- Spain

- /

- Capital Markets

- /

- BME:R4

Uncovering Three Hidden Gems with Promising Potential

Reviewed by Simply Wall St

In a week marked by a flurry of earnings reports and mixed economic signals, small-cap stocks have demonstrated resilience, holding up better than their larger counterparts amid broader market fluctuations. As investors navigate this complex landscape, identifying promising opportunities within the small-cap space can be crucial for uncovering potential growth stories. In this context, seeking out stocks with strong fundamentals and unique market positions can offer intriguing possibilities for those looking to capitalize on under-the-radar investments.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Petrol d.d | 42.18% | 17.56% | -0.49% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Britam Holdings | 8.55% | -2.40% | 35.94% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Renta 4 Banco (BME:R4)

Simply Wall St Value Rating: ★★★★☆☆

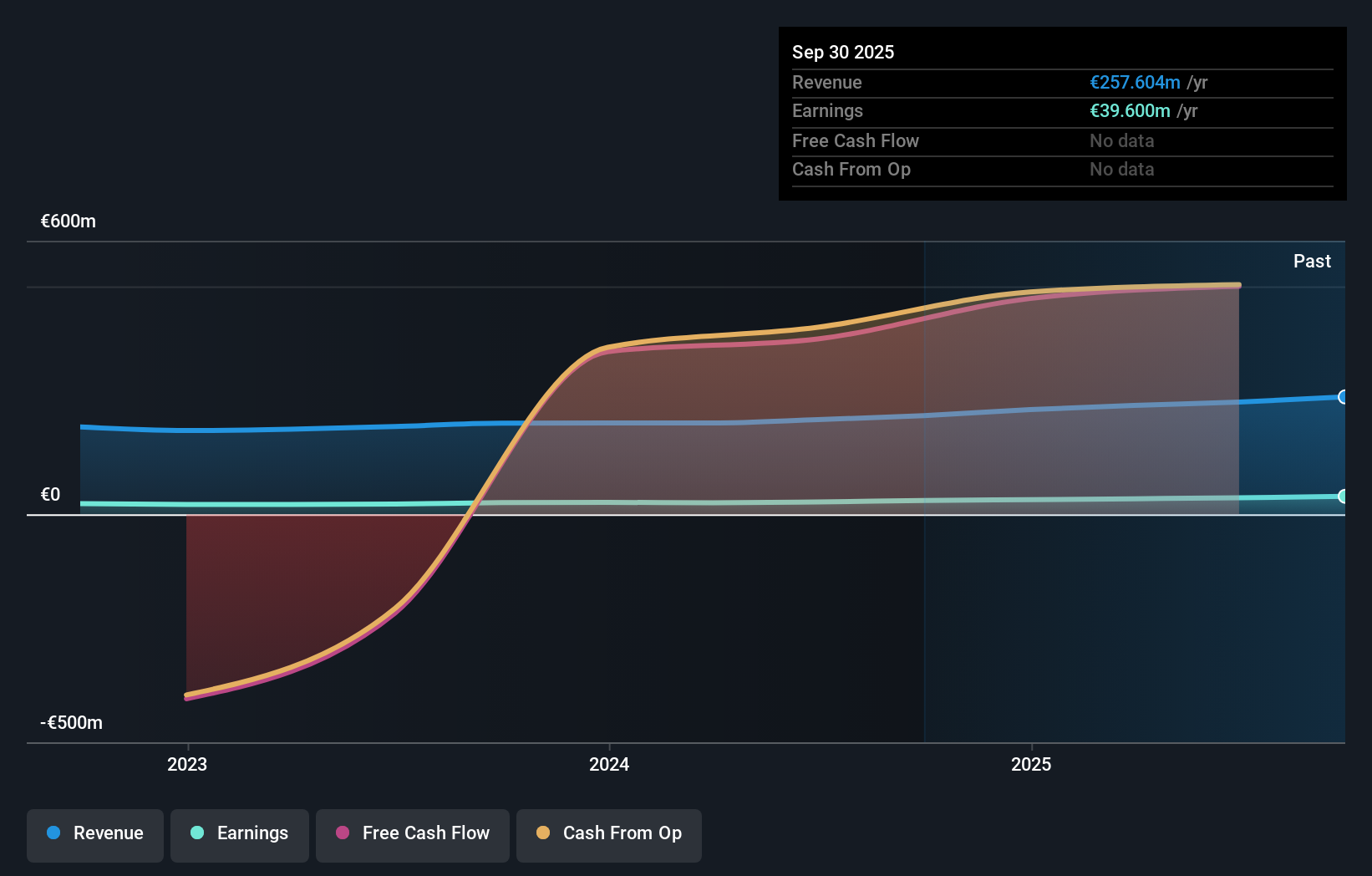

Overview: Renta 4 Banco, S.A. operates in wealth management, brokerage, and corporate advisory services both in Spain and internationally, with a market capitalization of €524.94 million.

Operations: Renta 4 Banco generates revenue primarily from brokerage (€95.51 million), asset management (€91.13 million), and corporate services (€33 million). The net profit margin reflects the company's efficiency in converting revenue into profit after expenses.

Renta 4 Banco, a notable player in the financial sector, showcases a favorable price-to-earnings ratio of 19.3x compared to the Spanish market's 19.8x, indicating potential value. The company has experienced an impressive earnings growth of 19.9% over the past year, outpacing its industry peers who saw -17.8%. R4's debt management is commendable with its debt-to-equity ratio dropping from 9.8% to just 0.4% over five years, reflecting prudent financial strategies and more cash than total debt on hand. However, investors should be cautious about its recent share price volatility observed over three months and insufficient data on interest coverage by EBIT raises some concerns about future obligations management.

- Take a closer look at Renta 4 Banco's potential here in our health report.

Evaluate Renta 4 Banco's historical performance by accessing our past performance report.

Aica Kogyo Company (TSE:4206)

Simply Wall St Value Rating: ★★★★★☆

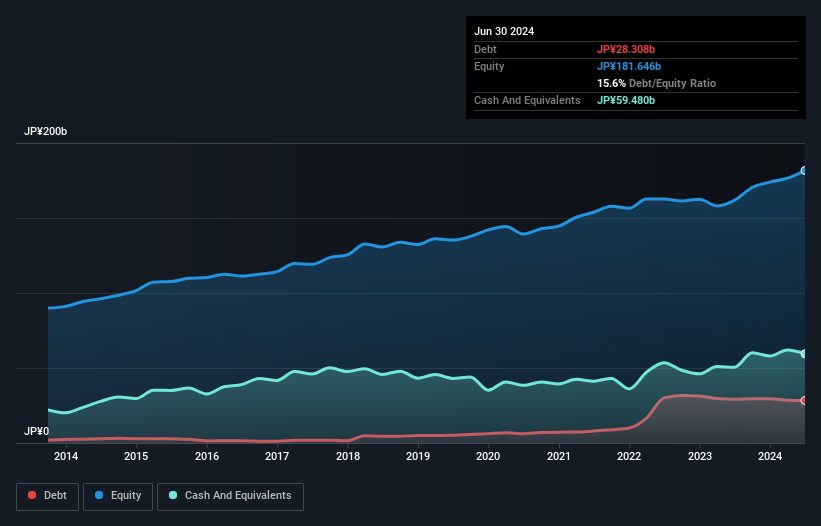

Overview: Aica Kogyo Company, Limited is engaged in the development, production, and sale of chemical products, laminates, and building materials both in Japan and internationally, with a market capitalization of ¥215.33 billion.

Operations: Aica Kogyo generates revenue through the sale of chemical products, laminates, and building materials across domestic and international markets. The company's financial performance is characterized by its market capitalization of ¥215.33 billion.

Aica Kogyo, a notable player in the chemicals sector, has been making strides with its recent earnings growth of 50.7%, outpacing the industry's 12.3%. The company is financially robust, boasting more cash than total debt and maintaining a healthy interest coverage ratio. Its price-to-earnings ratio of 13x suggests it might be undervalued compared to the broader JP market at 13.2x. Despite an increased debt-to-equity ratio from 4.1% to 15.4% over five years, Aica's high-quality earnings provide a solid foundation for future prospects, further bolstered by their dividend increase to JPY 56 per share this quarter.

- Dive into the specifics of Aica Kogyo Company here with our thorough health report.

Assess Aica Kogyo Company's past performance with our detailed historical performance reports.

Japan Lifeline (TSE:7575)

Simply Wall St Value Rating: ★★★★★★

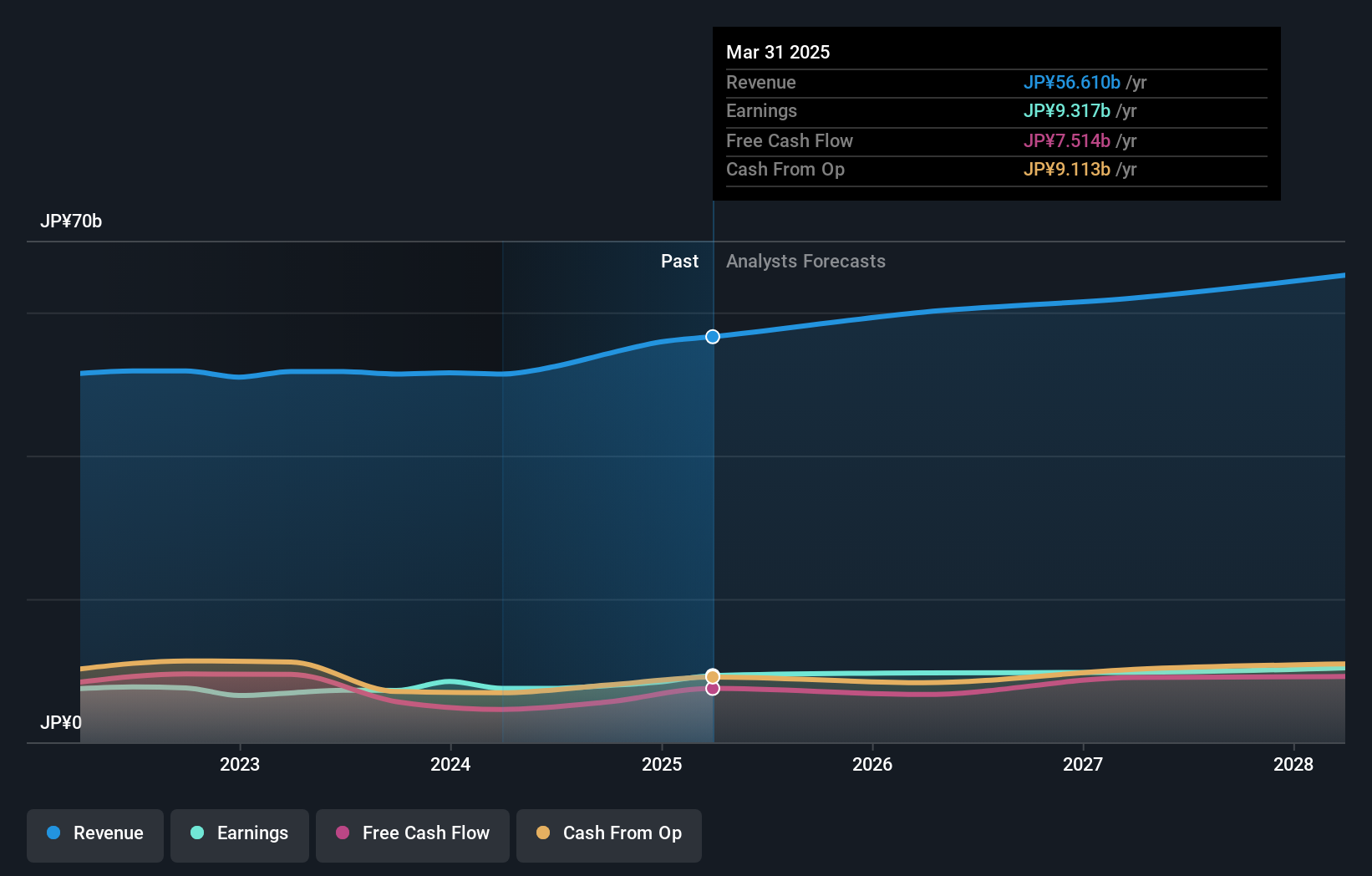

Overview: Japan Lifeline Co., Ltd. is a medical device company specializing in the development, production, importation, distribution, and trading of cardiovascular-related medical devices in Japan with a market cap of ¥88.12 billion.

Operations: The company generates revenue primarily through the sale of cardiovascular-related medical devices in Japan. It has a market capitalization of ¥88.12 billion, reflecting its financial standing within the industry.

With a focus on innovative medical devices, Japan Lifeline is making strides in the neurovascular market. Its recent launch of the pRESET stent retriever aims to capture 10-15% of a six billion yen market, supported by an exclusive distribution agreement with Wallaby Medical. Over the past year, earnings growth reached 9.6%, outpacing industry averages. The company's debt-to-equity ratio has improved from 21.4% to 9.7% over five years, reflecting stronger financial health and more cash than total debt. Trading at nearly half its estimated fair value suggests potential upside for investors seeking opportunities in this niche sector.

- Get an in-depth perspective on Japan Lifeline's performance by reading our health report here.

Understand Japan Lifeline's track record by examining our Past report.

Key Takeaways

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4738 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:R4

Renta 4 Banco

Engages in the provision of wealth management, brokerage, and corporate advisory services in Spain and internationally.

Solid track record with adequate balance sheet and pays a dividend.