Nicca Chemical Co.,Ltd. (TSE:4463) Stock Catapults 25% Though Its Price And Business Still Lag The Market

Nicca Chemical Co.,Ltd. (TSE:4463) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 55%.

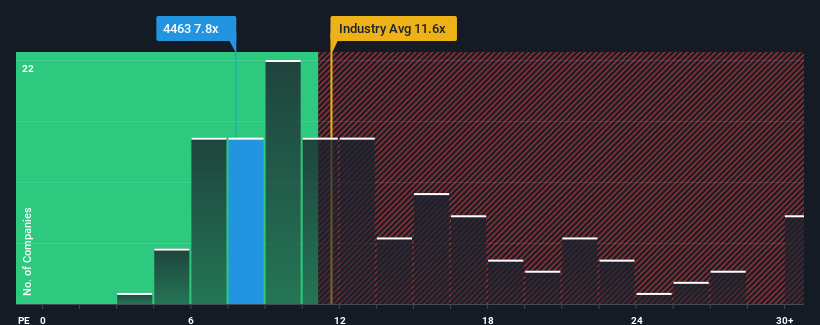

Although its price has surged higher, Nicca ChemicalLtd's price-to-earnings (or "P/E") ratio of 7.8x might still make it look like a buy right now compared to the market in Japan, where around half of the companies have P/E ratios above 14x and even P/E's above 21x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for Nicca ChemicalLtd as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Nicca ChemicalLtd

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Nicca ChemicalLtd would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 95% last year. EPS has also lifted 6.4% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 9.6% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Nicca ChemicalLtd's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

What We Can Learn From Nicca ChemicalLtd's P/E?

The latest share price surge wasn't enough to lift Nicca ChemicalLtd's P/E close to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Nicca ChemicalLtd maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for Nicca ChemicalLtd that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Nicca ChemicalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4463

Nicca ChemicalLtd

Manufactures and sells surfactants for textile chemicals, metals, pulp and paper, paints, dyes, synthetic resins, and dry and professional cleaning agents in Japan and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives