- Japan

- /

- Metals and Mining

- /

- TSE:5463

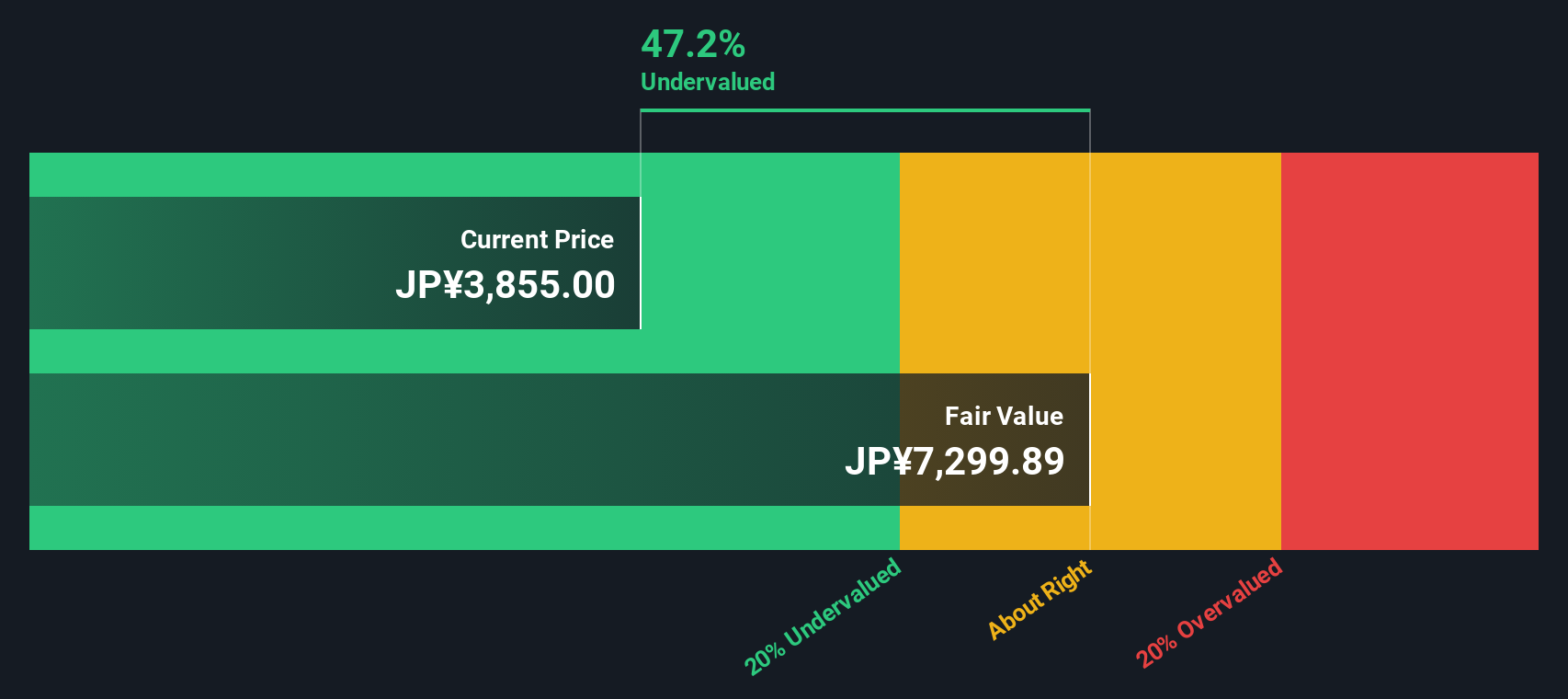

A Look at Maruichi Steel Tube (TSE:5463) Valuation Following Upgraded Earnings Guidance and Dividend Increase

Reviewed by Simply Wall St

Maruichi Steel Tube (TSE:5463) updated its outlook for the year ending March 2026, raising both earnings guidance and the interim dividend. Investors are taking note because these moves highlight improved profitability and higher shareholder returns.

See our latest analysis for Maruichi Steel Tube.

With Maruichi Steel Tube recently bumping up its earnings guidance and interim dividend, momentum has been building, and the share price reflects that. It is up 15.4% year-to-date, and the one-year total shareholder return sits at an impressive 24.5%. Short-term gains are adding to steady long-term growth, so it is no surprise investors are watching closely.

If the renewed optimism around Maruichi Steel Tube has you considering what else the market offers, it is a great time to broaden your perspective and discover fast growing stocks with high insider ownership

But with such strong performance and upbeat guidance already reflected in the recent share price rally, the real question now is whether Maruichi Steel Tube is undervalued or if the market has already priced in this growth. This could leave little upside for new investors.

Price-to-Earnings of 9.8x: Is it justified?

Maruichi Steel Tube trades at a price-to-earnings (P/E) ratio of 9.8x, which is noticeably lower than both the market and its industrial peers. With a closing price of ¥1330, this multiple positions the stock as relatively undervalued compared to its sector.

The P/E ratio measures how much investors are paying for each yen of company earnings and is particularly relevant for mature, earnings-generating companies like Maruichi Steel Tube. In capital-intensive industries, this ratio helps investors gauge whether the market is undervaluing future profitability.

Despite recent upgrades and strong historical growth, Maruichi Steel Tube's P/E is not only lower than the Japanese market average of 13.7x; it is also well below the Metals and Mining industry average of 12.2x and the peer average of 16.1x. More telling, the fair price-to-earnings ratio is estimated at 12.3x. This suggests the market could re-rate the stock upward if current trends continue.

Explore the SWS fair ratio for Maruichi Steel Tube

Result: Price-to-Earnings of 9.8x (UNDERVALUED)

However, declining annual net income and limited upside to analyst price targets suggest investors should stay alert for potential changes in the growth outlook.

Find out about the key risks to this Maruichi Steel Tube narrative.

Another View: DCF Model Signals Caution

Looking from another angle, the SWS DCF model estimates Maruichi Steel Tube’s fair value at ¥1,261.71, which is about 5% below the current share price. This suggests the stock might be slightly overvalued by this method, raising the question: are expectations running ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Maruichi Steel Tube for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 897 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Maruichi Steel Tube Narrative

If you would rather dive into the numbers yourself or believe a different story could emerge, you can build a fresh perspective in just a few minutes. Do it your way

A great starting point for your Maruichi Steel Tube research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Step up your investing game with creative stock picks that give you a real edge. Act now so you do not miss the next big opportunity.

- Unlock growth by targeting these 3579 penny stocks with strong financials, which are poised for strong financial performance and untapped potential in overlooked market corners.

- Capitalize on yield with these 15 dividend stocks with yields > 3%, offering consistent income and attractive dividend returns that can strengthen your portfolio for the long term.

- Ride the innovation wave by selecting these 30 healthcare AI stocks, driving transformation in medicine with artificial intelligence breakthroughs and technologies changing the industry.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5463

Maruichi Steel Tube

Manufactures and sells steel tubes, surface treated steel sheets, and poles in Japan, North America, and Asia.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives