- Japan

- /

- Basic Materials

- /

- TSE:5273

Undiscovered Gems In Global Highlight These 3 Promising Stocks

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by mixed performance in major indices and cautious economic sentiment, small-cap stocks have experienced heightened sensitivity to interest rate movements, notably underperforming with the Russell 2000 Index dropping 1.83% recently. In this environment, identifying promising stocks often involves looking for companies that can demonstrate resilience and potential growth amid broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Daphne International Holdings | NA | -5.92% | 82.03% | ★★★★★★ |

| VICOM | NA | 6.95% | 4.06% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Xiamen Jiarong TechnologyLtd | 8.54% | -5.04% | -25.38% | ★★★★★★ |

| Wison Engineering Services | 28.12% | -0.65% | 12.25% | ★★★★★★ |

| YH Entertainment Group | 4.44% | -11.47% | -43.36% | ★★★★★★ |

| Tai Sin Electric | 37.42% | 10.92% | 7.66% | ★★★★☆☆ |

| Pizu Group Holdings | 41.45% | -2.37% | -15.01% | ★★★★☆☆ |

| Fengyinhe Holdings | 9.39% | 53.36% | 74.10% | ★★★★☆☆ |

| Billion Industrial Holdings | 33.11% | 16.86% | -16.10% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Yurtec (TSE:1934)

Simply Wall St Value Rating: ★★★★★★

Overview: Yurtec Corporation operates as a facility engineering company in Japan and internationally, with a market cap of ¥177.21 billion.

Operations: Yurtec generates revenue primarily through facility engineering services both domestically and internationally. The company's operations are influenced by various cost components, including materials and labor. Analyzing its financial performance, the net profit margin reflects the efficiency of converting revenue into actual profit.

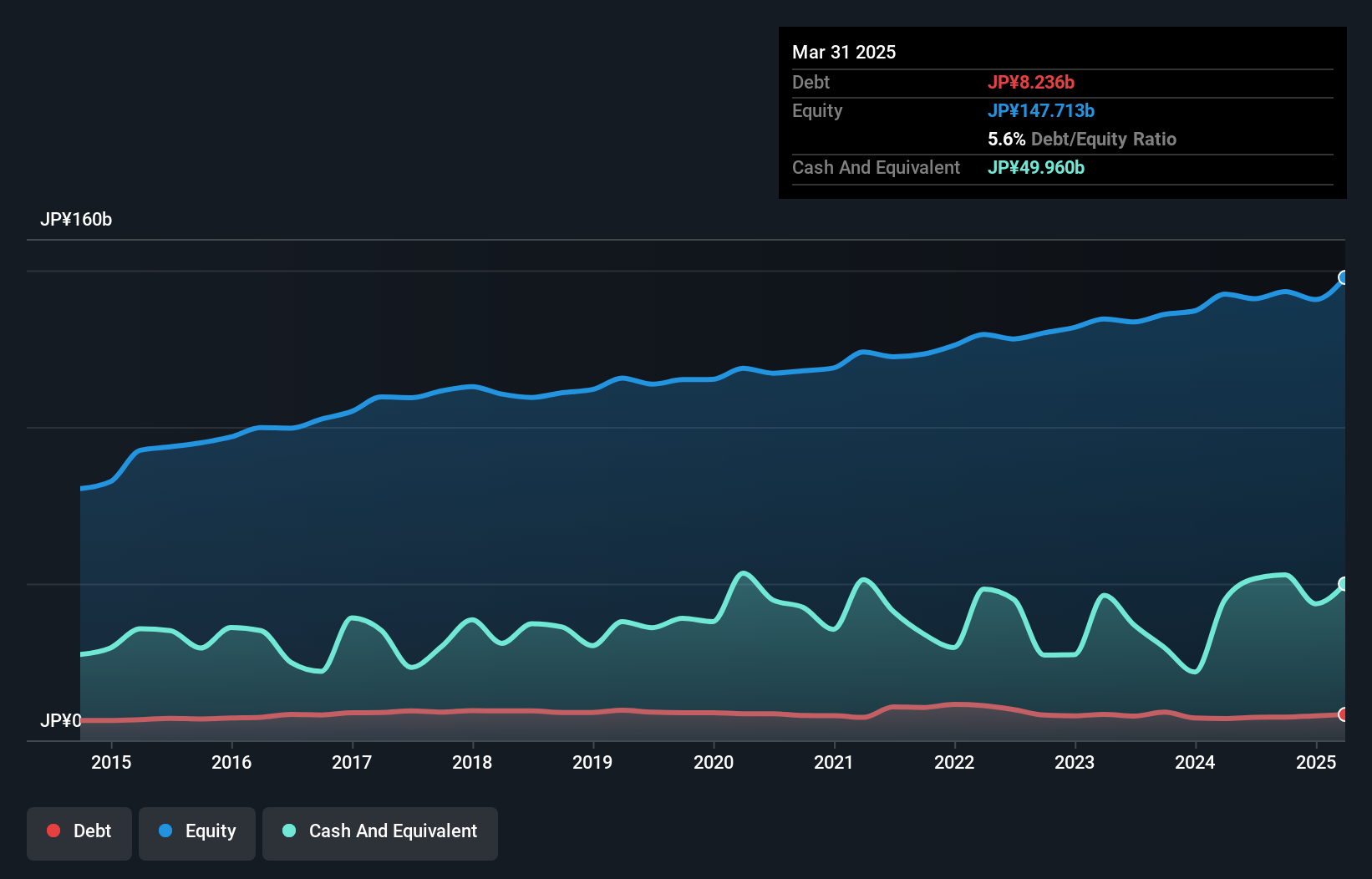

Yurtec, a smaller player in the construction industry, stands out with its robust financials. The company is trading at 38.5% below its estimated fair value, suggesting potential undervaluation. Over the past year, earnings surged by 41%, outpacing the industry's growth of 33%. Yurtec's debt-to-equity ratio improved from 6.7 to 5.6 over five years, reflecting better financial health and more cash than total debt. Recent developments include a dividend hike to JPY 36 per share from JPY 23 last year, indicating confidence in future prospects and shareholder value enhancement strategies amidst management revisions for cost-conscious operations.

- Click to explore a detailed breakdown of our findings in Yurtec's health report.

Gain insights into Yurtec's past trends and performance with our Past report.

Cybozu (TSE:4776)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cybozu, Inc. is a Japanese company specializing in the development, sale, and operation of groupware solutions with a market capitalization of ¥142.20 billion.

Operations: The primary revenue stream for Cybozu, Inc. comes from software development and sales, amounting to ¥35.62 billion. The company focuses on groupware solutions in Japan.

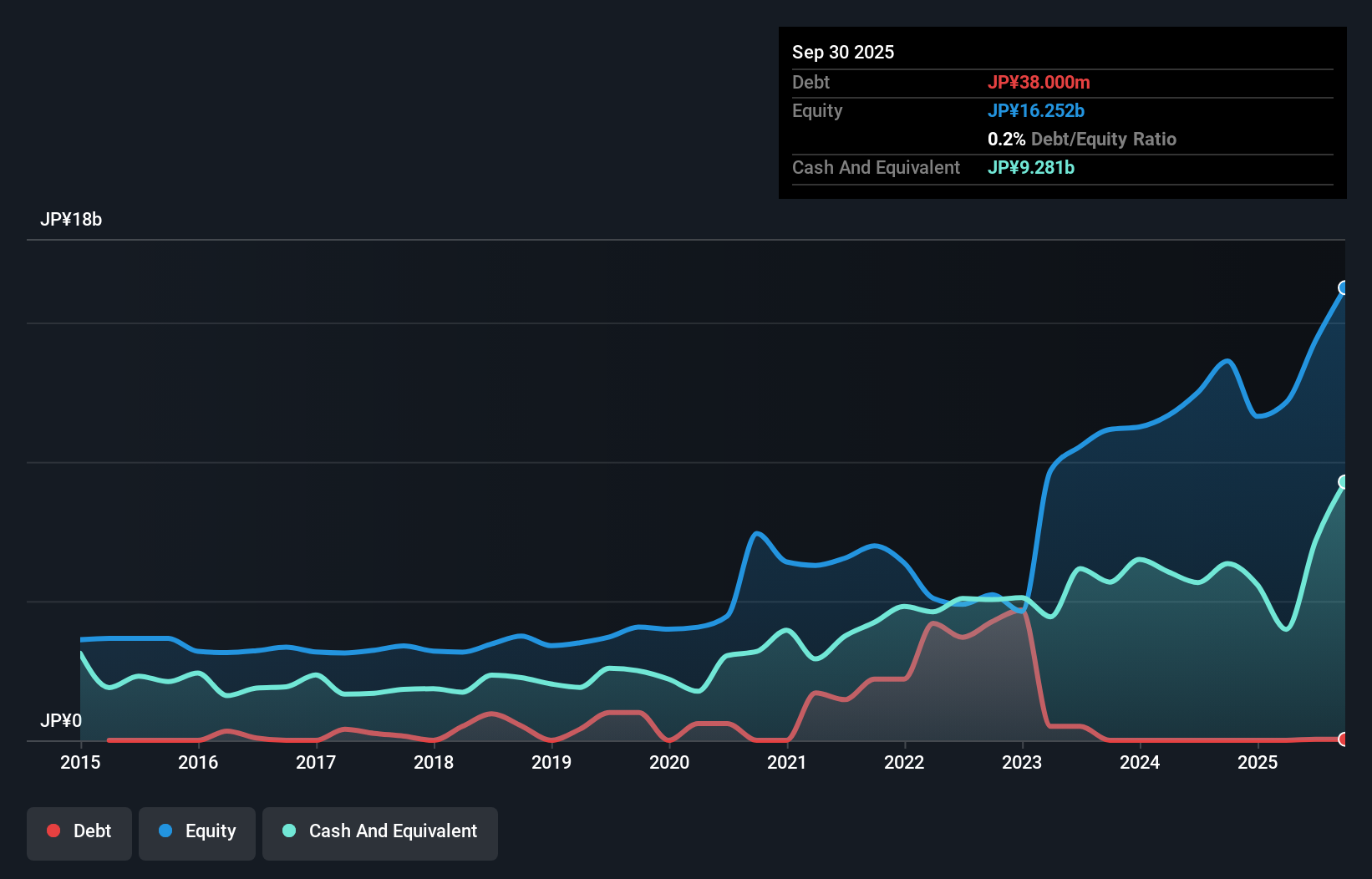

Cybozu, an intriguing player in the software industry, has shown impressive financial performance recently. Earnings surged by 136% over the past year, outpacing the industry's 22% growth rate. The company’s net income for the nine months ended September 2025 reached ¥5.45 billion, a significant jump from ¥2.60 billion last year. Despite a slight rise in its debt-to-equity ratio to 0.2% over five years, Cybozu remains financially sound with more cash than total debt and free cash flow positive at ¥5974 million as of June 2025. Trading at roughly 16% below estimated fair value suggests potential upside for investors eyeing this promising entity.

- Click here and access our complete health analysis report to understand the dynamics of Cybozu.

Review our historical performance report to gain insights into Cybozu's's past performance.

Mitani Sekisan (TSE:5273)

Simply Wall St Value Rating: ★★★★★★

Overview: Mitani Sekisan Co., Ltd. and its subsidiaries specialize in the production and sale of concrete products in Japan, with a market capitalization of ¥132.25 billion.

Operations: Mitani Sekisan generates revenue primarily from the production and sale of concrete products in Japan, with a market capitalization of ¥132.25 billion.

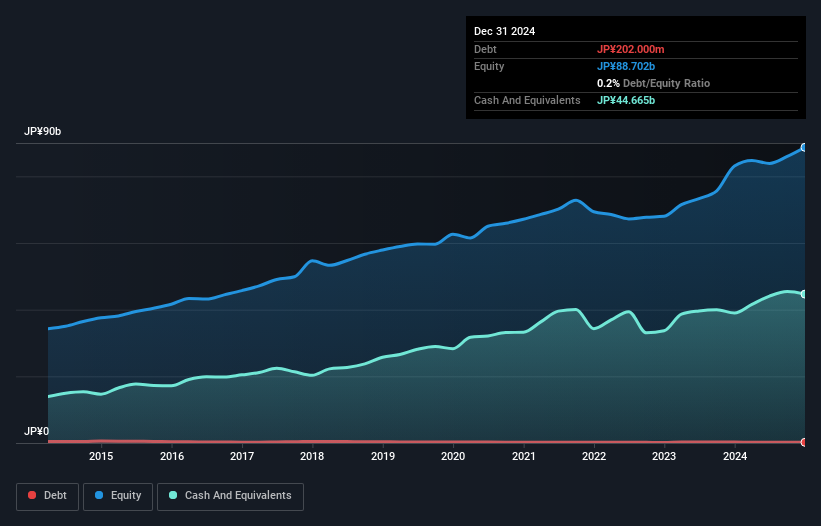

Mitani Sekisan is carving a niche with its robust earnings growth of 24.8% over the past year, outpacing the Basic Materials industry which grew by 12.1%. The company's debt to equity ratio has impressively halved from 0.4% to 0.2% in five years, indicating prudent financial management. Trading at a notable discount of 31.4% below estimated fair value, it presents an intriguing opportunity for investors seeking undervalued prospects in Japan's market landscape. Despite not repurchasing shares recently, Mitani completed a buyback of 189,000 shares earlier this year for ¥1,432 million (US$9 million), reflecting strategic capital allocation efforts.

Seize The Opportunity

- Access the full spectrum of 3012 Global Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5273

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives