Adeka (TSE:4401) Valuation in Focus as New Earnings Guidance and Dividend Hike Announced

Reviewed by Simply Wall St

Adeka (TSE:4401) shared its earnings outlook for the fiscal year ending March 2026 and revealed a higher second quarter-end dividend. Investors are taking note because these announcements highlight both performance expectations and shareholder returns.

See our latest analysis for Adeka.

Adeka’s latest dividend bump and earnings guidance come as the stock enjoys strong momentum, with a year-to-date share price return of 25.4% and an impressive total shareholder return of 29.1% over the past year. Long-term investors have also benefited handsomely, with the five-year total shareholder return climbing over 139%, which signals steady value creation and growing confidence in the company’s outlook.

If Adeka’s steady performance has you thinking about other opportunities, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

But with Adeka’s shares nearing analysts’ price targets and future earnings guidance now public, the key question is whether the stock remains undervalued or if the market has already accounted for these growth prospects in the price.

Most Popular Narrative: 9.3% Undervalued

With Adeka’s fair value set at ¥3,915 and its latest close at ¥3,549, the narrative points to attractive upside potential as market expectations recalibrate.

The restructuring of ADEKA's Chemicals segment into Electronics and Environmental Materials divisions, focusing on semiconductors and eco-friendly products, reflects proactive investment in new materials and semiconductor peripherals. This organizational change aims to enhance efficiency and collaboration, potentially driving future revenue growth and improving margins.

What’s behind this valuation? The narrative highlights a pivotal business overhaul and bold bets on future technologies. In addition, there is aggressive margin expansion that could catch markets off guard. Want to know how analysts tie together these sweeping changes with financial projections rarely seen in the sector? The answer might explain what gives Adeka its edge in the valuation game.

Result: Fair Value of ¥3,915 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in Life Science sales or heightened market volatility could easily undermine Adeka's potential to meet these optimistic growth forecasts.

Find out about the key risks to this Adeka narrative.

Another View: Are the Ratios Telling a Different Story?

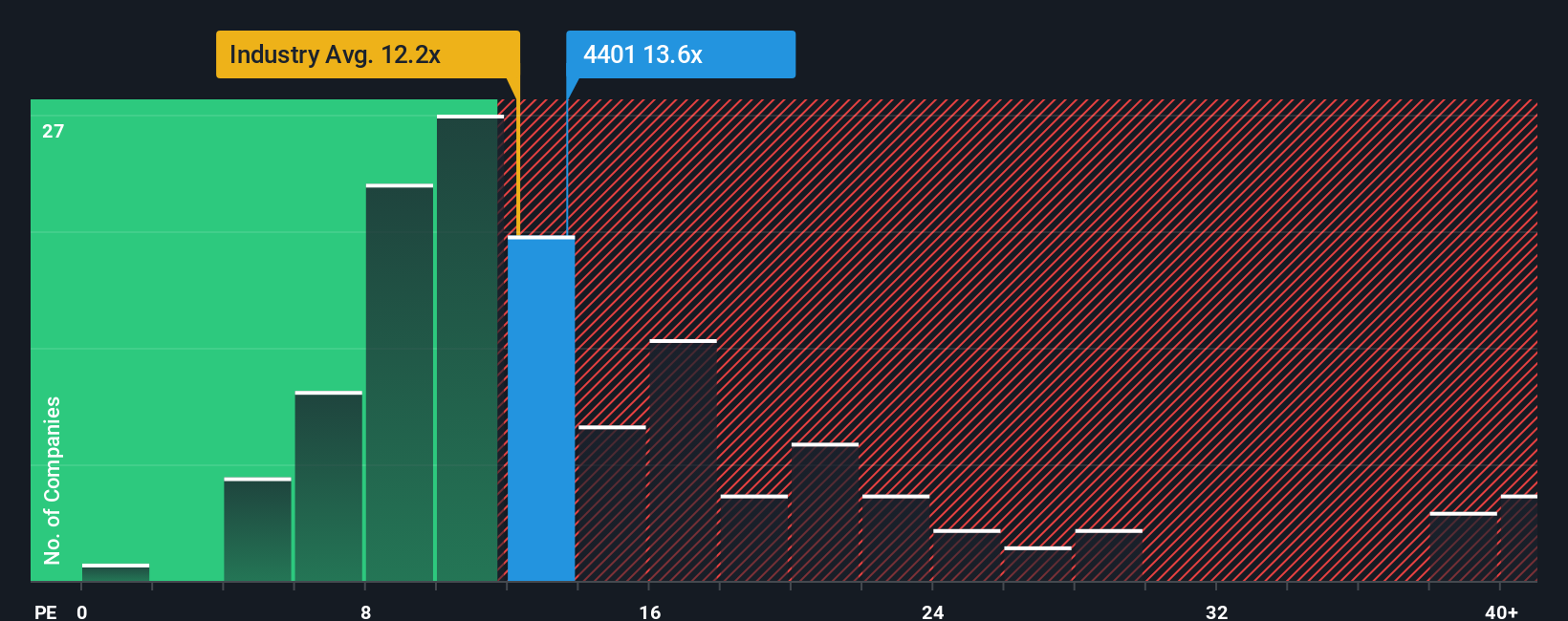

Looking through the lens of the price-to-earnings ratio, Adeka trades at 13.6 times earnings, which is above the industry average of 12.3 but well below its peer average of 24.7. Interestingly, this is still cheaper than the fair ratio of 16, hinting at some relative value yet also raising questions about whether the stock is as underappreciated as it first appears. Is the market hiding a risk or a fresh opportunity here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Adeka Narrative

If you think there’s more beneath the numbers or want to dive even deeper, you can craft your own take on Adeka’s story in just minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Adeka.

Looking for More Investment Ideas?

Unlock your potential and future-proof your strategy by checking out other opportunities tailored to today’s market. Don’t be the one who watches ideas pass by while others get ahead.

- Boost your income with steady cash flow and stability by reviewing these 16 dividend stocks with yields > 3% offering yields above 3% amidst today's uncertain rate landscape.

- Uncover explosive tech growth by starting with these 26 AI penny stocks that are driving the AI revolution and transforming industries across the globe.

- Step ahead of the crowd and seize rare entry points with these 928 undervalued stocks based on cash flows that stand out based on rigorous cash flow analysis and long-term value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4401

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives