Investors Aren't Entirely Convinced By Nitta Gelatin Inc.'s (TSE:4977) Revenues

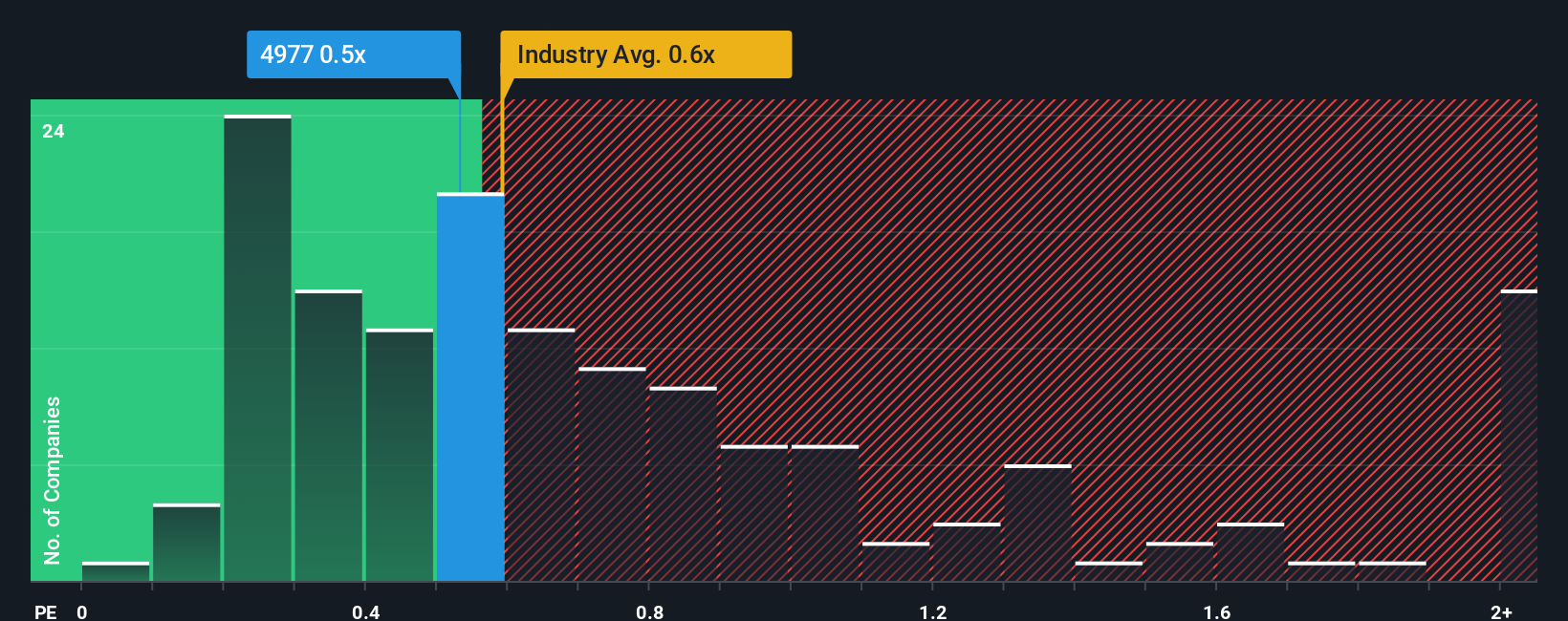

With a median price-to-sales (or "P/S") ratio of close to 0.6x in the Chemicals industry in Japan, you could be forgiven for feeling indifferent about Nitta Gelatin Inc.'s (TSE:4977) P/S ratio of 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Nitta Gelatin

How Has Nitta Gelatin Performed Recently?

Nitta Gelatin could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Nitta Gelatin will help you uncover what's on the horizon.How Is Nitta Gelatin's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Nitta Gelatin's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.4%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 12% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 7.8% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 3.2%, which is noticeably less attractive.

In light of this, it's curious that Nitta Gelatin's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Nitta Gelatin's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Nitta Gelatin currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Plus, you should also learn about these 2 warning signs we've spotted with Nitta Gelatin (including 1 which is significant).

If these risks are making you reconsider your opinion on Nitta Gelatin, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Nitta Gelatin might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4977

Nitta Gelatin

Produces and sells edible gelatin, pharmaceutical gelatin, and photographic gelatin in Japan.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives