Steel’s net profit margin stands at 5.1%, just under last year’s 5.4%, and reflects a period in which profitability stayed positive after the company's return to the black over five years of 20.4% annual earnings growth.

- While the company’s margin has held steady, the prevailing market view is that this resilience is more a sign of Daido Steel’s niche stability than of new upside. This is particularly relevant as the broader steel sector deals with cost pressures and slow recovery.

- Narrowing margins support the notion that investors are not expecting a surge in profits without more sector momentum, even as core operations remain reliable for now.

- The lack of major negative news supports sentiment but does not excite bulls, who are watching for either rising orders or new specialty contracts to shift the narrative.

Growth Forecast Lags Market Average

- Looking forward, Daido Steel is forecast to grow earnings by 4.45% per year, noticeably below the broader Japanese market's expected average of 7.9% and also behind the steel industry’s projected revenue growth of 4.5% compared to Daido’s 2.6%.

- Prevailing market view suggests Daido Steel’s growth outlook limits near-term excitement, but its defensive, value-oriented positioning attracts investors seeking stability over rapid expansion.

- This subdued forecast supports claims that while Daido Steel is favored for its quality and specialty exposure, new growth drivers are needed to change sentiment beyond viewing the stock as a “steady industrial.”

- Sector trends around manufacturing and infrastructure could offer upside. Until these catalysts emerge, investors are taking a wait-and-see approach.

Valuation Trades at a Discount to Peers

- Daido Steel is priced at a 10x Price-to-Earnings ratio, lower than the steel industry’s 13x and peer average of 11.8x. However, its share price of 1461.5 remains above the DCF fair value of 1156.72.

- Despite trading at a relative bargain compared to other specialty steelmakers, current pricing signals that investors are weighing potential for sector recovery against the company’s more modest earnings trajectory.

- This valuation gap highlights the balance between strong historical profitability and the risks surrounding dividend sustainability and slower projected growth, as noted in the filing summary.

- The market’s neutral sentiment is reinforced by reasonable valuation multiples, with any shift likely to follow visible improvements in sector momentum or company profitability.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Daido Steel's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Daido Steel’s outlook is limited by slower forecast growth and concerns around earnings momentum. These factors keep it trailing both market and industry averages.

If you want to target companies poised for stronger, more reliable expansion, consider stable growth stocks screener (2094 results) to spot those that consistently deliver healthy earnings growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5471

Daido Steel

Engages in the manufacture and sale of steel products in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives