What UBE (TSE:4208)'s Expanded Consolidation Means for Its Evolving Investment Narrative

Reviewed by Sasha Jovanovic

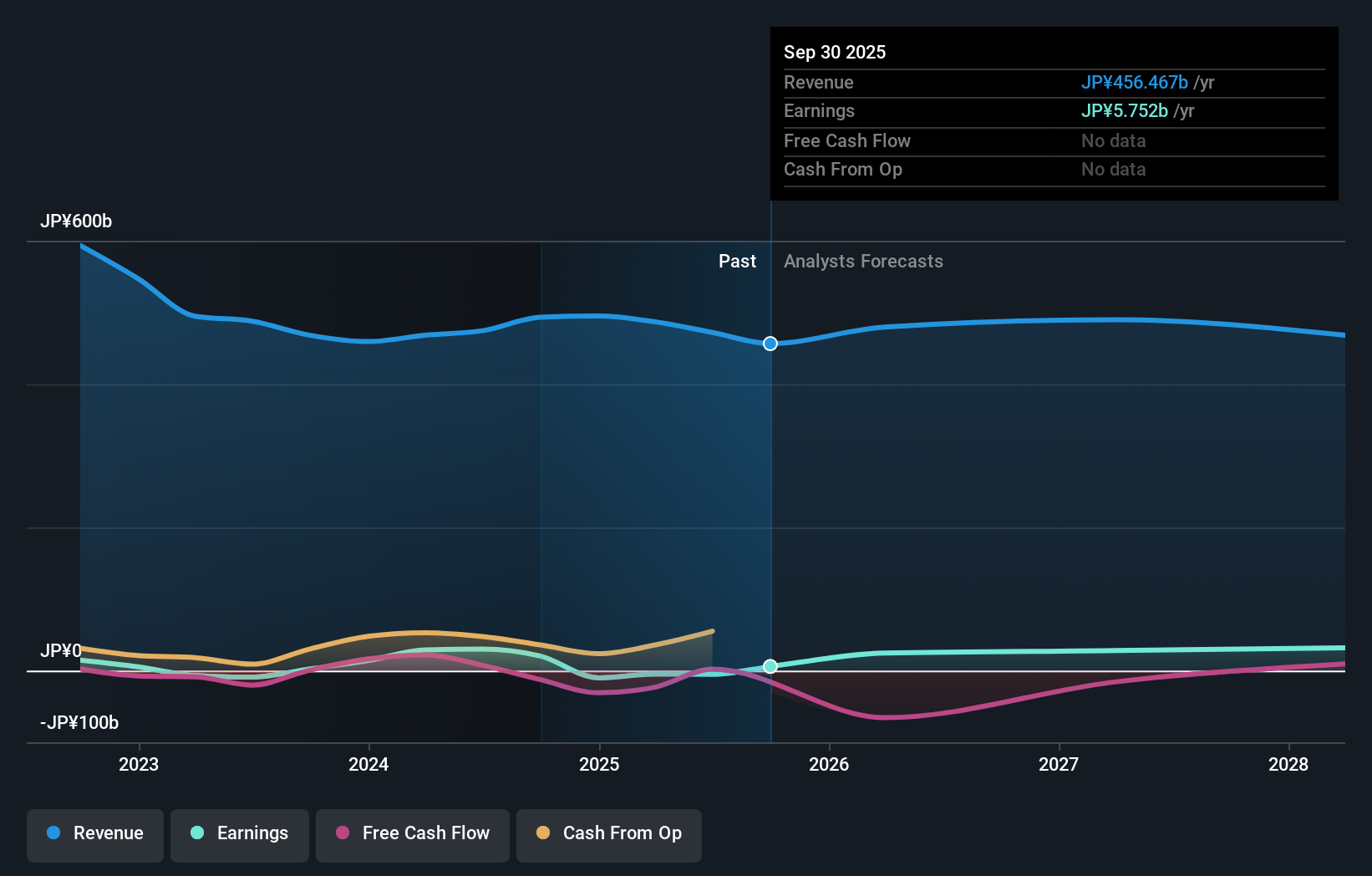

- UBE Corporation reported a very large increase in ordinary profit for the first half of 2025, driven by expanding its consolidation scope to include 11 additional companies.

- This move has considerably strengthened UBE's operational capabilities and international market position within the chemical industry.

- We will explore how the addition of new companies to UBE’s consolidation scope could shape its evolving investment narrative.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is UBE's Investment Narrative?

Anyone considering UBE right now has to weigh a story that is in flux. The recent, very large jump in ordinary profit, driven by the addition of 11 newly consolidated companies, marks a sharp turn from earlier trends and may change short-term expectations. Previously, the biggest catalysts were cost-cutting through restructuring, the launch of the new Louisiana plant for electric vehicle components, and signs of nascent profit recovery after years of losses. However, prior risks were equally clear: declining revenue forecasts, an uncovered dividend, and a balance sheet with debt not covered by operating cash flow. This surprise profit surge may prompt investors to reconsider those risks, particularly around earnings sustainability and whether the consolidation actually addresses root business pressures, or just smooths over ongoing challenges. Share price moves so far have been muted, suggesting the market is still processing the real implications.

But there are still real questions about how sustainable those profits will be. UBE's shares are on the way up, but they could be overextended by 11%. Uncover the fair value now.Exploring Other Perspectives

Explore 2 other fair value estimates on UBE - why the stock might be worth 10% less than the current price!

Build Your Own UBE Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UBE research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free UBE research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UBE's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4208

UBE

Engages in the materials and machinery businesses in Japan, Asia, Europe, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives