- Japan

- /

- Metals and Mining

- /

- TSE:5410

Godo Steel (TSE:5410) Earnings Growth Turns Negative, Challenging Bullish Valuation Narrative

Reviewed by Simply Wall St

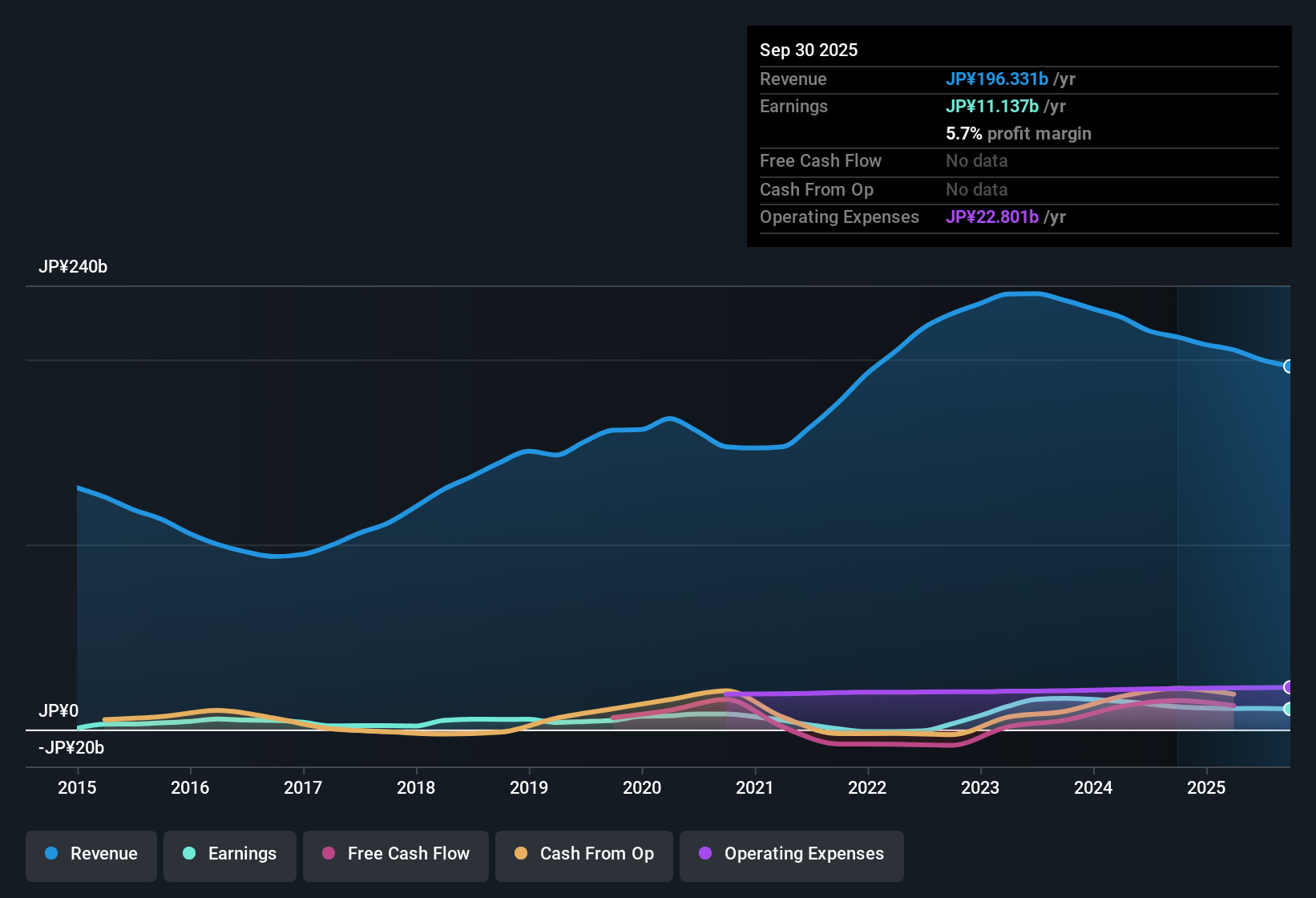

Godo Steel (TSE:5410) posted a net profit margin of 5.7%, slipping just below last year’s 5.8% level. While the company has averaged 28.4% earnings growth per year over the past five years, this latest period brought a reversal, with annual earnings growth turning negative. Despite this, the shares trade on a price-to-earnings ratio of just 4.8x, which is well under both the industry average of 12.9x and the peer average of 8.5x. The current price of ¥3,660 also stands far below an estimated fair value of ¥12,889.62. All told, the stock combines high quality earnings with a discounted valuation, although some concern lingers around the sustainability of its dividend.

See our full analysis for Godo Steel.The next section puts these headline results side by side with Simply Wall St’s narrative breakdown, exploring where the market’s favorite stories are confirmed and where the numbers raise new questions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Stay Resilient Above 5%

- Net profit margin reached 5.7% for the year, only marginally lower than last year's 5.8%. This signals the company's ability to maintain profitability in a tough steel sector environment.

- With Godo Steel maintaining this margin, prevailing market analysis highlights how steady operational performance and cost discipline preserve investor confidence, even as sector peers struggle with overcapacity and demand shifts.

- Despite margin pressure throughout the Japanese steel industry, Godo Steel's marginal dip points to relative success compared to competitors wrestling with steeper declines.

- Market sentiment supports the idea that such stability can attract long-term investors looking for reliability rather than quick growth.

Growth Streak Halts After 5 Years

- Earnings averaged a rapid 28.4% annual increase across the past five years, but the most recent period saw a reversal with negative earnings growth, marking a clear shift from the company's established upward trend.

- What stands out is that while previous multi-year momentum built a reputation for resilience, the sudden break in this pattern is prompting investors to weigh Godo Steel's adaptability as the steel market faces global headwinds.

- The narrative emerging from market observers is that historical outperformance may not guarantee continued gains if export demand or sector pricing remains challenged.

- This break in earnings growth is a signal for investors to focus on operational flexibility and cost control as future catalysts rather than assume the past will repeat.

Valuation Still Deeply Discounted

- The stock trades at a price-to-earnings ratio of just 4.8x and a current share price of ¥3,660. Both are significantly below the industry (12.9x) and peer averages (8.5x), as well as far under its DCF fair value of ¥12,889.62.

- This persistent discount heavily supports the thesis that Godo Steel is undervalued compared to fundamentals and sector peers, despite lingering doubts about dividend sustainability.

- Defensive positioning in the sector is reinforced by the company's high-quality earnings and discounted multiple, helping to offset some short-term growth risks for value-focused investors.

- Market watchers note that more cautious investors may continue to wait until there is visible improvement in dividend stability before re-rating the shares higher.

See our latest analysis for Godo Steel.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Godo Steel's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Godo Steel’s five-year growth streak coming to a halt and concerns about earnings sustainability highlight its vulnerability to ongoing industry challenges.

If reliable performance and consistent expansion matter to you, discover companies delivering steady progress through uncertainty by starting with stable growth stocks screener (2090 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5410

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives