Chugoku Marine Paints (TSE:4617) Valuation Update Following Upbeat Guidance and Dividend Hike

Reviewed by Simply Wall St

Chugoku Marine Paints (TSE:4617) lifted its earnings guidance for the year ending March 2026, citing unexpectedly strong marine coatings sales and successful pricing efforts. The company also announced a higher dividend for the second quarter.

See our latest analysis for Chugoku Marine Paints.

Chugoku Marine Paints’ upbeat guidance and dividend hike come as its momentum gathers speed, with the stock notching an 87.6% year-to-date share price return and a stellar 73.1% total shareholder return over the past year. Recent board decisions, including a subsidiary merger, reflect a company that is doubling down on its strengths and growth strategy.

If today’s powerful move in Chugoku Marine Paints has you thinking bigger, now’s a great opportunity to discover fast growing stocks with high insider ownership

But after such a dramatic rally, is Chugoku Marine Paints still undervalued and offering investors upside? Or is the recent share price surge a sign that the market has already priced in the company’s future growth?

Price-to-Earnings of 18.8x: Is it justified?

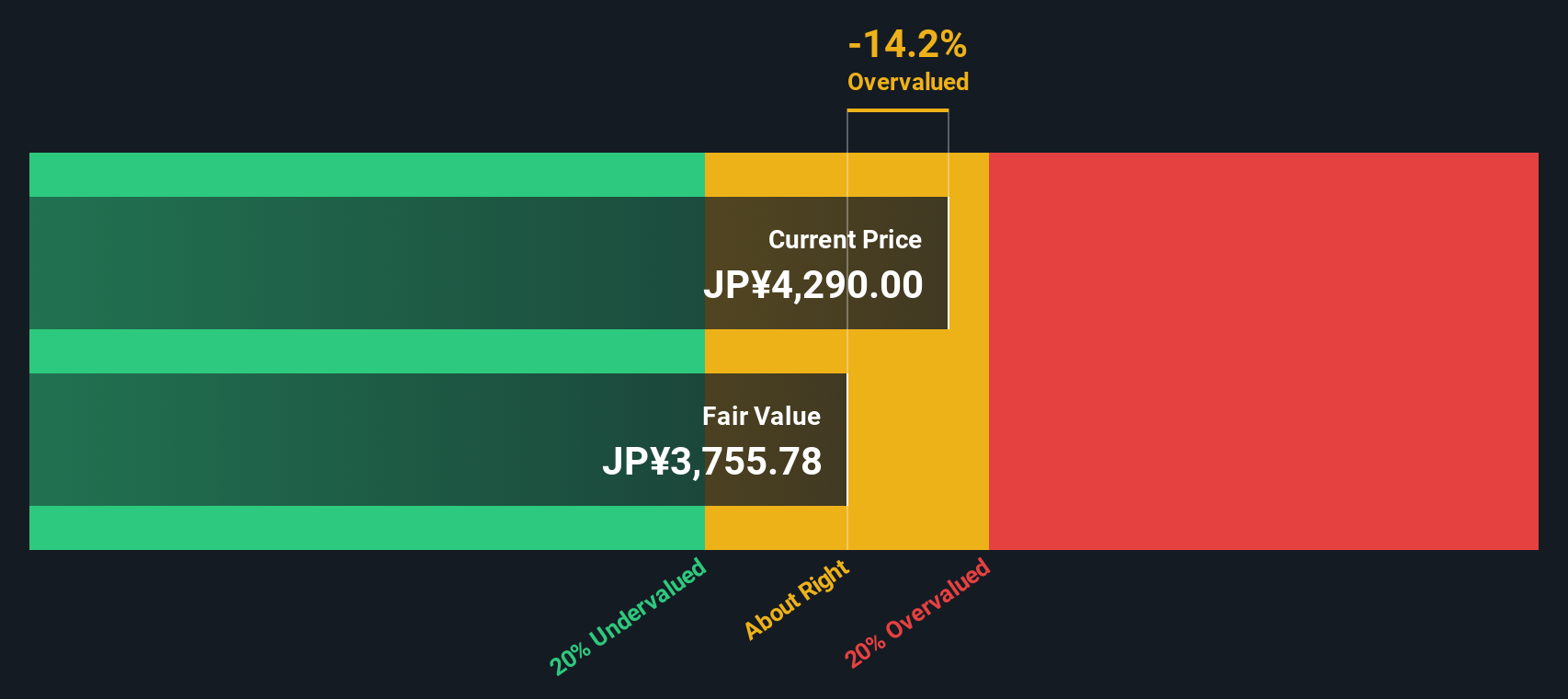

Chugoku Marine Paints trades at a price-to-earnings (P/E) ratio of 18.8x, standing noticeably above both its peer group and industry benchmarks. With the share price at ¥4,290, this valuation suggests investors are paying a premium compared to what similar companies command in the chemicals sector.

The price-to-earnings ratio reflects how much investors are willing to pay for each yen of current earnings. It is a widely used metric for established, profit-generating companies. A higher P/E can indicate growth expectations, quality, or simply overvaluation.

In this case, the company’s 18.8x multiple is not only above the Japanese Chemicals industry average of 13x but also exceeds the peer group average of 14.5x. This premium may signal optimism about future earnings, but according to our fair value regression, a level closer to 14.9x would better reflect its fundamentals and sector standing. If market sentiment cools, there is a clear reference for where the valuation might settle.

Explore the SWS fair ratio for Chugoku Marine Paints

Result: Price-to-Earnings of 18.8x (OVERVALUED)

However, investors should be mindful of the stock’s premium valuation, as well as the risk that earnings growth could slow or analyst targets remain unmet.

Find out about the key risks to this Chugoku Marine Paints narrative.

Another View: The SWS DCF Model Perspective

Looking at Chugoku Marine Paints through our SWS DCF model provides a different perspective. The discounted cash flow approach suggests the company's shares are actually trading above their calculated fair value, which may indicate potential overvaluation. Could the current price be extending beyond fundamental worth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Chugoku Marine Paints for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 860 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Chugoku Marine Paints Narrative

If you think the story here could unfold differently or want to dig into the numbers yourself, it takes just a few minutes to shape your own view, Do it your way.

A great starting point for your Chugoku Marine Paints research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Stock Ideas?

Confidently broaden your horizons and keep growing your portfolio with innovative stocks and fresh strategies available in the Simply Wall Street Screener. Don’t get left behind while others pinpoint tomorrow’s big winners.

- Unlock tomorrow’s biggest profit opportunities by snapping up value with these 860 undervalued stocks based on cash flows as your guide to stocks priced below their worth.

- Get ahead of the curve in healthcare breakthroughs by targeting industry leaders through these 32 healthcare AI stocks, your resource for the smartest medical AI advancements.

- Multiply your passive income streams by seeking out market favorites with solid yields using these 17 dividend stocks with yields > 3%, a tool tailored for dependable dividend stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4617

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives