Japan's stock markets have recently experienced sharp losses, with the Nikkei 225 Index falling 6.0% and the broader TOPIX Index down 5.6%, largely due to pressures on technology stocks and a strengthening yen impacting exporters' profit outlooks. Despite these challenges, opportunities remain for discerning investors willing to explore less prominent sectors. In this context, identifying a good stock involves looking beyond immediate market fluctuations to find companies with strong fundamentals, innovative products or services, and potential for long-term growth—qualities that can be particularly valuable in an unpredictable market environment.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Business Brain Showa-Ota | 0.05% | 7.50% | 59.43% | ★★★★★★ |

| Uchida Yoko | 6.26% | 7.83% | 16.58% | ★★★★★★ |

| Kanda HoldingsLtd | 31.83% | 4.29% | 19.02% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | -0.49% | 11.48% | ★★★★★★ |

| KurimotoLtd | 17.04% | 3.22% | 19.20% | ★★★★★★ |

| Yashima Denki | 3.27% | -2.99% | 11.12% | ★★★★★★ |

| Ad-Sol Nissin | NA | 1.94% | 6.44% | ★★★★★★ |

| Denyo | 4.86% | 3.76% | 1.84% | ★★★★★☆ |

| GakkyushaLtd | 22.47% | 5.11% | 19.19% | ★★★★★☆ |

| Marusan Securities | 5.33% | 1.01% | 10.00% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Aica Kogyo Company (TSE:4206)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aica Kogyo Company, Limited develops, produces, and sells chemical products, laminates, and building materials in Japan and internationally with a market cap of ¥222.87 billion.

Operations: The company's revenue streams include chemical products, laminates, and building materials sold both domestically and internationally. Key financial metrics indicate a net profit margin of 10.5%.

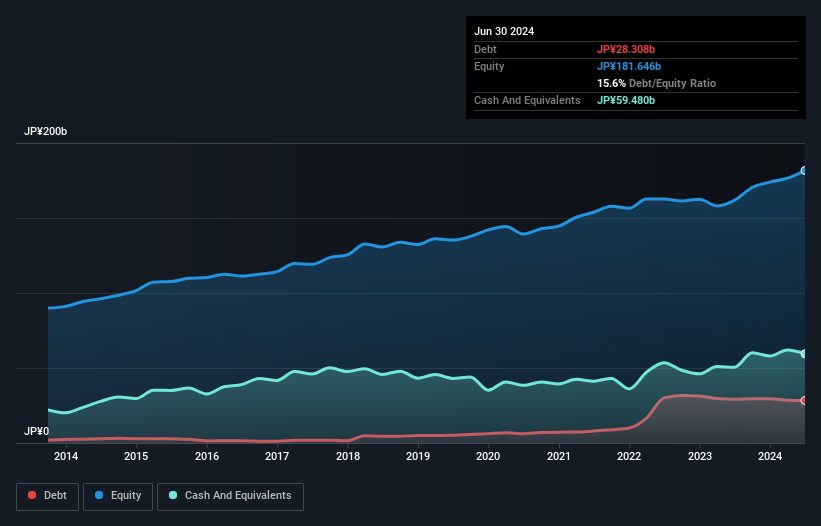

Aica Kogyo's earnings growth of 56.1% outpaced the Chemicals industry at 8.8%, reflecting high-quality past earnings and a strong financial position with more cash than total debt. The company’s debt-to-equity ratio increased from 3.9% to 15.6% over five years, yet it remains profitable with free cash flow positive status and a P/E ratio of 13.8x below the JP market average of 14.5x, suggesting good value for investors looking at small-cap opportunities in Japan.

- Click here to discover the nuances of Aica Kogyo Company with our detailed analytical health report.

Assess Aica Kogyo Company's past performance with our detailed historical performance reports.

artience (TSE:4634)

Simply Wall St Value Rating: ★★★★★☆

Overview: artience Co., Ltd. operates in the colorants and functional materials, polymers and coatings, printing and information, and packaging materials sectors across Japan, China, Europe, Africa, Asia, the Americas, and internationally with a market cap of ¥169.94 billion.

Operations: artience generates revenue through its segments in colorants and functional materials, polymers and coatings, printing and information, and packaging materials across multiple regions. The company has a market cap of ¥169.94 billion.

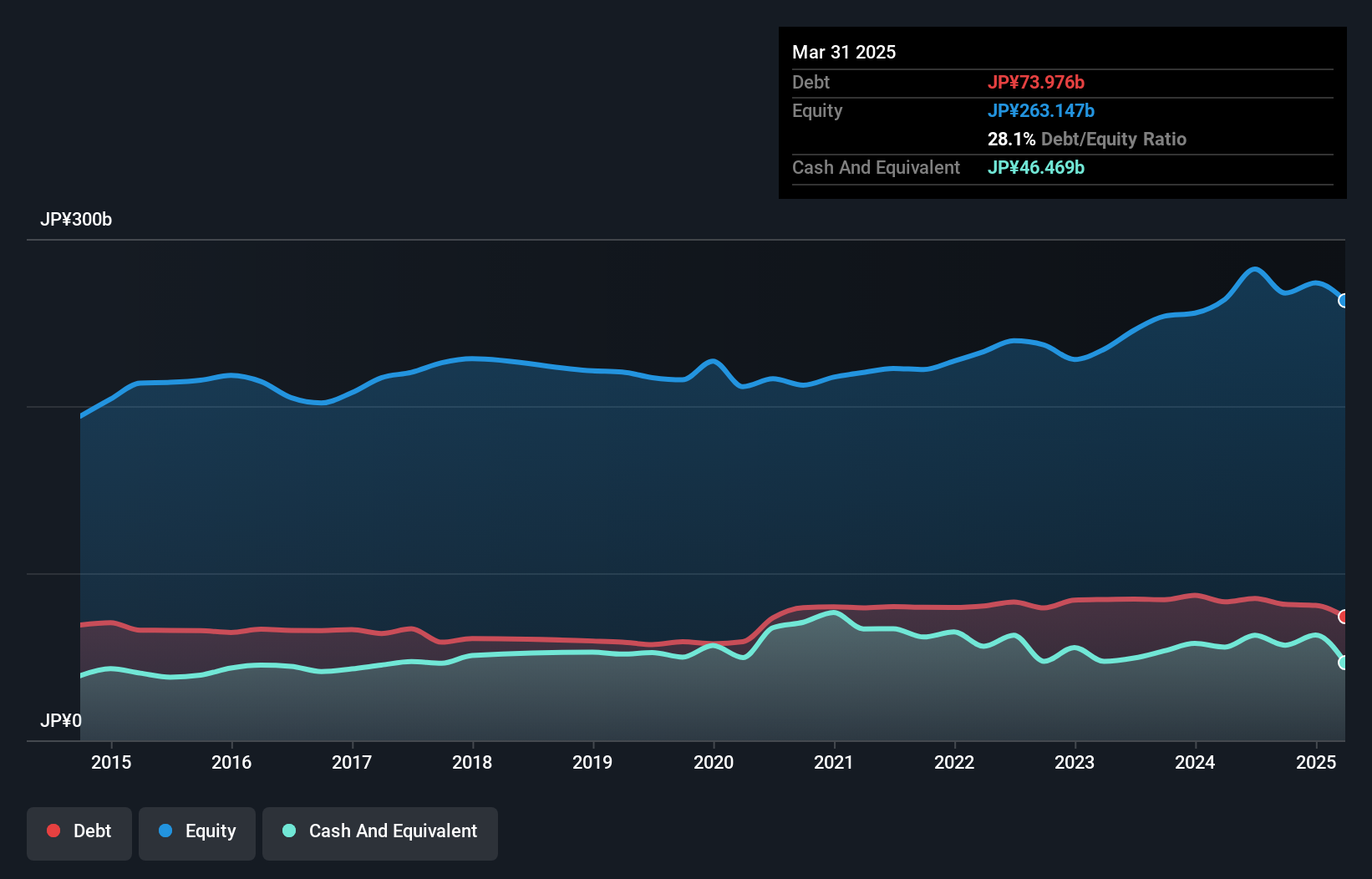

Artience has shown impressive growth with earnings surging 101% over the past year, significantly outpacing the Chemicals industry. The company's net debt to equity ratio stands at a satisfactory 10.3%, reflecting strong financial health. Trading at a P/E ratio of 12.7x, it offers good value compared to the JP market average of 14.5x. Additionally, Artience's interest payments are well covered by EBIT (52x), and it's forecasted to grow earnings by 8.66% annually.

- Unlock comprehensive insights into our analysis of artience stock in this health report.

Examine artience's past performance report to understand how it has performed in the past.

Totech (TSE:9960)

Simply Wall St Value Rating: ★★★★★★

Overview: Totech Corporation specializes in the sale of environment control equipment in Japan and has a market cap of ¥105.66 billion.

Operations: Totech Corporation generates revenue primarily through the sale of environment control equipment in Japan. The company has a market cap of ¥105.66 billion.

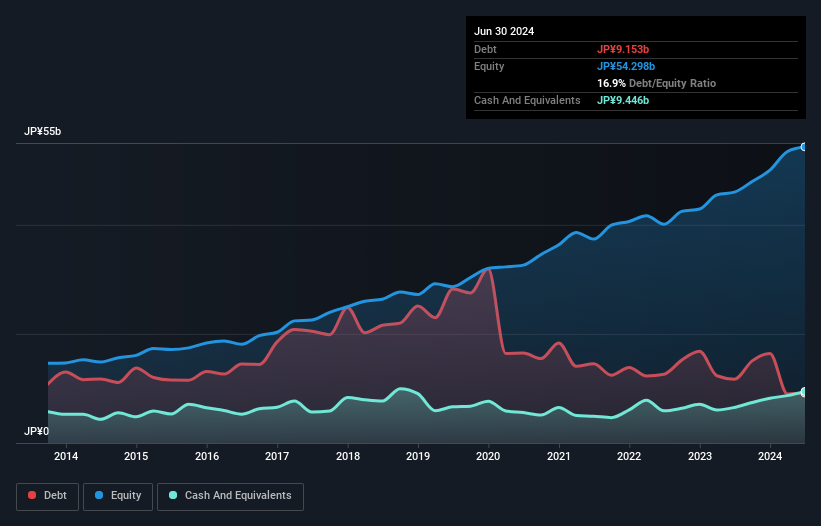

Totech, a smaller player in the Japanese market, has shown impressive earnings growth of 33.9% over the past year, significantly outpacing its industry. The company's debt to equity ratio has improved from 78.7% to 16.8% in five years, reflecting prudent financial management. Additionally, Totech's net debt to equity ratio stands at a satisfactory 0.6%. Recent news includes an increased annual dividend of JPY144 per share and a positive earnings forecast for FY2025 with expected net sales of JPY146 billion and operating profit of JPY10.5 billion.

- Dive into the specifics of Totech here with our thorough health report.

Gain insights into Totech's historical performance by reviewing our past performance report.

Turning Ideas Into Actions

- Explore the 738 names from our Japanese Undiscovered Gems With Strong Fundamentals screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4634

artience

Engages in the colorants and functional materials, polymers and coatings, printing and information, and packaging materials businesses in Japan, China, Europe, Africa, Asia, the Americas, and internationally.

Solid track record with excellent balance sheet and pays a dividend.