- Japan

- /

- Metals and Mining

- /

- TSE:5401

Does Lowered U.S. Profit Outlook Shift the Bull Case for Nippon Steel (TSE:5401)?

Reviewed by Sasha Jovanovic

- Nippon Steel recently lowered its full-year earnings guidance for the period ending March 31, 2026, citing ongoing U.S. market uncertainties and expected reorganization losses from the transfer of its equity interest in Usiminas, while also reporting a net loss of ¥113.38 billion for the half year ended September 30, 2025.

- This shift in outlook highlights the company’s exposure to overseas market volatility and the financial impact of its international portfolio restructuring.

- We'll explore how the downward revision of U.S. profit expectations shifts Nippon Steel's investment narrative amid global market pressures.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Nippon Steel's Investment Narrative?

For anyone considering Nippon Steel, it’s clear the big-picture thesis rests on recovery in international steel demand, successful portfolio restructuring, and the outcome of expansion and M&A efforts, particularly in the U.S. The recent guidance cut, driven by ongoing U.S. market uncertainty and expected losses tied to the Usiminas equity transfer, has reset short-term catalysts and heightened risks, especially around overseas operations. With the company forecasting a full-year loss of ¥60 billion and a sharper dividend reduction, some near-term investor optimism has likely faded. These revised forecasts signal that market headwinds could weigh on outcomes more materially than earlier analysis suggested, making profitability targets and global strategy execution even more critical moving forward. For current and prospective shareholders, the balance between potential long-term benefits and the complexity of immediate hurdles has shifted, investing here requires belief in management’s ability to steer through near-term shocks and deliver on their international ambitions.

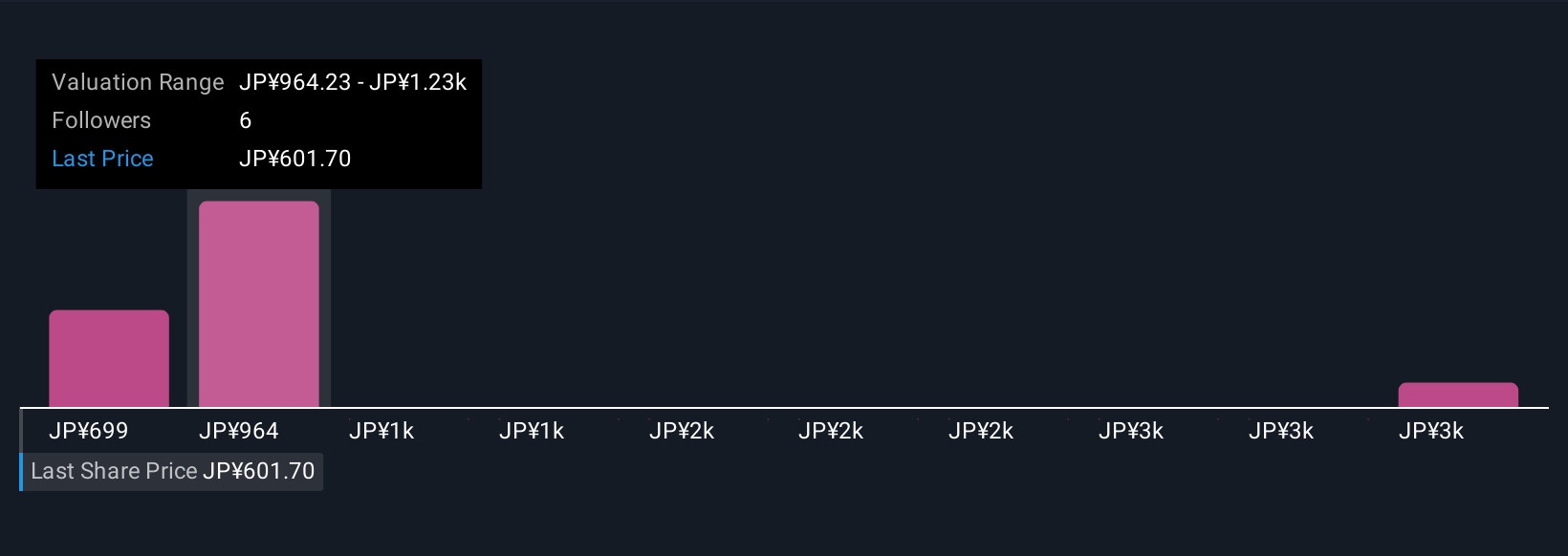

On the other hand, the elevated risk tied to U.S. market uncertainties can’t be ignored. Despite retreating, Nippon Steel's shares might still be trading 42% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on Nippon Steel - why the stock might be worth just ¥707!

Build Your Own Nippon Steel Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nippon Steel research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nippon Steel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nippon Steel's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Steel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5401

Nippon Steel

Engages in steelmaking and steel fabrication, engineering, chemicals and materials, and system solutions businesses in Japan and internationally.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives