- Japan

- /

- Metals and Mining

- /

- TSE:5471

Daido Steel (TSE:5471): Exploring Valuation After Recent Unexplained Share Price Movement

Reviewed by Simply Wall St

If you have been following Daido Steel (TSE:5471), there is a good chance this recent price movement has caught your attention. Nothing specific sparked the shift this time, but even in the absence of headline-grabbing news, moments like these can leave investors wondering whether the shares are quietly signaling something. When a stock moves without clear reason, it tends to raise questions about underlying value or changing market sentiment.

Over the past year, Daido Steel’s performance has been a mixed bag, with shares posting a modest decline overall, despite impressive long-term gains. The company’s return over the past month and three months has been positive, pointing to renewed momentum even after a quiet period. Looking back further, Daido Steel has sharply outperformed over three and five years, underlining some real staying power amid the ups and downs.

This brings us to the key question: after recent gains, is the market undervaluing Daido Steel, or is it simply catching up to future growth expectations already in the price?

Price-to-Earnings of 9.3x: Is it justified?

Daido Steel is trading at a price-to-earnings (P/E) ratio of 9.3x, which is below both the peer average (13.4x), the Japanese market average (14.7x), and the industry average (12.9x). On this basis, the company appears to be undervalued compared to its sector and major benchmarks.

The price-to-earnings ratio is a popular valuation metric that compares a company’s current share price to its per-share earnings. For industrial and materials companies like Daido Steel, the P/E ratio provides insight into how much investors are willing to pay for each unit of profit. It also accounts for cyclicality and growth prospects in the sector.

This lower valuation multiple suggests that the market might be underpricing Daido Steel’s earnings power, possibly due to concerns about slower future growth, recent profit trends, or industry headwinds. However, given that the company’s P/E is well below its peers while maintaining profitability, it raises the possibility of value opportunities for long-term investors if the business can sustain or improve its earnings base.

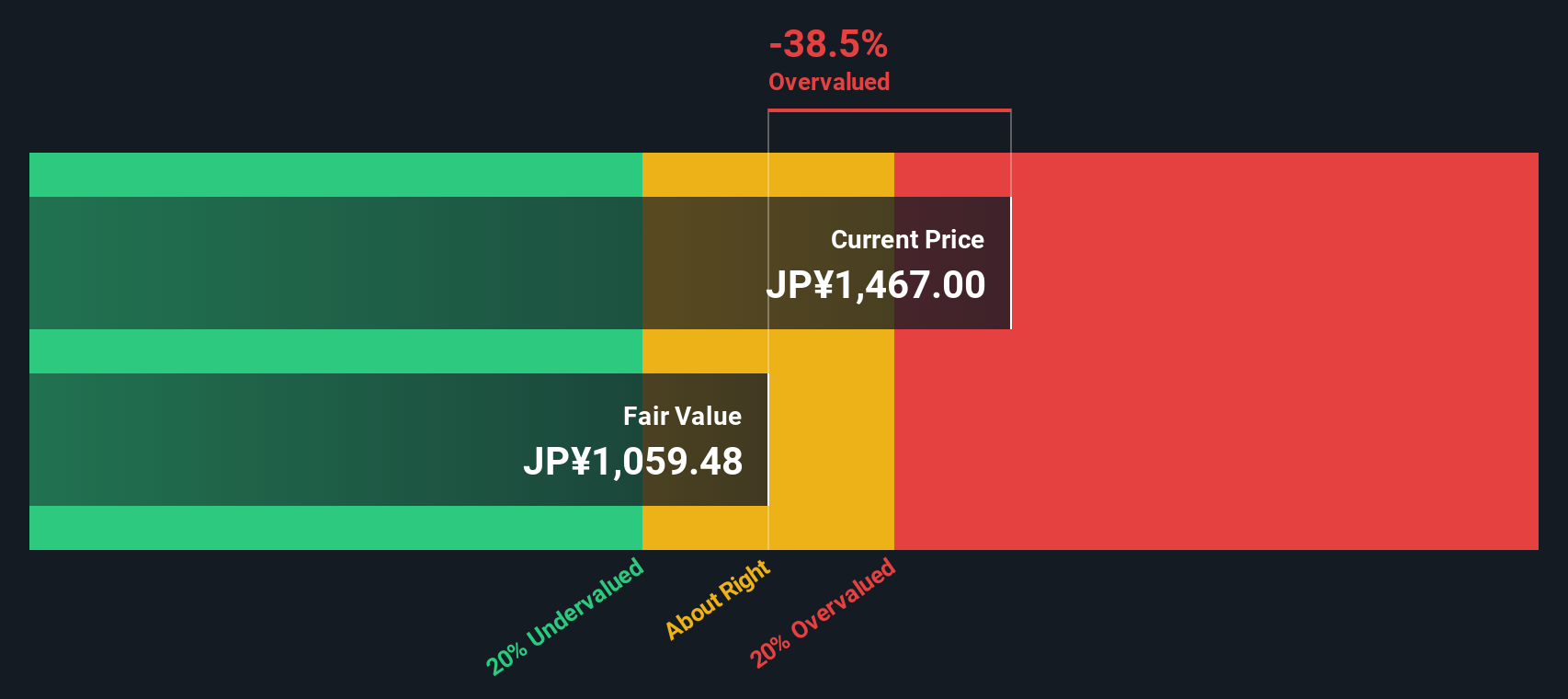

Result: Fair Value of ¥1,155.26 (OVERVALUED)

See our latest analysis for Daido Steel.However, risks remain, including profit volatility and market sentiment shifts. Either of these factors could prompt a reassessment of Daido Steel’s valuation outlook.

Find out about the key risks to this Daido Steel narrative.Another View: DCF Model Offers a Different Perspective

While the market’s current multiple suggests Daido Steel might be undervalued, our DCF model takes a more cautious approach and points to the shares being overvalued. Which approach better captures the true outlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Daido Steel Narrative

If you see things differently or want to dig deeper into the numbers, you can easily put together your own perspective in just a few minutes with our tools, such as Do it your way.

A great starting point for your Daido Steel research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

There is a whole universe of compelling stocks out there, and using the Simply Wall Street Screener opens the door to opportunities you might otherwise miss. Give yourself an edge and find your next successful investment today.

- Catch the next tech surge by uncovering companies shaping artificial intelligence breakthroughs with AI penny stocks woven into emerging markets and future demand.

- Secure steady income streams by focusing on firms offering robust payouts and higher yields through dividend stocks with yields > 3%, which can strengthen your portfolio’s foundation.

- Spot undervalued gems rapidly by seeking out businesses trading below their intrinsic worth via undervalued stocks based on cash flows, and position yourself ahead of the curve.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5471

Daido Steel

Engages in the manufacture and sale of steel products in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives