- Japan

- /

- Metals and Mining

- /

- TSE:5406

How Higher Profits on Lower Sales at Kobe Steel (TSE:5406) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

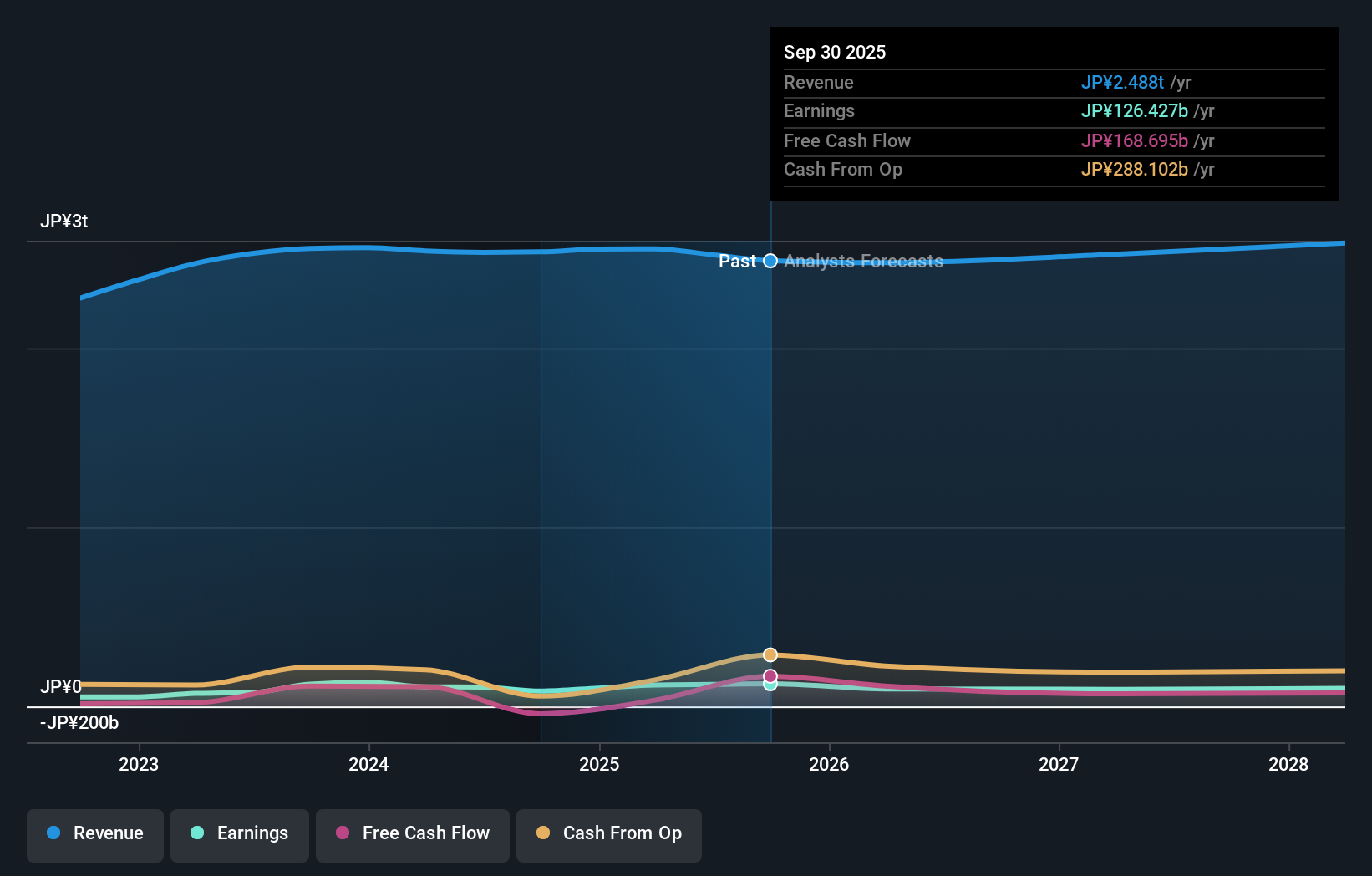

- Kobe Steel announced its half-year earnings results for the period ended September 30, 2025, revealing sales of ¥1.18 trillion and net income of ¥62.83 billion, compared to ¥1.25 trillion and ¥56.58 billion respectively in the previous year.

- Despite a decline in sales, the company’s ability to grow net income and basic earnings per share highlights increased operational efficiency and profitability.

- We’ll explore how Kobe Steel’s improved profitability, even with lower sales, influences its current investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Kobe Steel's Investment Narrative?

To own Kobe Steel shares today, you need to believe in the company's ability to boost profitability even when top-line growth is pressured. The latest half-year results, which showed rising net income and improved margins despite lower sales, reinforce hopes for stronger operational discipline and cost control, at least in the near term. While short-term catalysts like undervaluation and recent buybacks may continue to support sentiment, the news of shrinking sales could temper enthusiasm about sustained momentum going forward. This could also shift the risk picture, as forecasts before this announcement saw gradual earnings declines and muted revenue growth ahead, so the company’s improved efficiency in this report may give some hope, but doesn't erase larger structural challenges. As a result, the risks from slower profit growth, high debt levels, and a less stable dividend remain front of mind. On the other hand, high debt and a weak dividend history could complicate the recovery story.

Kobe Steel's shares have been on the rise but are still potentially undervalued by 30%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Kobe Steel - why the stock might be worth as much as 43% more than the current price!

Build Your Own Kobe Steel Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kobe Steel research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kobe Steel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kobe Steel's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kobe Steel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5406

Kobe Steel

Engages in the materials, machinery, and electric power businesses worldwide.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives