DKS Co. Ltd. (TSE:4461) Stock Rockets 72% But Many Are Still Ignoring The Company

Despite an already strong run, DKS Co. Ltd. (TSE:4461) shares have been powering on, with a gain of 72% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 78% in the last year.

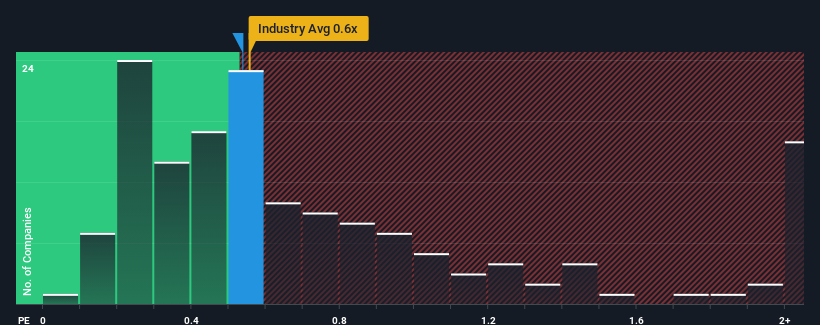

In spite of the firm bounce in price, it's still not a stretch to say that DKS' price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Chemicals industry in Japan, where the median P/S ratio is around 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for DKS

What Does DKS' P/S Mean For Shareholders?

Recent times haven't been great for DKS as its revenue has been falling quicker than most other companies. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. You'd much rather the company improve its revenue if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on DKS will help you uncover what's on the horizon.How Is DKS' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like DKS' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 5.3% decrease to the company's top line. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 8.8% during the coming year according to the only analyst following the company. That's shaping up to be materially higher than the 6.1% growth forecast for the broader industry.

With this information, we find it interesting that DKS is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From DKS' P/S?

DKS' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, DKS' P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You need to take note of risks, for example - DKS has 3 warning signs (and 2 which are potentially serious) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4461

DKS

Engages in the production and sale of surfactants, other industrial chemicals, and life sciences-related products in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives